"What goes up must come down" is a well-known aphorism. So is, "Actions have consequences, and so do inactions."

On one hand, I try not to think about or predict markets (because I recognize the futility of trying to predict something random to me). On the other hand, it is an election year, and my opinion matters as a proxy for what people like me think or feel in an election year. So, with that in mind, I expected to see a brief market correction blamed on various geopolitical instabilities and partisan weaknesses, followed by a long and steady push higher as we approach the November elections.

What do you think? Is the market's move downwards the start of something bigger, or is it just a temporary correction before a push higher into November?

Looking closer, 10 of 11 sectors in the S&P 500 lost money in April.

via FinViz

Not to mention, for the past few years, the top 20 stocks have contributed almost exclusively to the success of the S&P 500. In 2023, the top 20 stocks drove 7.08% of the 7.55% return.

Those stocks are almost exclusively AI & Tech Stocks.

Often, people look to the S&P as a sign of the economy, but this is a helpful reminder that markets are not the economy.

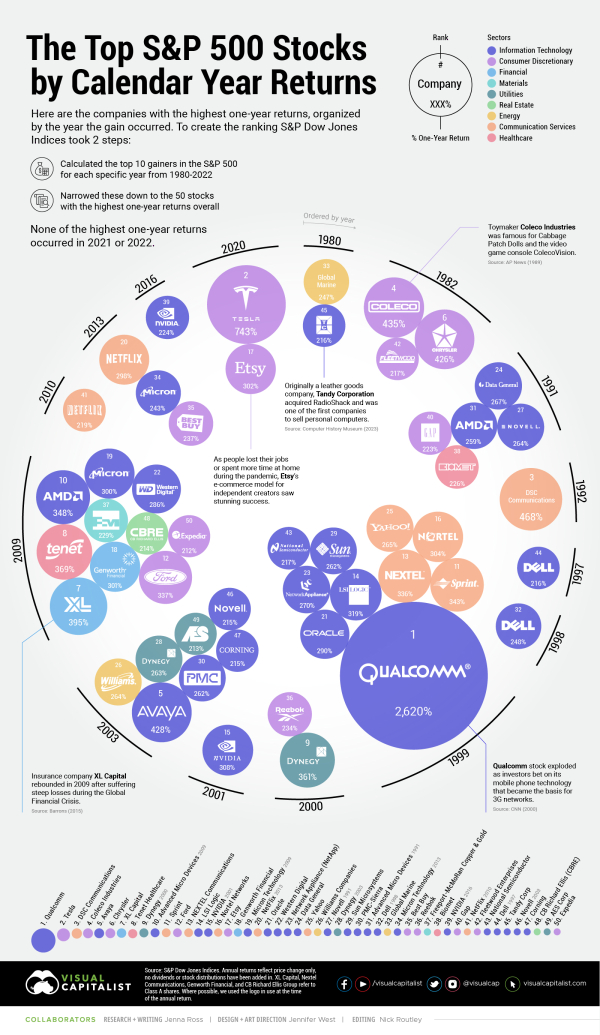

As we look at the S&P, it's also interesting to look at the top stocks over the past 40 years. Visual Capitalist compiled a chart that ranks the top S&P 500 stocks by calendar year returns.

Qualcomm's 2620% return in 1999 is hard to imagine, especially with Tesla's 743% percent growth from 2020 being a distant 2nd place.

In case you were wondering, Qualcomm's growth in 1999 was primarily driven by patents for Code Division Multiple Access (CDMA) technology, which was the infrastructure for "fast" wireless internet access and the 3G network.

via

via

Leave a Reply