In part 1 of this post, I played around with ChatGPT’s new Advanced Voice Mode. I used it to create an article with essentially no editing, showing how quick and easy using the tool was. This time, I’ll redo that process, emphasizing the prompts used to interact with the AI. Then, I will add some additional prompts to refine the writing. Creating an article this way was dramatically quicker and easier than our typical process. And it’s pretty surprising to see the level of quality content that you can produce with the current state of the technology and relatively minimal effort.

This image was created using X’s Grok AI to pair with this article.

This image was created using X’s Grok AI to pair with this article.

What follows is the transcript from my chat with Advanced Voice Mode, with only light editing and formatting to provide better insight into the process and its outputs.

“I want to write an article about how exponential technology will change life and business. Can you ask me questions until you have enough information to create an outline? And then I’ll give you some other topics, and you can ask me more questions until you have enough time to write the article.”

00:22

Great, let’s dive in! First, for the article on exponential technology, could you share what specific areas of life and business you want to focus on? Are there any particular technologies or industries you find most intriguing? This will help shape the direction of the outline.

“Yeah, I am the CEO of an AI platform company, and I tend to communicate with entrepreneurs, senior executives, and investors, and I’m primarily talking about AI.”

00:15

Great, focusing on AI makes a lot of sense given your background. Let’s narrow it down further. Are you interested in exploring how AI impacts specific industries, like finance or digital media? Or would you rather discuss broader themes, such as AI’s role in transforming business operations, customer experiences, or decision-making processes?

“It started in areas like finance and digital media, but it will impact broader areas.”

00:12

Great point! We can explore how AI began transforming finance and digital media and is now set to revolutionize various other sectors. We could highlight emerging trends and future possibilities in healthcare, education, retail, and more. How does that sound for the article’s direction?

“Sounds fine, but I also want to discuss how it will change everything. AI isn’t just another technological advancement; it’s a fundamental shift transforming the very fabric of our lives. It’s something different ... because it’s no longer just about the technology itself, but the adoption and what it creates and makes possible.”

00:16

Absolutely, AI’s impact hinges on how it’s adopted across industries and societies. It’s this integration into daily life and business that will truly redefine our future. Should we explore examples of this adoption and its potential to change everything?

“Yeah, and I think we ought to talk about how fast OpenAI got ChatGPT to a million users, and then to a hundred million users ... and the fact that it’s not only that the users are playing with the technology, it’s that the companies now have data about what people are trying to do and what they’re having challenges doing, and it’s literally giving them a roadmap of how to eliminate constraints faster and create what comes next at unprecedented speed and rates of change.”

00:21

The rapid adoption of ChatGPT highlights not just public interest, but also the potential for businesses to harness user data. This provides invaluable insights into user needs and pain points, effectively offering a roadmap for innovation. Shall we delve into how this data-driven approach is reshaping business strategies?

“Yes, and let’s do that at a high level and then pose a challenge to the user saying, you don’t have to figure out how to use the current state of technology today ... It’s more important for you to build the muscle about thinking about how tools like this are going to help you build what you want to create for tomorrow.”

00:22

That’s a powerful perspective. Let’s summarize the high-level implications of AI adoption and then challenge readers to think beyond current capabilities. By building a mindset geared towards leveraging AI for future opportunities, they’ll be better positioned to innovate and stay ahead in a rapidly changing landscape.

“I think that’s great. On a separate note, not related to the article, can you speed your voice up by like 0.25?”

00:10

Sure, I can do that. How does this sound?

“I also need you to increase the delay when you’re waiting for me to talk, because I’m someone who thinks and then talks. But I want you to talk a little bit faster like that, and that will seem much more natural for me when brainstorming.”

00:18

Got it! I’ll speak a bit faster and give you more time to think before jumping in. Let’s keep the brainstorming going. What other topics are on your mind for articles?

“I think that agentic processes are poised for the next big wave of innovation. And as much as everybody’s going to start to hear about it, it’s going to follow Gartner’s hype cycle, where we’re going to create inflated expectations and excitement ... but then have a trough of disillusionment as people find that it’s harder to do than they expected. As a practical aside, my company has created an autonomous trading system. In the beginning, we thought it was about trading better ... but it’s really about figuring out the myriad of ways that life gets in the way – from power failures, internet outages, fires in the server room, and geopolitical events. But the real issue is figuring out how to make something work reliably even in the face of errors, competition, mistakes, and bad luck.”

00:50

That’s a fascinating shift in perspective. It really underscores the importance of resilience and adaptability in AI systems. Do you think exploring these real-world challenges in an article could offer valuable insights for others in the tech industry? It seems like it could be a great way to share your expertise.

“Yeah, I just think we have to do that somewhat superficially, so that they think about some of the challenges but then realize that the right thing to do is partner with somebody who’s already figured it out.”

00:14

That’s a smart approach. You can introduce the complexities of implementing AI, just enough to highlight the challenges, and then pivot to the value of partnering with experts who have navigated these obstacles. This could position your company as a trusted guide in the AI landscape. How does that sound as a direction for your article?

“It sounds good. However, you’ve gone back to speaking slowly again. I don’t know if some human is reading the transcript, but you were doing great, and now you’re back to your original pace.”

00:19

I’ll keep the pace up. It sounds like you’re all set. What else would you like to cover?

“That Natural Language Processing has become a key component of AI innovation. It’s amazing how it’s changing how humans interact with computers or access AI capabilities. It used to be that you needed to be good at prompt engineering, but companies like OpenAI have figured out how to interpret simple requests and build a more detailed prompt behind the scenes, so you’re still getting the benefit of prompt engineering without having to become an expert at it yourself. A simple example is the difference between the response to a prompt simply consisting of the word “Improve – and (then a sentence)” six months ago, versus what you’ll get today. And the same is true for a simple image prompt. The result you would have gotten six months ago is vastly different than what you’ll get today because the tools and technologies and multimodal capabilities are working together beneath the surface to create a much more robust and resilient and capable answer engine.”

01:06

That’s a great observation. The evolution of AI is making it more accessible, allowing users to focus on their needs rather than the technicalities. This progress opens up new opportunities for innovation and creativity, as users can leverage AI’s capabilities more efficiently, effectively, and easily.

“OK, do you have enough information to create a basic outline?”

00:04

Absolutely! Here’s a basic outline for your article:

Title: Navigating the AI Revolution: From Exponential Technology to Practical Applications

I. Introduction

- The rapid growth of AI and its transformative impact on life and business.

- Brief overview of AI’s origins in industries like finance and digital media.

II. Exponential Technology in Business

- How AI is revolutionizing various sectors, including healthcare, education, and retail.

- AI’s role in reshaping business operations, customer experiences, and decision-making.

III. The Role of Natural Language Processing (NLP)

- The evolution of NLP in making AI more user-friendly.

- How companies like OpenAI simplify complex requests, enhancing user experience.

IV. Real-World Challenges and Resilience in AI

- Introduction to the challenges of implementing AI systems, using autonomous trading as an example.

- The importance of resilience and adaptability in AI, focusing on overcoming real-world obstacles.

V. Data-Driven Innovation

- How user data from AI applications provides insights for

“Your outline is fine. Please generate a rough draft. Please use some quotes, headlines, subheads, and bullets. I like structure in the article. And please end with a conclusion.”

00:17

Absolutely. Here’s a rough draft with the structure and formatting you requested.

Note: The entire conversation with ChatGPT’s Advanced Voice Mode occurred during a casual neighborhood walk lasting 10-15 minutes. I made no effort to rush the process - it was simply a natural dialogue with my handphone that concluded before I returned home. At this point, ChatGPT generated a draft of the article that was okay, but similar to last time. It didn’t really reflect our style to the level that would make us happy. So, I asked ChatGPT to rewrite the draft using my voice, tone, and style. To accomplish this, I provided five examples of previous articles and instructed it to analyze the voice, tone, and style ... and to generate a prompt that mimics those characteristics. I then returned to the original conversation where ChatGPT had provided its draft and requested it to rewrite the content with those instructions. Here is the output.

Navigating the AI Revolution: Bridging Exponential Technology with Practical Application

Imagine a world where artificial intelligence, once the stuff of sci-fi dreams, shapes the foundations of our daily lives and businesses. What began as a tool in niche sectors like finance and digital media now pulses through healthcare, education, and retail, each industry redefining its approach to productivity, decision-making, and even creativity. Yet, while AI’s exponential growth makes headlines, the real story often lies in the complex journey of making these systems resilient and truly reliable on a large scale.

This image was created using X’s Grok AI to pair with this article.

This image was created using X’s Grok AI to pair with this article.

AI’s potential doesn’t just come from its incredible computational speed; it’s about adaptability—learning as it goes. Think of the impact it’s having in healthcare, where AI diagnoses diseases earlier and personalizes treatments, or in retail, where it sharpens customer experiences with laser-focused recommendations. But here’s the catch: many businesses hit roadblocks when trying to bring this transformative technology into their workflows. Moving from promise to practice takes more than powerful algorithms. It takes a strategy that integrates AI into every part of an organization, backed by a collaborative culture and a solid tech infrastructure to handle the unique demands AI brings.

Natural Language Processing: A Giant Leap Forward

One of the most accessible advancements in AI is natural language processing (NLP). You no longer need a deep technical background to generate impactful results. Companies like OpenAI have unlocked the potential for anyone to leverage complex technology without getting bogged down in the intricacies of prompt engineering. By transforming simple requests into nuanced responses, NLP democratizes technology—empowering business users, entrepreneurs, and consumers alike to harness AI for content creation, strategic analysis, and decision-making.

Real-World Resilience: AI’s Practical Challenges

Despite its transformative promise, deploying AI in the real world is not yet a plug-and-play endeavor. Take autonomous trading systems as an example. While initially focused on optimizing trading strategies, it became clear that the real mission was building resilience against the unpredictable: power outages, unstable internet, server issues, and even geopolitical shifts that could halt operations in an instant. Making AI that doesn’t just perform but thrives in an unpredictable world calls for a fundamental shift in thinking—from optimizing a single outcome to building systems that can handle whatever comes their way.

At its core, AI transforms raw data into actionable insights. For companies, this translates into deeper customer insights, trend forecasting, and optimizing operations on a grand scale. But here’s the challenge: it’s not just about amassing data but about pulling the right insights while respecting user privacy and regulatory requirements.

Those companies that can weave AI seamlessly into their processes—and keep the trust of their users—will lead the charge in this data-driven revolution.

Conclusion: Moving from Exponential to Essential

As AI advances from a cutting-edge tool to an essential part of business strategy, success will hinge not on speed but on the quality of execution. It’s about embedding resilience, enhancing user experience, and remaining ethically grounded. Companies that bring a clear vision and long-term adaptability to AI adoption will find themselves ahead, not just capitalizing on its transformative potential but building a future where AI becomes a natural, reliable partner in progress.

At that point, ChatGPT said:

Let me know if you’d like any adjustments! This draft keeps the original article’s structure and depth while incorporating your reflective, future-oriented tone and approachable insights.

Breaking The Fourth Wall

Hopefully, it wasn’t too confusing to read the transcripts and the article. In this section, I’ll discuss the experience and what I want to improve.

Ultimately, even after asking ChatGPT to rewrite the article, it doesn’t feel exactly like something I wrote. Yes, it was objectively better - cleaner, more structured, more polished. Yet it wasn’t quite “me.”

Better isn’t always good enough.

But here’s the real insight: This “almost but not quite” result might be what we need in the age of AI-assisted content creation. Think of it as a high-quality first draft that gives you a massive head start. Instead of staring at a blank page, you’re starting with something substantial that just needs your unique touch.

To be fair, I could have easily gotten closer to the intended target with just a few more prompts.

In addition, I could easily train an AI in-depth on my voice and writing style. Frankly, I should do that.

In the old days, we relied on style guides. With today’s level of AI, you can create custom AI prompts to transform base content into audience-specific communications. This opens up an intriguing possibility for businesses. The implications for scaling high-quality, consistent content are significant.

Or, I could practice what I preach and use this as the base primer to write something better. This article demonstrates the power of that hybrid approach. Some parts detail the AI’s contribution, while others share strategic insights and personal perspectives. Together, they create something more valuable than humans or machines can produce alone.

If you genuinely enjoy writing, AI shouldn’t be your replacement - it should be your amplifier, enhancing and multiplying what makes your writing uniquely yours.

As much as that’s true, sometimes you just have to produce decent-quality output. This process certainly did that, and there are plenty of simple add-ons that can elevate the quality from merely acceptable to genuinely good.

Even though I didn’t want to use another tool (because of the premise of this article), I pasted the article into a tool called Type (which is similar to Lex). Both are AI document editors that speed up and simplify the writing process. Type gave me these options, each of which would have improved the article.

-

Improve: Remove clichés, fix errors, and improve transitions.

-

Fix Errors: Fix grammar and spelling errors.

-

Shorten: Remove fluff and simplify lengthy phrases.

-

Enhance Structure and Formatting: Make things easier to skim and read.

Additionally, Type has a cool feature that analyzes your document and suggests things to incorporate at specific points. It can generate sentences, lists, and paragraphs directly at your cursor as you write. It also can help you find the perfect idea with real-time suggestions. Type analyzes your writing to identify opportunities to expand or improve it. When you like a suggestion, Type’s writing AI can write it out and insert it into your document.

Here are some of the suggestions it had for the “Navigating the AI Revolution” article.

-

Highlight successful case studies of companies that have effectively integrated AI.

-

Include specific metrics and ROl examples from Al implementations.

-

Outline the necessary steps for businesses to begin their Al transformation journey.

-

Describe the role of human oversight and the balance between automation and human judgment.

-

Explore the future implications of Al on workforce development and job markets.

-

Discuss the importance of cross-functional teams in Al implementations.

-

Address cybersecurity concerns and protective measures when deploying Al systems.

It’s like having a team of grammar, style, story, and industry-specific knowledge specialists. You can brainstorm and examine issues from multiple angles to incrementally improve your base product and transform it into something worth saving and sharing.

In conclusion, I spent more time crafting the intro and conclusion than writing the base article with ChatGPT’s Advanced Voice Mode.

When I first started playing with AI tools, I hoped they could improve my writing. Now, I realize they’re already so capable and powerful that they are changing how I write and even how I think about writing.

In business, I often say you don’t want to be the bottleneck or limit of how good things can be. With tools like these, that’s true with writing as well. The limits of your initial thinking or knowledge no longer constrain the upper limit of what you can produce.

For executives and teams looking to stay ahead, the question isn’t whether to use AI in content creation - it’s how to use it most effectively while maintaining your authentic voice. The leaders who crack this code first will have a significant competitive advantage.

I’d love to hear your thoughts on this article or how you are using AI.

Why Leave The House When You Can Shop Online ...

The holidays are almost here! Time's running out to get your gifts in time.

Luckily, it's never been easier to get stuff. On top of online shopping, Amazon has stewarded the switch to almost instantaneous shipping.

I remember when malls were filled to the brim, and Black Friday led to stampedes and people dying. Now, it's brick-and-mortar stores that are dying.

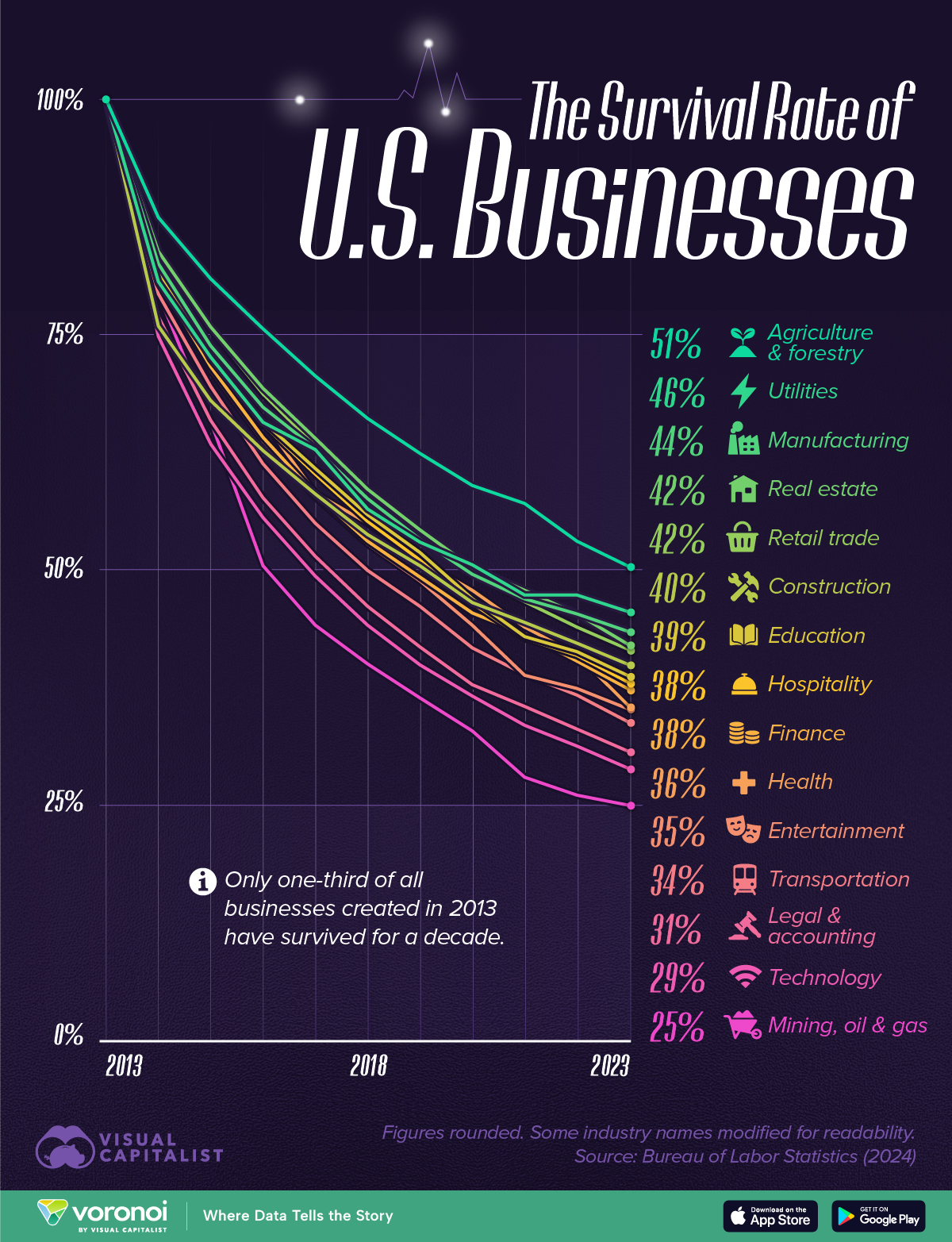

Not only are the in-store deals not as good, but the best deals are online. Here's a chart showing the surge of online shopping.

via visualcapitalist

Online shopping now accounts for about 15% of consumer spending, up from 4.1% in 2010.

In addition, Q4 always sees a massive spike, with online spending accounting for 17.1% of consumer spending in 2023.

This year, Cyber Monday attracted over 64 million U.S. shoppers, three times the number who shopped in stores.

You can find change everywhere, but one place to look hasn't changed. Amazon is all about infrastructure and disruption.

It's interesting to consider how drastically this changes supply chain management. People now expect free and fast shipping and the ability to return items if they don't work out (instead of trying them in-store). Meanwhile, brands have high fixed costs due to their existing retail locations, yet they need to keep most of their stock in warehouses instead of their box stores to deal with the surplus of online orders.

We're already seeing the failure of malls and the bust of commercial real estate. If this trend continues of work-from-home and online shopping, we could see a $250 billion decrease in commercial property value by 2026.

What do you think it would take to stop the bleeding and encourage both consumers and employees to leave their homes?

Posted at 06:59 PM in Books, Business, Current Affairs, Gadgets, Ideas, Market Commentary, Science, Trading, Web/Tech | Permalink | Comments (0)

Reblog (0)