In 2017, I wrote an article “asking” why the Patriots were so good. Then Tom Brady left, the Patriots have suffered (somewhat), and Tom Brady won another Super Bowl with the Buccaneers.

Now, several sports pundits are reporting that he may be retiring. Tom Brady insists that he hasn’t made a final decision yet.

Of course, there is the matter of the $15 Million portion of his signing bonus that becomes payable to him on Friday. That might explain the “confusion” on timing?

Regardless, all this talk reminded me about what makes Tom Brady special.

There is a difference between ‘luck’ and ‘skill’.

Both exist ... yet, luck favors the prepared.

In life, as in sports, hard work often beats talent (especially if talent fails to work hard).

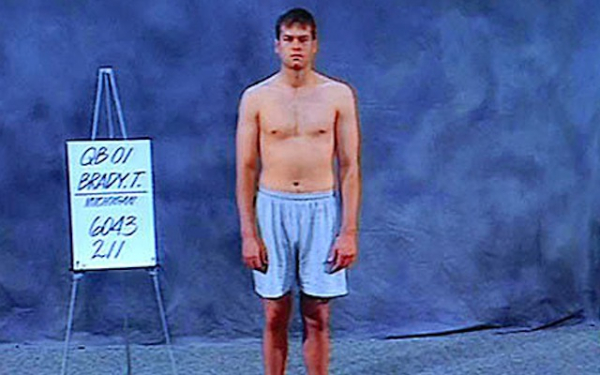

But, when you see this picture from the 2000 NFL Combine, it’s hard to believe that Tom Brady would be a 7-time Superbowl MVP taking the Buccaneers to the Super Bowl in his first year with them. All at the geriatric (for an NFL player) age of 44.

via CBS Sports

When I talked about the Patriots, I focused on the fact that they were a well-oiled machine with a powerful framework of success that allowed individual greatness to shine.

I think Brady’s continued success is emblematic of that.

Tom Brady is a paragon of culture, process, and hard work. Much of his approach was molded by his time with Belichick, but of course, he gets enormous personal credit as well.

He expects the best of himself and brings out the best in his teammates. That’s enabled him to stay a top-level competitor despite not being the strongest, fastest, or most mobile QB (and that was when he was young).

As well, Tom Brady is remarkably consistent and disciplined; his diet, his routine, his exercise, his film routine, etc. All NFL athletes have impressive routines for the most part, but take a look at Tom Brady’s routine. It’s a routine built for him and his needs - and he’s got it dialed in. He doesn’t need to waste time trying to get big in the gym, so he focuses on 9-key exercises to support his goals.

The System is the ‘system’; but, within it, you can measure what works, who contributes, and then use those insights to identify the best things to try next.

Win, lose, or draw ... some things speak for themselves. And whether he retires today, next year, or never, we don’t need to wait five years to know he’s a Hall of Fame player with an incredible career.

Here Are Some Links For Your Weekly Reading - February 13th, 2021

Here are some of the posts that caught my eye. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 08:46 PM in Business, Current Affairs, Gadgets, Games, Ideas, Just for Fun, Market Commentary, Science, Sports, Television, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)