Last week, I wrote about various “indicators” for markets that just don’t make sense — like the Superbowl Indicator. The lesson from those indicators is that we crave order and look for signs that make markets seem a little bit more predictable, even where there are none. This is especially true in complex systems like the stock market, where so many variables and factors are at play that it can be difficult to predict or explain why things happen.

Now, it doesn't mean there aren't patterns - and benefits to watching them. Warren Buffet has proven that. In order to improve your understanding of "markets" you can focus on the fundamentals of individual companies and industries rather than broader market trends. By conducting thorough research and analysis of financials, management, and competitive landscapes of companies, you can make informed decisions about which stocks to buy or sell. Another way to improve your understanding of the market is to focus on long-term trends and avoid getting caught up in short-term fluctuations. It's about focusing on what doesn't change - instead of what does. But, ultimately, you should realize that if you don't know what your edge is ... you don't have one. And, market movements are getting faster, more automated, and harder to predict over time, not less.

With that said, Wall Street is still inundated with theories that attempt to predict the performance of the stock market and the economy. More people than you would hope, or guess, attempt to forecast the market based on gut instinct, ancient wisdom, and prayers.

While hope and prayer are good things ... they aren’t good trading strategies.

It’s true that there are many indices and economic indicators that can provide valuable insights into the workings of economies and markets. While some of these indices may seem “out there,” or even frivolous, they can often shed light on underlying economic trends and realities.

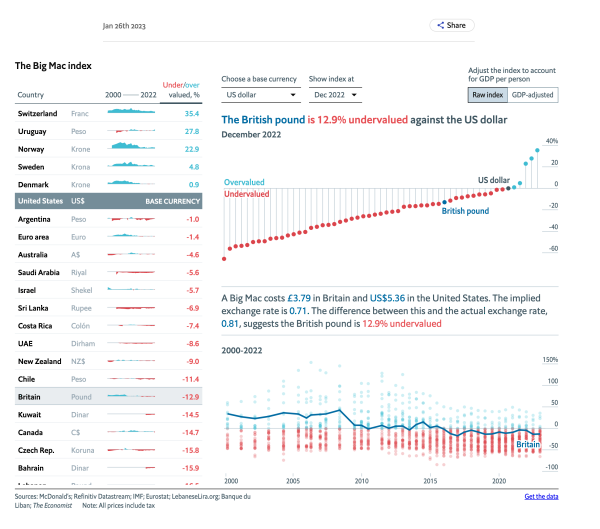

One example of this is the Big Mac Index, which is published annually by The Economist. This index is based on the idea of purchasing power parity, which suggests that exchange rates should adjust to ensure that the price of a basket of goods is the same in different countries. The Big Mac Index uses the price of a McDonald’s Big Mac burger as a proxy for this basket of goods. It compares the price of a Big Mac in different countries to determine whether currencies are overvalued or undervalued.

While the Big Mac Index is not a perfect measure of purchasing power parity, it can provide valuable insights into the relative value of different currencies and the economic factors that influence exchange rates. By looking beyond the headline numbers, and digging into the underlying data and trends, investors and economists can gain a deeper understanding of the forces shaping the global economy.

Ultimately, the key to using economic indicators like the Big Mac Index is to approach them with a critical eye and a willingness to dig deeper. By looking beyond the surface level and using data-driven analysis to understand the underlying trends and drivers of economic performance, we can gain a more accurate picture of the economic realities shaping the world around us.

In 2020, when I last talked about the Big Mac Index, the Swiss Franc was 20.9% overvalued based on the PPP rate. That math was based on the idea that, in Switzerland, a Big Mac costs 6.50 francs. In the U.S., it costs $5.71. The implied exchange rate was 1.14, and the actual exchange rate was 0.94 - thus, 20.9 was overvalued. At the time, the most undervalued was South Africa.

As of the end of 2022, The Swiss Franc is still the most overvalued but has now increased to a whopping 35.4%. Meanwhile, the South African rand has “increased” to only 45.9% undervalued, making the Egyptian Pound the most undervalued currency at 65.6%.

Click the image below to see the interactive graphic.

via The Economist

Obviously, there are more factors at play if something can be significantly overvalued or undervalued for multiple years without significant consequences.

It is not meant to be the most precise gauge, but it works as a global standard because Big Macs are global and have consistent ingredients and production methods. It’s lighthearted enough to be a good introduction for college students learning more about economics.

You can read more about the Big Mac index here or read the methodology behind the index here.

My Thoughts On ChatGPT and the AI Revolution

Last week, I shared a post about the rise of ChatGPT. To summarize ... new AI tools (like ChatGPT) are cool, but they can be a distraction if you're not focused on your actual business goals. Likewise, those tools seem smart, but they are not smart enough to replace you.

Below is a video containing an edited version of my contributions about using AI in business at a recent Genius Network meeting.

via GeniusNetwork.

With something as powerful and game-changing as AI, smart people find a way to take advantage of it (rather than finding ways to avoid or ignore it).

If you keep your head in the dirt, you'll get left behind like Blockbuster, Kodak, or RadioShack.

With that said, one of the key things I've noticed about new tech is that there's massive churn. You've seen it with the blockchain and cryptocurrencies. The companies, products, and modalities that pioneer the industry aren't always the ones who make it. I think it's because they focus on technology instead of solving their customers' real problems.

Pioneers often end up with arrows in their backs and blood on their shoes. Too often, this causes them to give up before they achieve real and lasting success.

You don't have to rush, even if it feels like you're falling behind. To use a surfing metaphor, you shouldn't ignore the coming waves, but you can certainly take the time to wax your board, get in the ocean, and choose which wave you want to ride.

You can catch the little waves and take advantage of ChatGPT or Midjourney, but as a final reminder, if everyone is doing it, it's not a competitive advantage ... it's the playing field.

Posted at 09:57 PM in Business, Current Affairs, Gadgets, Ideas, Market Commentary, Personal Development, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)