Trip Advisor has an interesting game called Traveler IQ Challenge.

I thought it was fun.

On a related note, here are some of my favorite Travel sites.

On a related note, here are some of my favorite Travel sites.

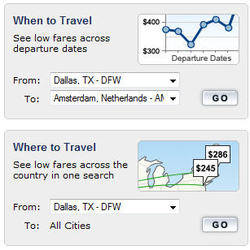

Farecast: This site has lots of nice features. This link shows cheap fares from a city. The graphic to the right shows other features to look for on that page. For example:

- when to travel (which days have the lowest fares), and

- where to travel (which cities have the best deals).

Kayak: Search 140+ travel sites at once to find and compare the cheapest fares from all sites together – great grids and filters to find what you are looking for fast.

Airfare Watchdog: Up-to-date list of low fares from major airlines (including Southwest). You can subscribe to alerts too.

Leave a Reply