A few weeks ago was Rosh Hashanah – The Jewish New Year, and this evening starts Yom Kippur – the Day of Atonement. The practice around these holidays is a good reminder to take account of where you are and appreciate the blessings around you. It was a reminder to me to sprint towards the end of 2020 with the energy of a new year.

Yom Kippur is a lot like a Catholic confession, but it happens once a year. The holiday is a mix of contemplation, mindfulness, and contrition. Ultimately, we apologize for the sins we've committed against ourselves, our communities, our friends, and our faith. Also important is the promise to do better next year. On top of repenting, we fast (no food or water) for a full day to make sure we're mindful.

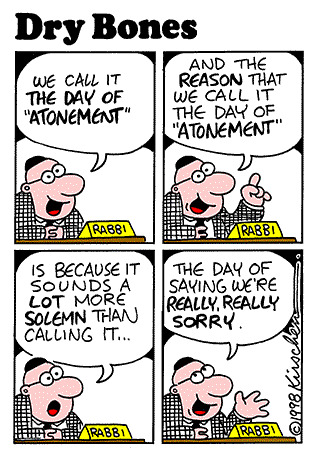

via Dry Bones

It's interesting how little human nature has changed in the past several thousand years. The list of sins is just as relevant today as I imagine it was back then. Even if you have managed to stay on the right side of the Ten Commandments, and haven’t killed or stolen … you have most likely been frivolous, stubborn, hurtful, dismissive, or judgmental (I know I have …).

To help drive the importance of the day, we ceremoniously read a poem called the Unetaneh Tokef. Below is a brief excerpt because it's a powerful read, regardless of faith.

Who will rest and who will wander, who will live in harmony and who will be harried, who will enjoy tranquillity and who will suffer, who will be impoverished and who will be enriched, who will be degraded and who will be exalted.

On one hand, you can read that and pray for Divine intervention (or perhaps favor) or you can recognize that we each have a choice about who we want to be, how we show up, and what we make things mean. Your choices about these things have very real power to create the experience and environment you will live in during the next year.

This year, my local Synagogues are closed due to the pandemic. As a result, I happen to be in Cabo for today. As I look at a photo I took, I find myself thinking about that lesson - that we have a choice about who we want to be, how we show up, and what we make things mean.

The picture is just a picture. The story you tell about it (or what it means to you) is actually more important than the image itself.

One could lament that the sun is going down just as easily as they could celebrate the beautiful sunset. Someone could complain about the rough desert terrain or decide to notice its natural beauty. You could complain about the heat and humidity or jump in the ocean to cool off. You could struggle with how difficult it is to get there or appreciate how nice it is to be somewhere so remote and secluded. In every case, the choice is yours ... this is “free will”.

In addition, some might say that it is wrong that I was in Cabo at the start of Yom Kippur. It reminds me of a story.

Someone asks their religious leader if they can smoke during prayer time ... consequently, they are told “of course not” and reminded to take prayer time seriously and to treat it as a sacred moment. Meanwhile , a different person says “while walking along the beach, and smoking, they feel close to God and start to pray ... they ask their religious leader if this is OK ... with that framing, the answer is “of course” because it is always a good time to feel close to the Divine and to pray.

Progress starts by telling the truth. And Yom Kippur is a time to honest reflection. Equally important to recognizing and repenting for your sins, is recognizing and appreciating that you did good and well ... for yourself, your friends and family, or your community.

All-in-all, it's a nice framework that highlights how you have grown; and, it also shows where you have room to grow.

100 Days Left

We're currently bringing in the Jewish New Year, but we also have just under 100 days before the normal New Year. Many will spend those 100 days stressing about the upcoming elections, grumbling about how 2020 sucked and pretending it's the universe's fault they didn't accomplish what they set their mind to ... but, 100 days is a great amount of time to sprint, to make a change, to end the year on a high note.

That's plenty of time to make this your best year yet. What can you do? What will you do?

I hope you all experience growth in your mental state, your relationships, and your businesses. Best wishes for a great day, and an even better year!

via How Normal Am I?

Have You Voted?

It's election season! Early voting is now open in most places.

Regardless of your preference, it doesn't count if you don't vote.

If you're not sure where your polling location is, check here.

Posted at 01:53 PM in Business, Current Affairs, Ideas, Market Commentary, Religion, Science, Television, Trading, Web/Tech | Permalink | Comments (0)

Reblog (0)