My kids are getting older. In fact, not only are they both adults, but they're both married. Father's Day looks a little different than it used to.

As I look back, I realize that there was an investment I made that paid off in a big way, and I want to share it with you.

Like many parents, I wanted to teach my children that, to a large extent, they control what happens to them. One of the first ways I did that was to set up a "compensation system" for them to earn video games.

Some parents try to limit the amount of time their kids spend watching TV or playing video games. I tried something different. Instead, my kids earned their games by reading books. Here is a photo from way back then.

Paid With Play.

Here's how it worked. When they were younger, 10 books were enough to earn a small game. When they finished a book, it was their right, and my obligation, to take them to the bookstore for us to pick up the next book together. Likewise, when they finished the requisite number of books, it was their right, and my obligation, to take them to the computer store or game store for them to choose any game they wanted.

When they finished a hundred books, they got a bonus of earning the next game system. That meant if they had a Nintendo, they could now also get a PlayStation 3 or Xbox 360.

How Can You Encourage a Jump to the Next Level?

There came a point when I wanted one of my sons to start reading grown-up books. He was comfortable reading a certain type of book, and didn't want to read the kind of books that I read. So, I created a bonus system that counted a particular book as three books. I didn't force him; I just let the easier path to a reward "whisper" in his ear what to read. Once he finished that, he never went back to teen fiction.

It Is a Great Way to Learn About Your Kids.

I also used the bookstore visits to gauge how the boys were doing. For example, I might say, "I notice that you read five books in that series, maybe you'd like this book". Or, "That sure is a lot of science fiction; what was the last biography you read?" For the most part, though, I didn't care what they read. The key was to get them to want to choose certain books for their own reasons. Ultimately, their preference meant they were learning to love reading.

It Puts Them In Control of Their Destiny and Rewards.

My younger son likes competition. He also broke or misplaced many things. So, to earn back the Game Boy unit he lost, I challenged him to read five books in five days. These weren't easy books either. It was designed to stretch him, and also to teach him that he could read a book a night. The bet was that he either finished all the books in the allocated time, or none of them counted towards games or Game Boys. On the other hand, if he read a book a night for two weeks, not only would he get his Game Boy back, but the books would also count towards a game. It worked like a charm, and we were both happy.

So, Who Got the Better Bargain?

As they started to get into their teenage years, I needed to up the ante a little. So, 500 books meant they got a laptop of their choice. Both boys cashed in, and probably felt like they were taking advantage of their dad.

I got what I wanted, though; both my boys love reading, and know that they can accomplish anything they put their minds to … one step at a time.

Here is a recent picture of us. All of us love reading ... and none of us needs diapers.

Speaking of diapers, I've leveled up to become a grandfather. Watching my oldest become a father is the ultimate dividend.

I still remember my father joking with me to be careful of what I said about him, because I would have kids who would do the same to me.

Watching my granddaughter grow, explore, and enjoy the world is an incredible blessing.

Plus, I know Karma is a Bitch. ... wait till she starts using everything she's learned against him.

It is part of the cycle of life ... just like diapers.

via Anna Vital

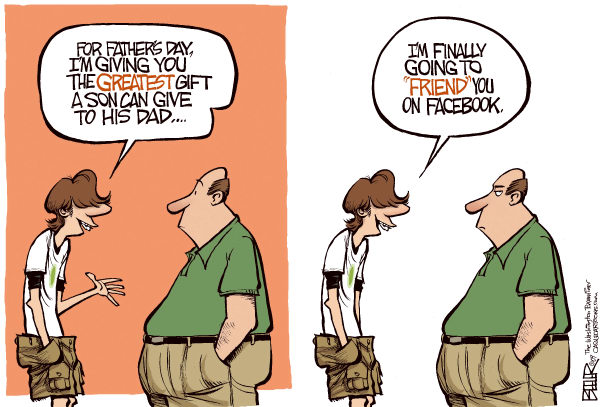

Market Growth in the First Half of 2025.

According to S&P Global, the U.S. market cap rose by 4.7% in the past 6th months. This represents a modest gain compared to the average market capitalization growth of 12.2% during the same period.

Leaders in growth were South Korea, Spain, Germany, Italy, and Brazil.

We have previously discussed this, but in addition to investments in technology and artificial intelligence, global capital is also being directed toward emerging markets, where many businesses are being established.

At first glance, some may see U.S. underperformance, but it can also be read as a sign of relative maturity and stability. Another potential perspective is that U.S. companies have already experienced explosive growth in recent years, particularly in sectors such as tech and AI, suggesting the market may currently be in a phase of consolidation.

While it's always great to see explosive growth, people undervalue resilience and steady growth, especially in light of the volatile first quarter of the year.

Time will tell!

Posted at 04:30 PM in Business, Current Affairs, Market Commentary, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)