What happens doesn't matter nearly as much as what you make it mean ... and what you choose to do.

For example, Dallas has been 100+ degrees almost all summer, and nothing stops. You'll see people running outside, dogs walking, sports being played. My son plays 8+ hour rugby tournaments in that heat, and no one bats an eye.

Growing up in New England, we were woefully underprepared for that heat. The world would stop. On the other hand, 8 inches of snow was nothing, but a little bit of ice ... and Texas shuts down.

Snow isn't 'good' or 'bad' … and neither was the change of plans.

Perspective.

Fund managers recognize the importance of sensibly diversifying risks and opportunities.

Be that as it may, as Mother Jones reported in the wake of the 2009 financial crisis, the nation's ten largest financial institutions held 54% of our total financial assets (compared to the 20% they held in 1990). Meanwhile, the number of banks has dropped from almost 15,000 to barely 4,000.

via Statista

Many people are shocked by a chart like this. It must be 'bad' to have so much controlled by so few, right?

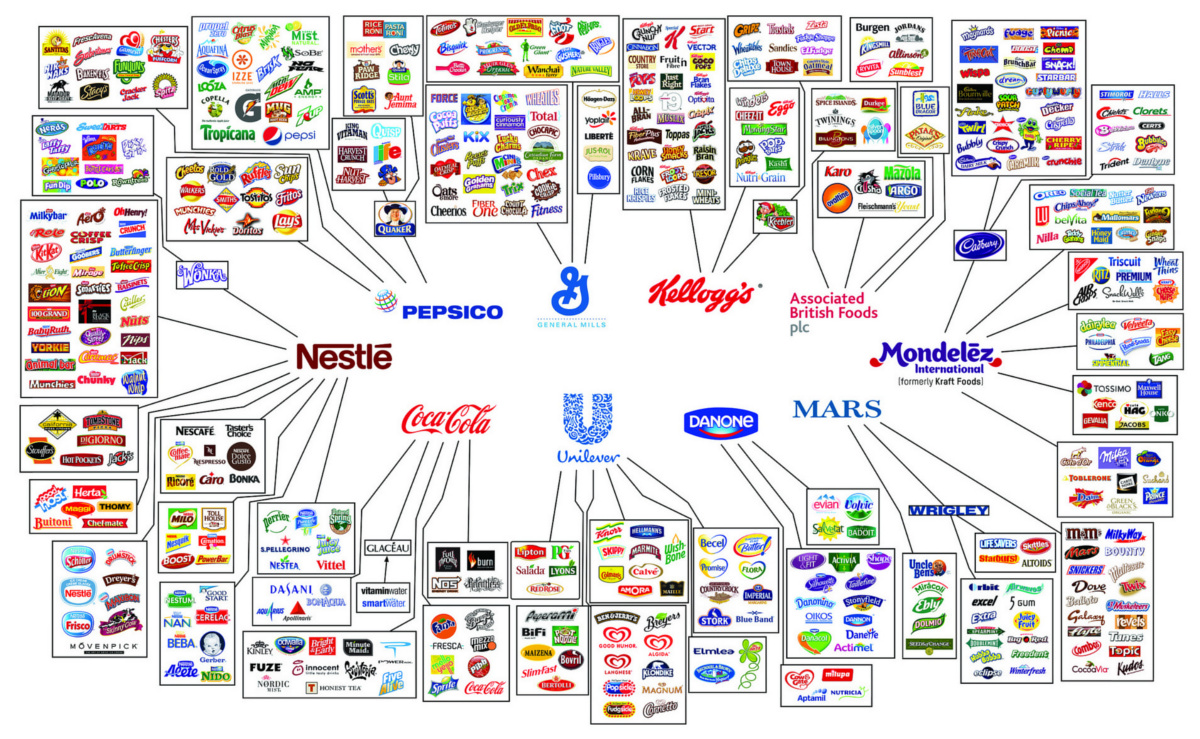

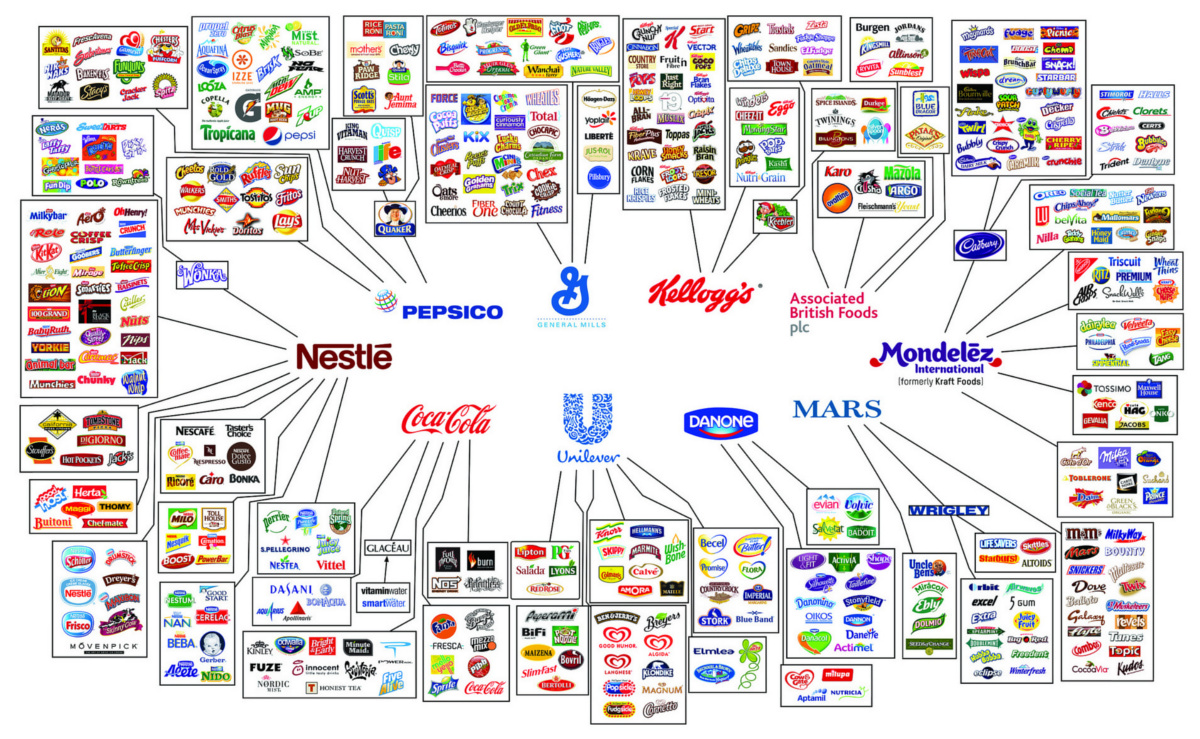

But it isn't hard to find a version of this story playing out in other industries: Print Media, Music, Broadcast Channels, and Consumer Products … this type of consolidation happens for a reason.

A firm that marshals more resources gains a competitive advantage and has more ways to win.

They benefit from economies of scale, transactional leverage, better distribution and partners, and more ways to diversify risks. In addition, if they work to communicate, collaborate, and coordinate their actions (and data), they can unlock opportunities that others don't have (or can't see).

Here is a Chart Showing Some of the 'Winners' at that Game.

The following chart highlights our "Illusion of Choice." A surprisingly significant portion of what you buy comes from one of these ten mega-companies (Kraft, Coca-Cola, PepsiCo, Kellogg's, Nestlé, Proctor & Gamble, Mars, Johnson & Johnson, General Mills, and Unilever).

It's amazing to see what these giants own or influence. Click the picture to see a bigger version.

via visualcapitalist

Here is a more specific example. You probably think you are familiar with Nestlé. It is famous for chocolate. But did you realize it was an almost $300 billion corporation … and the biggest food company in the world? Nestlé owns nearly 8,000 different brands worldwide and takes a stake in (or is partnered with) many others. This network includes shampoo company L'Oreal, baby food giant Gerber, clothing brand Diesel, and pet food makers Purina and Friskies.

Kind of cool? Mostly terrifying...

The Most Popular Spotify Artists

Time and technology march forward relentlessly.

It is easy to keep up – until you pause or slow down.

Being an Early Adopter was a big part of my identity. At this point in my life, I am still early with respect to new technologies, but I feel like I'm losing touch with a lot of today's culture.

Perhaps this started over a decade ago? I remember finding my sons' slang and music off-putting.

As an aside, my youngest son, Zach, went through a phase where it felt like he used the verbal tic ... "Dude" in every other sentence. Parenting trick – I broke his habit by screaming "FOOPDEEDOO!!" every time he said it, regardless of when it happened, where we were, or who we were with.

If it's crazy and it works ... it's not crazy. He certainly stopped saying "dude".

OK, back to the point. I realize that the Top 40 is basically a list of 40 songs that I don't know (and feel like I only randomly know some of the artists). Meanwhile, my staff laughingly refer to my favorite stations on SiriusXM radio as old-man music.

To make the point further, my research assistant asked me if I knew about Bad Bunny. To me, it sounded like a Disney cartoon for Halloween. But, apparently, he is a Grammy-winning recording artist who won "Album of the Year" for music that I had never heard.

It didn't take long to get to the list of top Spotify artists. For the record, I do know most of those artists – but admittedly few of their songs.

Here is the list. How did you do?

via StatsPanda

But as I said, listening to the Top 40 is getting harder for me. Where's the rock (or songs with discernable melodies)?!

Meanwhile, I'm about to start a new art exhibit. I call it "Jen Sleeps At Pop Concerts"

So far, we've got Taylor Swift, Coldplay, Beyoncé, Ariana Grande, Bob Seger, the Eagles, and the Rolling Stones. In case you're curious, she did not fall asleep at John Legend, Queen, or Ed Sheeran.

Times are changing ...

Posted at 05:25 PM in Business, Current Affairs, Gadgets, Ideas, Just for Fun, Market Commentary, Movies, Music, Personal Development, Television, Web/Tech | Permalink | Comments (0)

Reblog (0)