At the beginning of 2024, I asked the question - how did markets do in 2023?

It makes sense to ask the same question as we start 2025.

Before I get started, it’s worth stating that the market is not the economy ... but with Trump about to step into office, I know people are wondering.

I still think about the often-quoted quip “It's the economy, stupid” - coined by James Carville, a strategist in Bill Clinton’s successful 1992 U.S. presidential election against incumbent George H. W. Bush.

2022 was the worst year for the U.S. stock market since the 2008 financial crisis.

2023 was much better, but much of the gains came in concentrated sectors.

2024 saw nearly every sector posting gains - driven primarily by AI enthusiasm and a robust U.S. economy.

To help you get a sense of 2024 returns, VisualCapitalist put together a few helpful infographics.

via visualcapitalist

66% of companies on the S&P ended up in positive territory this year. The S&P also had its best two-year stretch since the late 90s.

Communication Services usurped IT’s #1 spot, driven primarily by Meta & Google. Strong consumer spending and digital ad revenue brought ad spending to almost $400 billion.

Materials was the only sector to see negative returns, hampered by China’s economic slowdown and increased interest rates.

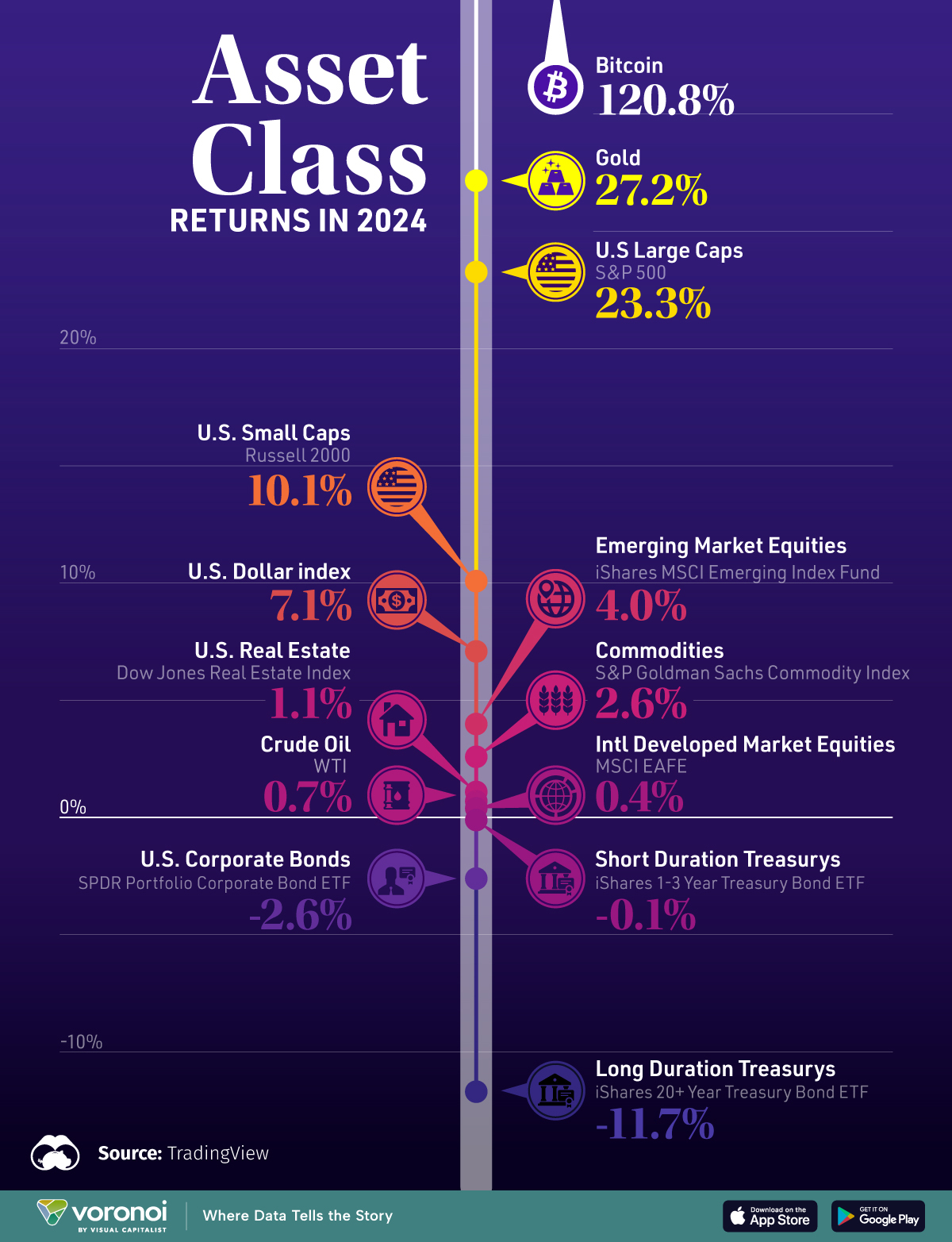

Here is a more global look at return by asset class.

via visualcapitalist

Driven by that end-of-year run, Bitcoin surged to all-time highs, and gold also saw its best performance in 14 years. Meanwhile, bonds suffered heavily amid reflationary concerns and a potential widening deficit under the Trump administration.

In 2024, I predicted a brief market correction, blamed on various geopolitical instabilities and partisan weaknesses, followed by a long and steady push higher as the November elections approached.

How did that prediction hold up? I'd say pretty well.

On one level, I try not to think about or predict markets (because I know better). On another level, sometimes I can’t help myself ...

Part of me is so bullish about AI (and its impact on other things) that it’s hard to maintain objectivity. With that said, I think we’ll have another decent year. However, I expect increased volatility and noise.

What do you expect for 2025?

Do you think the continued investment into generative AI will impact these trends?

Will cryptocurrency continue to explode? What scenarios do you think have the potential to be force multipliers?

Here Are Some Links For Your Weekly Reading - January 12th, 2024

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 03:02 PM in Business, Current Affairs, Ideas, Just for Fun, Market Commentary, Personal Development, Religion, Science, Trading, Trading Tools, Travel, Web/Tech | Permalink | Comments (0)

Reblog (0)