I’m sure you remember James Carville’s famous line, “It's the economy, stupid.”

Seasons come and go, as do political regimes, but one constant remains: people focus on the economy … and their wallets.

Recently, my inbox has seen a deluge of wild claims about spending, waste, inflation … and worse.

This morning, I saw several sources citing Robert Kiyosaki’s recent warnings of an impending market crash, massive layoffs, depression, and even war.

Mass market hype aside, I thought it would be interesting to examine these issues and how typical Americans spend their money.

A quick glance shows that household debt recently approached $18 trillion, and credit card debt surpassed $1 trillion.

But, why?

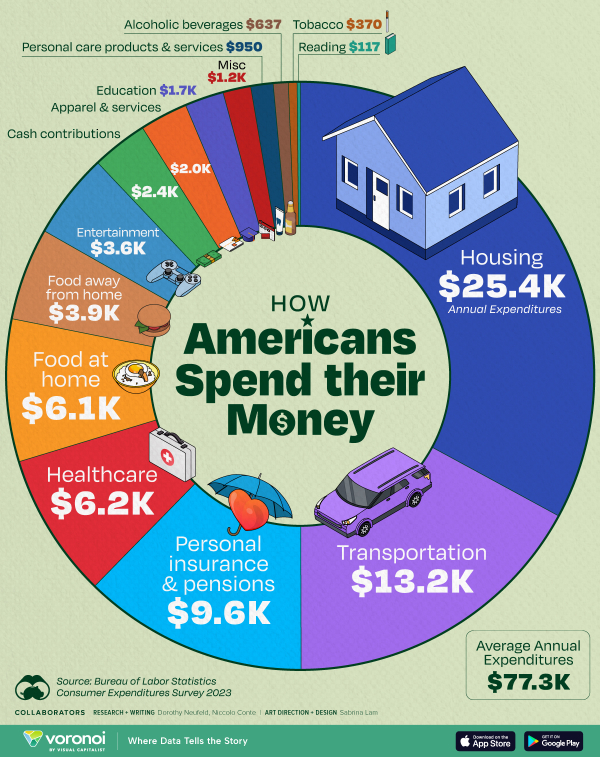

The chart below came from VisualCapitalist. It shows “How Americans Spend Their Money.”

via visualcapitalist

via visualcapitalist

Unsurprisingly, almost half of consumer spending goes toward housing and transportation.

While this has slightly outpaced inflation, it hasn’t by much.

Meanwhile, spending in some areas surged well beyond wage and overall inflation levels. For example, Americans spend 21% more on food than in 2021. A closer look shows that the cause isn’t just inflation. Food and beverage companies increased their operating profits by 79% from 2019-2023.

Educational spending and healthcare spending are also rising.

How do you think the Trump administration’s actions will impact the economy and the wallets of typical Americans?

Many of my close friends and advisors are optimistic about the Trump administration’s actions and expected impacts. However, as I’ve often noted regarding technological change, people are good at noticing big turning points – but struggle with predictions about the second and third-order consequences of these shifts.

How do you see this playing out?

Leave a Reply