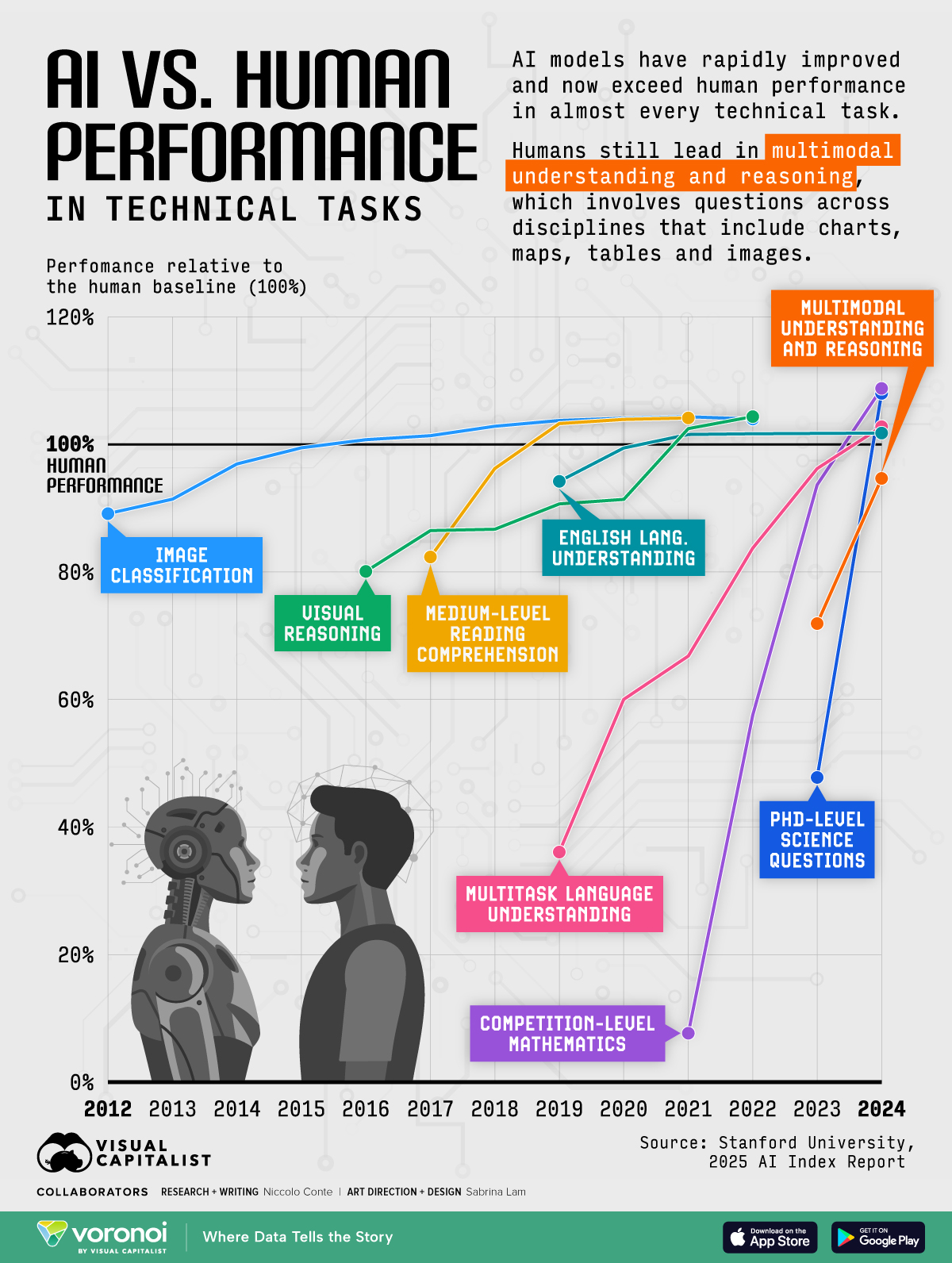

Time seems to go faster as I get older. Likewise, technology seems to be advancing faster than ever, too.

Take AI as an example... even though I've been involved in this field for many years, I'm surprised by how rapidly it's improving now.

I suspect that part of the surprise comes from comparing the current pace of change to my memories of how long it took to improve in the past. Even though I had a sense of the quickening, the thing about exponential technologies is that there's a tipping point ... and clearly we're past that point on the curve.

I'm often met with surprise when I talk about my AI journey ... because it began in 1991, when it was still hard to spell AI.

Looking back, it makes a lot more sense to me than it did as I was moving through it. Here is a video about that journey and what it means for you and your future.

Click here to view the transcript of the video.

Looking back on my life and career, one could argue that I got my start in AI with my most recent company, Capitalogix, which was founded over 20 years ago. Or, perhaps, we could go back further and say it started with my previous company, IntellAgent Control (which was an early AI company, focused on the creation and use of intelligent agents). By today's standards, the technology we used back then was too simple to be considered AI, but at the time, we were on the cutting edge.

Maybe we should go further back and say it started when I became the first lawyer in my firm to use a computer ... or was it when I first fell in love with technology?

The truth is ... I've spent my whole life on this path. My fascination with making better decisions, taking smarter actions, and getting better results probably started when I was two years old (because of the incident discussed in the video).

Ultimately, the starting point is irrelevant. Looking back, it seems inevitable. The decisions I made, the people I met, and my experiences ... they all led me here.

However, at any point in the journey, if you asked, "Is this where you thought you'd end up?" I doubt that I'd have said yes.

I've always been fascinated by what makes people successful and how to become more efficient and effective. In a sense, that's what AI does. It's a capability amplifier.

When I transitioned from being a corporate securities lawyer to an entrepreneur, Artificial Intelligence happened to be the best vehicle I found to do that. It made sense then, and it makes sense now.

Like most things in life, it's easy to see the golden thread looking backwards, but it's a lot harder to see projecting forwards.

I wouldn't have it any other way. It certainly keeps things interesting.

Onwards!

Diminishing Returns in AI: The Most Common AI Mistake

At some point, more of the same stops paying off ... it is called the law of diminishing returns.

Nature (and common sense) reminds us that equilibrium is important. For example, when you exercise too much, you get injured; when you drink too much water, you get poisoned; etc.

This concept applies almost everywhere.

A related nugget of wisdom from the extreme ... Too much of a good thing is a bad thing!

And of course ... Be moderate in everything, including moderation.

A recent study on the effects of ChatGPT use on brain activity also supports this theme.

As a result, the ChatGPT essays also ended up lacking original thought and sounding similar.

Ultimately, I think it's telling us something we probably could have already guessed. If you're not actually the one reading or writing something ... you're not going to absorb the information as well. Your brain isn't going to activate as well. And if you're not finding other places to train your brain, you'll get worse at critical thinking.

I'm positive it can make YOU smarter and more effective if you use it in moderation and to support your unique abilities.

Onwards!

Posted at 09:32 PM in Books, Business, Current Affairs, Gadgets, Healthy Lifestyle, Ideas, Market Commentary, Personal Development, Science, Trading, Trading Tools, Web/Tech, Writing | Permalink | Comments (0)

Reblog (0)