Last week, I wrote about various “indicators” for markets that just don’t make sense — like the Superbowl Indicator. The lesson from those indicators is that we crave order and look for signs that make markets seem a little bit more predictable, even where there are none. This is especially true in complex systems like the stock market, where so many variables and factors are at play that it can be difficult to predict or explain why things happen.

Now, it doesn't mean there aren't patterns - and benefits to watching them. Warren Buffet has proven that. In order to improve your understanding of "markets" you can focus on the fundamentals of individual companies and industries rather than broader market trends. By conducting thorough research and analysis of financials, management, and competitive landscapes of companies, you can make informed decisions about which stocks to buy or sell. Another way to improve your understanding of the market is to focus on long-term trends and avoid getting caught up in short-term fluctuations. It's about focusing on what doesn't change - instead of what does. But, ultimately, you should realize that if you don't know what your edge is ... you don't have one. And, market movements are getting faster, more automated, and harder to predict over time, not less.

With that said, Wall Street is still inundated with theories that attempt to predict the performance of the stock market and the economy. More people than you would hope, or guess, attempt to forecast the market based on gut instinct, ancient wisdom, and prayers.

While hope and prayer are good things ... they aren’t good trading strategies.

It’s true that there are many indices and economic indicators that can provide valuable insights into the workings of economies and markets. While some of these indices may seem “out there,” or even frivolous, they can often shed light on underlying economic trends and realities.

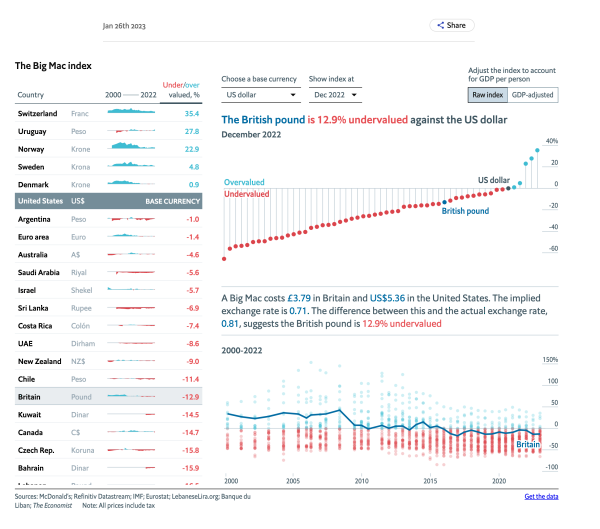

One example of this is the Big Mac Index, which is published annually by The Economist. This index is based on the idea of purchasing power parity, which suggests that exchange rates should adjust to ensure that the price of a basket of goods is the same in different countries. The Big Mac Index uses the price of a McDonald’s Big Mac burger as a proxy for this basket of goods. It compares the price of a Big Mac in different countries to determine whether currencies are overvalued or undervalued.

While the Big Mac Index is not a perfect measure of purchasing power parity, it can provide valuable insights into the relative value of different currencies and the economic factors that influence exchange rates. By looking beyond the headline numbers, and digging into the underlying data and trends, investors and economists can gain a deeper understanding of the forces shaping the global economy.

Ultimately, the key to using economic indicators like the Big Mac Index is to approach them with a critical eye and a willingness to dig deeper. By looking beyond the surface level and using data-driven analysis to understand the underlying trends and drivers of economic performance, we can gain a more accurate picture of the economic realities shaping the world around us.

In 2020, when I last talked about the Big Mac Index, the Swiss Franc was 20.9% overvalued based on the PPP rate. That math was based on the idea that, in Switzerland, a Big Mac costs 6.50 francs. In the U.S., it costs $5.71. The implied exchange rate was 1.14, and the actual exchange rate was 0.94 - thus, 20.9 was overvalued. At the time, the most undervalued was South Africa.

As of the end of 2022, The Swiss Franc is still the most overvalued but has now increased to a whopping 35.4%. Meanwhile, the South African rand has “increased” to only 45.9% undervalued, making the Egyptian Pound the most undervalued currency at 65.6%.

Click the image below to see the interactive graphic.

via The Economist

Obviously, there are more factors at play if something can be significantly overvalued or undervalued for multiple years without significant consequences.

It is not meant to be the most precise gauge, but it works as a global standard because Big Macs are global and have consistent ingredients and production methods. It’s lighthearted enough to be a good introduction for college students learning more about economics.

You can read more about the Big Mac index here or read the methodology behind the index here.

The Big Mac Index: Worth Paying Attention To?

Last week, I wrote about various “indicators” for markets that just don’t make sense — like the Superbowl Indicator. The lesson from those indicators is that we crave order and look for signs that make markets seem a little bit more predictable, even where there are none. This is especially true in complex systems like the stock market, where so many variables and factors are at play that it can be difficult to predict or explain why things happen.

Now, it doesn't mean there aren't patterns - and benefits to watching them. Warren Buffet has proven that. In order to improve your understanding of "markets" you can focus on the fundamentals of individual companies and industries rather than broader market trends. By conducting thorough research and analysis of financials, management, and competitive landscapes of companies, you can make informed decisions about which stocks to buy or sell. Another way to improve your understanding of the market is to focus on long-term trends and avoid getting caught up in short-term fluctuations. It's about focusing on what doesn't change - instead of what does. But, ultimately, you should realize that if you don't know what your edge is ... you don't have one. And, market movements are getting faster, more automated, and harder to predict over time, not less.

With that said, Wall Street is still inundated with theories that attempt to predict the performance of the stock market and the economy. More people than you would hope, or guess, attempt to forecast the market based on gut instinct, ancient wisdom, and prayers.

While hope and prayer are good things ... they aren’t good trading strategies.

It’s true that there are many indices and economic indicators that can provide valuable insights into the workings of economies and markets. While some of these indices may seem “out there,” or even frivolous, they can often shed light on underlying economic trends and realities.

One example of this is the Big Mac Index, which is published annually by The Economist. This index is based on the idea of purchasing power parity, which suggests that exchange rates should adjust to ensure that the price of a basket of goods is the same in different countries. The Big Mac Index uses the price of a McDonald’s Big Mac burger as a proxy for this basket of goods. It compares the price of a Big Mac in different countries to determine whether currencies are overvalued or undervalued.

While the Big Mac Index is not a perfect measure of purchasing power parity, it can provide valuable insights into the relative value of different currencies and the economic factors that influence exchange rates. By looking beyond the headline numbers, and digging into the underlying data and trends, investors and economists can gain a deeper understanding of the forces shaping the global economy.

Ultimately, the key to using economic indicators like the Big Mac Index is to approach them with a critical eye and a willingness to dig deeper. By looking beyond the surface level and using data-driven analysis to understand the underlying trends and drivers of economic performance, we can gain a more accurate picture of the economic realities shaping the world around us.

In 2020, when I last talked about the Big Mac Index, the Swiss Franc was 20.9% overvalued based on the PPP rate. That math was based on the idea that, in Switzerland, a Big Mac costs 6.50 francs. In the U.S., it costs $5.71. The implied exchange rate was 1.14, and the actual exchange rate was 0.94 - thus, 20.9 was overvalued. At the time, the most undervalued was South Africa.

As of the end of 2022, The Swiss Franc is still the most overvalued but has now increased to a whopping 35.4%. Meanwhile, the South African rand has “increased” to only 45.9% undervalued, making the Egyptian Pound the most undervalued currency at 65.6%.

Click the image below to see the interactive graphic.

via The Economist

One of the main limitations of the index is that the price of a Big Mac reflects non-tradable elements such as rent and labor, which can vary widely across different countries and can distort the accuracy of the index. This means that the index is most useful when comparing countries that are at roughly the same stage of development and have similar economic structures and cost of living. Consequently, while it can provide some useful insights into exchange rates and currency values, it is important to recognize that it is only a rough guide and has some limitations when comparing countries.

Another limitation of the index is that it does not consider factors such as taxes, trade barriers, and transportation costs, which can also affect the relative value of currencies. These factors can be especially important in countries highly dependent on imports or exports. They can lead to significant disparities in currency values that are not reflected in the Big Mac Index.

Despite these limitations, the Big Mac Index can still be useful for gaining insights into global economic trends and currency values. By using the index in conjunction with other economic indicators and data sources, investors and economists can achieve a more comprehensive understanding of the forces shaping the global economy and make more informed decisions about how to invest their money.

Obviously, there are more factors at play if something can be significantly overvalued or undervalued for multiple years without significant consequences.

It is not meant to be the most precise gauge, but it works as a global standard because Big Macs are global and have consistent ingredients and production methods. It’s lighthearted enough to be a good introduction for college students learning more about economics.

You can read more about the Big Mac index here or read the methodology behind the index here.

Posted at 05:32 PM in Business, Current Affairs, Food and Drink, Ideas, Just for Fun, Market Commentary, Trading, Trading Tools, Travel | Permalink

Reblog (0)