The markets held-up well again this week despite lots of bad news on many fronts. While there were several bouts of selling, each time buyers were there to prop things back up.

Here were some of the news items the market handled last week.

- Housing had a tough week. New home sales were the worst in nearly 50 years, while existing home sales dropped and average selling prices declined.

- Businesses are still feeling the recession as Initial Jobless Claims rose again, while orders and shipments of durable goods slipped.

- Consumer Confidence fell more than 18% according to the latest Conference Board Survey.

And then there is the economy and the deficit …

So, let's use some technical analysis to see where the markets stand.

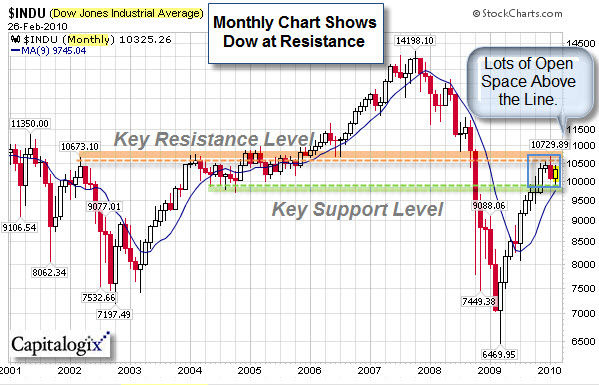

Three Views of the Market – and All Say the Same Thing.

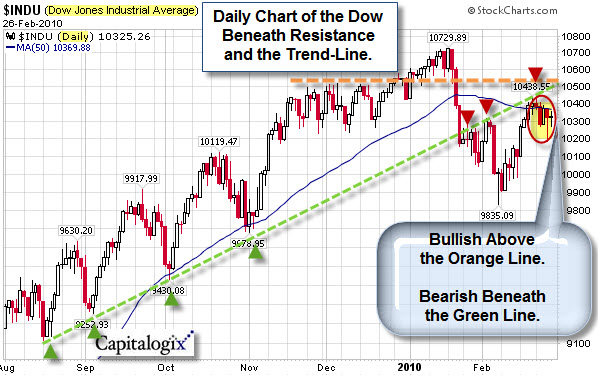

Sometimes simple is better. What follows is a top-down look at the Dow Jones Industrial Average. It starts with a monthly chart for the bigger picture. That is followed by a weekly chart, and then by a daily chart. In all three the key level is just above where we are.

Here is the weekly chart. It shows price re-testing the upwards sloping trend-line from below.

Here is the daily chart. A sustained move above the orange line would be bullish.

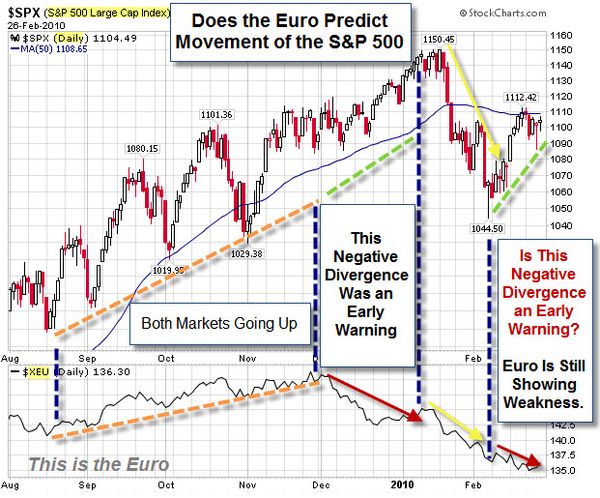

Does the Euro Help Predict US Equity Market Moves?

This video suggests that the Euro is worth watching as an early indicator of likely movement in the U.S. Equity Indices (like the S&P 500 Index).

That is something I will keep an eye on to see how it works. In the mean-time, here is a recent chart of the S&P 500 and the Euro. It is showing a negative divergence because the Euro is continuing to show weakness while the S&P 500 rallied in February.

Time will tell. Hope you have a good week.

Business Posts Moving the Markets that I Found Interesting This Week:

- Bernanke Reaffirms "Extended Period" of Low Rates. (NYTimes)

- Recovery Focus: Which Banks Are Worth Betting-On? (WSJ)

- U.S. New-Home Sales Drop 11.2% – to 1963 Levels. (WSJ)

- Intel, VCs Investing $3.5 Billion In U.S. Technologies. (InfoWeek)

- Economic Annual Report of the President – An Interesting Read. (White House)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Putting a Face to a Name: The Art of Motivating Employees. (Wharton)

- Sleepy

Heads: How Rest Helps Memory & Prepares the Brain to Learn.

(Economist) - U.S.

Would Lose Cyber-War Says Former Intelligence Chief. (InfoWeek) - Get

Ready Sports Fans, Pole Dancers Eye an Olympic Stage. (Newser) - Why the Olympics Might Not Be Televised in 2014. (InfoWorld)

- More Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7f8ada94-284e-4756-a250-21954814b1c7)

Leave a Reply