As I write this, Texas has already cleared up and is warm again ... but the effects of a week spent below freezing (with temperatures reaching below zero) will be felt for a long time.

via Joe Raedle/Getty Images

via Joe Raedle/Getty Images

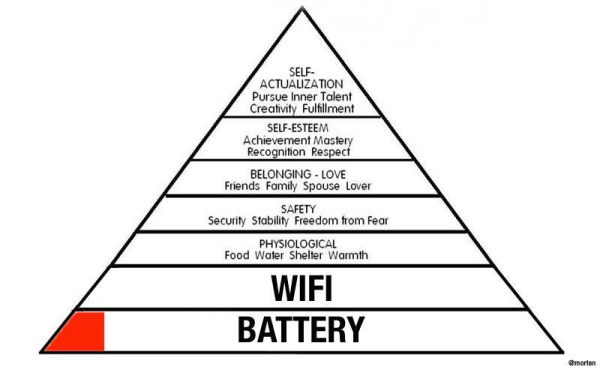

Even though it had not snowed here in for several days, the Rolling Blackouts continued through the end of the week. It is hard to believe Texas does not know how to handle six inches of snow. Having grown up near Boston, I recognize that with no plows, no sanding, and no salt ... you stand little chance of keeping the roads clear. At some level, it is just idiots slipping, sliding, and waiting for the sun to come out. But who would have thought that would describe top leaders of the State and its ability to provide basic human needs like power, water, and heating (let alone WiFi and battery power)?

The ice storm and cold snap weren’t so bad for me (compared to some of the stories I’m hearing from other people in our office). Yes, we lost power, water, and the Internet ... but only for a few isolated hours. I was lucky (and so was our data center), but millions (including several Capitalogix employees) suffered due to lack of water, electricity, or heat, and to add insult to injury – burst pipes.

Despite the fact that the temperature is back in the high 50s, here is a photo I took at our local supermarket this weekend. Let's say things aren't quite back to normal yet.

I've seen a lot of political mudslinging from both sides trying to avoid blame. The reality is that this mess is a disaster that doesn't need to be politicized (and should be used as the raw material to make sure that something like this doesn't happen again). While Texas rarely sees weather like this, this wasn't the first time we have, and it won't be the last.

Two major factors came into play.

First, Texas chose to stay off the national grid to avoid federal regulation. The Texas grid is called ERCOT, and it is run by an agency of the same name — the Electric Reliability Council of Texas. We joke about Texas seceding from the Union, but the reality is that many Texans are fiercely independent and crave less federal regulation (which is a discussion for another day) so the choice resonated with constituents. Especially since Texas is a very energy-rich state. Unfortunately, not being on the national grid means that when our grid is overtaxed, we're mostly on our own. In the winter of 2011, when our power sources couldn't keep up with needs we imported energy from Mexico to keep up, but this year much of Northern Mexico was struggling as well.

Second, Texas chose not to winterize its power sources. After 2011, a proposal was floated to winterize energy plants by adding insulation, heating pipes, etc. but it was very costly and wasn't adopted. Many Texans (including politicians) were quick to blame it on the underperformance of renewables, but in this case, according to ERCOT, natural gas, coal, and nuclear were affected.

All of these energy sources can be winterized, and renewables work fine even in Antarctica. This isn't an argument for renewables or for joining the national grid. Just an acknowledgment of the current situation.

ERCOT claimed that they were ready for the storm, and warned their plants to "winterize" how they could, but clearly, it wasn't enough. With more preparation locally and on the state level, Texans should be fine to handle these types of episodes in the future. With that said, it shouldn't take episodes like this to enact change.

Regardless, crises like this are opportunities to come together, and I've been very happy to see how many people have offered food, water, and their homes to people in need.

Thank you to all who reached out to check in on us.

Who Can You Trust?

Information is Power.

Consequently, your choice of information source heavily contributes to your perceptions, ideas, and worldview.

Coincidently, news sources are a lightning rod for vitriol and polemic.

I am still a little surprised by the abject hatred I hear expressed towards a particular news source by those who hold an opposing bias. This often leads to claims of fake news, delusion, and partisan press. Likewise, it is common to hear derision toward anyone who consumes that news source.

Perhaps the reality is that that most sources are flawed – and the goal should simply be to find information that sucks less?

It's to the point where if you watch the news, you're misinformed; and if you don't watch the news, you're uninformed. News sources aren't just reporting the news, they're creating opinions and arguments that become the news. And many don't care enough to think for themselves - or to extract the facts from the opinion.

Here's a chart that shows where news sources rank on various scales. You can click the image to go to an interactive version with more details.

via Ad Fontes Media

I once spent fifteen minutes in an argument about how you know whether the information in this chart is true. If you're curious about their methods, click here.

Distrust toward news agencies, big companies, the government, and basically anyone with a particularly large reach is the "new normal."

Perhaps even more dangerous is the amount of fake news and haphazard research shared on social media. Willful misrepresentations of complex issues are now a too common communication tactic now on both sides ... and the fair and unbiased consideration of issues suffers.

Social media spreads like wildfire, and by the time it has been debunked (or proven to be an oversimplification) the damage is done. People are convinced ... and some will never go beyond that.

The reality isn't as bleak. People agree on a lot more than they say they do. It is often easier to focus on "us" versus "them" rather than what we agree upon jointly. This is true on a global scale. We agree on a lot. Most Democrats aren't socialists, and most Republicans aren't fascists ... and the fact that our conversation has drifted there is intellectually lazy.

This idea that either side is trying to destroy the country is clearly untrue (OK, mostly untrue). There are loonies on the fringes of any group, but the average Democrat is not that unlike the average Republican. You don't have to agree with their opinions, but you should be able to trust that they want our country to succeed.

I don't know that we have a solution. But there is one common "fake news" fallacy I want to explain at least a little.

It's called the Motte and Bailey fallacy. It's named after a style of medieval castle prioritizing military defense.

Launceston Castle via Chris Shaw, CC BY-SA 2.0

On the left is a Motte, an artificial mound often topped with a stone structure, and on the right is a Bailey, the enclosed courtyard. The Motte serves to protect not only itself but also the Bailey.

As a form of argument, an arguer conflates two positions that share similarities. One of the positions is easy to defend (the motte) and the other is controversial (the bailey). The arguer advances the controversial position, but when challenged insists they're only advancing the moderate position. Upon retreating the arguer can claim that the bailey hasn't been refuted, or that the critic is unreasonable by equating an attack on the bailey with an attack on the motte.

It's a common method used by newscasters, politicians, and social media posters alike. And it's easy to get caught in it if you don't do your research.

Conclusion

As a society, we're fairly vulnerable to groupthink, advertisements, and confirmation bias.

We believe what we want to believe ... so it can be very hard to change a belief, even in the face of contrary evidence.

But, hopefully, in learning about these fallacies, and being aware, we do better.

I will caution that blind distrust is dangerous – because it feels like critical thought without forcing you to critically think.

Distrust is good ... but too much of a good thing is a bad thing.

Not everything is a conspiracy theory or a false flag.

Do research, give more credence to experts in a field - but don't blindly trust them either. How well do you think you're really thinking for yourself?

It's a complicated world, and it's only getting more complicated. But, hopefully, it encourages you to get outside your bubble and learn more about those you disagree with.

Posted at 08:08 PM in Business, Current Affairs, Healthy Lifestyle, Ideas, Market Commentary, Personal Development, Science, Television, Trading, Trading Tools, Weblogs | Permalink | Comments (0)

Reblog (0)