Against a backdrop of economic uncertainty, supply chain upheaval, and rapid technological transformation, foreign direct investment remains a bellwether of global confidence and strategic priorities.

Looking back to 2024, the patterns of FDI offer a window into what the world’s investors value most—and what new risks and opportunities are on the horizon.

In a rapidly shifting global landscape, investors are constantly on the hunt for both opportunity and resilience. Which sectors and regions captured the lion’s share of foreign direct investment in 2024—and what fueled these evolving priorities?

The Global State of FDI in 2024

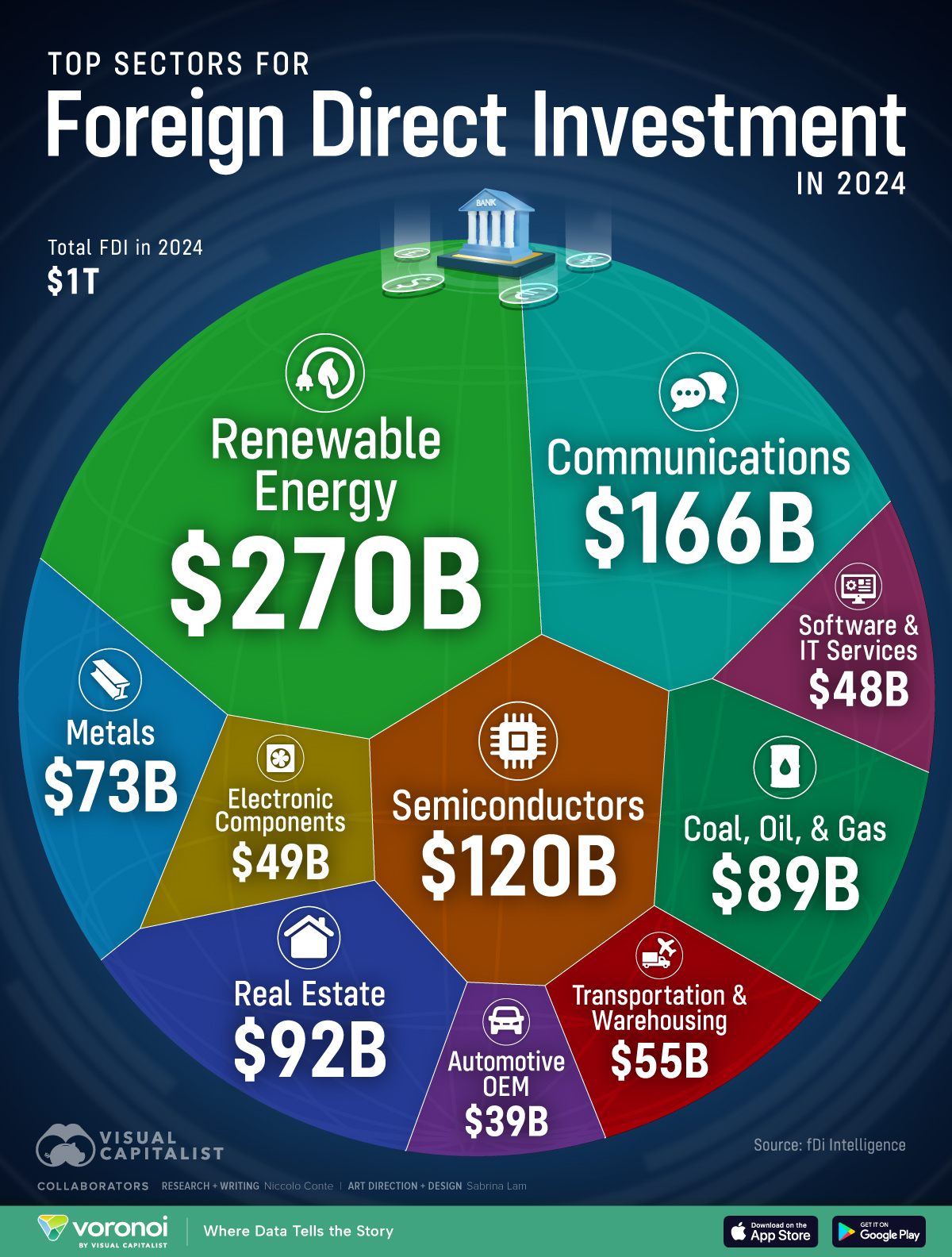

Visual Capitalist created an infographic that shows Foreign Investors allocated more than $1 trillion across the top 10 global sectors in 2024, highlighting the scope and realignment of worldwide capital movements.

via visualcapitalist

Sector Standouts: Winners and Surprises

Now let’s zoom into specific industries.

Renewable energy topped the list, drawing $270.1 billion in FDI. Even so, renewable energy FDI declined — mainly due to rising material costs, tougher regulations, and delayed projects. Despite these setbacks, long-term prospects in renewables are robust.

Perhaps the most surprising winner of 2024, the communications sector not only rebounded but grew by an astonishing 84%, far outpacing previous years. This likely reflects accelerated 5G rollouts and infrastructure expansions in both developed and emerging markets.

Semiconductors followed closely, likely reflecting the growing infrastructure requirements of global reliance on AI.

Notably, FDI in real estate increased despite a critical labor shortage, sparking questions about how investment is responding to workforce constraints.

Meanwhile, traditional manufacturing showed minimal growth, as investors appear wary of ongoing supply chain disruptions and increasing automation across the industry.

Regional Focus: Asia’s Rise & India’s Transformation

Regionally, the FDI tide was far from even. Asia emerged as the dominant destination for FDI. While India, alone, attracted investment across more than 1,000 distinct projects, driven by robust economic reforms and a burgeoning market.

What’s Next?

FDI patterns are not static reflections but dynamic forecasts of the next big global moves. Consequently, geopolitics and regulatory shifts impact FDI as well.

As global investment patterns continue to evolve, the next wave of foreign direct investment will likely redefine which strategies (and which regions) lead. Will emerging trends hold, or will new surprises shift the map again next year?”

Where would you bet global capital will go next?

Leave a Reply