Last year, we looked at Warren Buffet’s origins, as well as his holdings (In the past, we’ve also taken a look at Renaissance and Jim Simons).

As a math and artificial intelligence nut, looking at Warren Buffet is still educational. It is fascinating to study his holdings as well as his perspective on the markets. Clearly, he has an advantage and knows how to leverage it.

As the world continues to change, and edges come and go, it’s immensely valuable to understand what remains the same. In Buffet’s case, he has always been honest about his bread-and-butter “trick” … he buys quality companies at a discount and holds on to them.

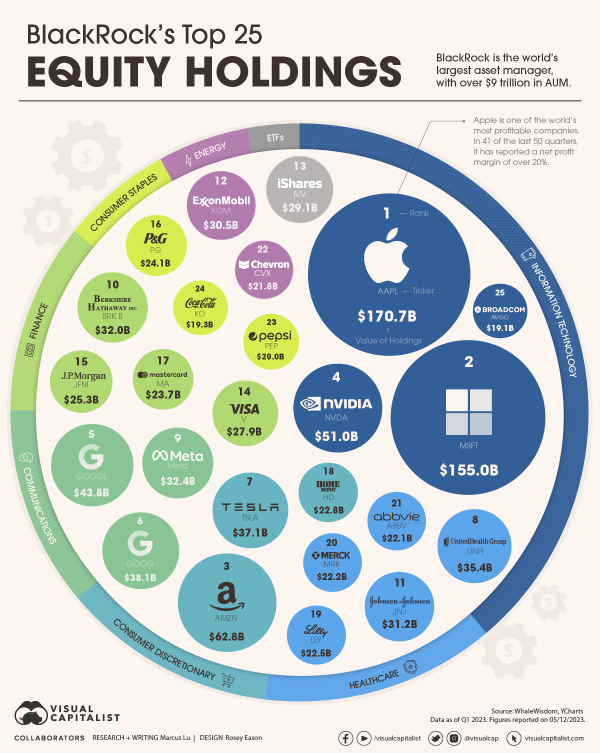

But what about another behemoth in the space – Blackrock? They haven’t been around for nearly as long as Buffet, founded just 34 years ago in 1988. Despite that, BlackRock has quickly become the world’s largest asset manager, with over $9 trillion in assets under management (AUM).

They aren’t as transparent as Berkshire Hathaway about what or how they do what they do. From their website, BlackRock positions themselves as systematic investors leveraging vast datasets and new technologies. To look a little deeper, here is a chart showing their equity holdings.

via visualcapitalist

via visualcapitalist

While Berkshire Hathaway and BlackRock take different approaches and the core of their equity investments aren’t the same … Apple is #1 for both of them. Not particularly surprising.

While this is an interesting graph to look at, it’s important to know that this is one way to invest … and might be a reasonable way to get from a lot of money to even more money – but this might not be the portfolio that works for the average investor (or you).

When there is blood in the streets … asking, “What would Warren or Blackrock do?” might be a great place to start.

But it is hard to have an edge if you use the same process and the same data as your competitors.

As the flywheels of commerce spin faster, edges will emerge and decay faster. Finding a solution is only a step in an ongoing process.

Robust, reliable, and repeatable innovation at scale is a meaningful competitive advantage. That implies that idea factories will become as important (if not more so) than factories that produce material products. Likewise, innovation funnels will become more important than sales funnels.

The world changes at the speed of thought … and as technology continues to improve … even faster.

Onwards!

Leave a Reply