It's been about a month since we discussed Silicon Valley Bank (SVB). But the impact is still lingering. I know friends whose money is still tied up, and we've continued to see increased coverage of banks' perceived failures.

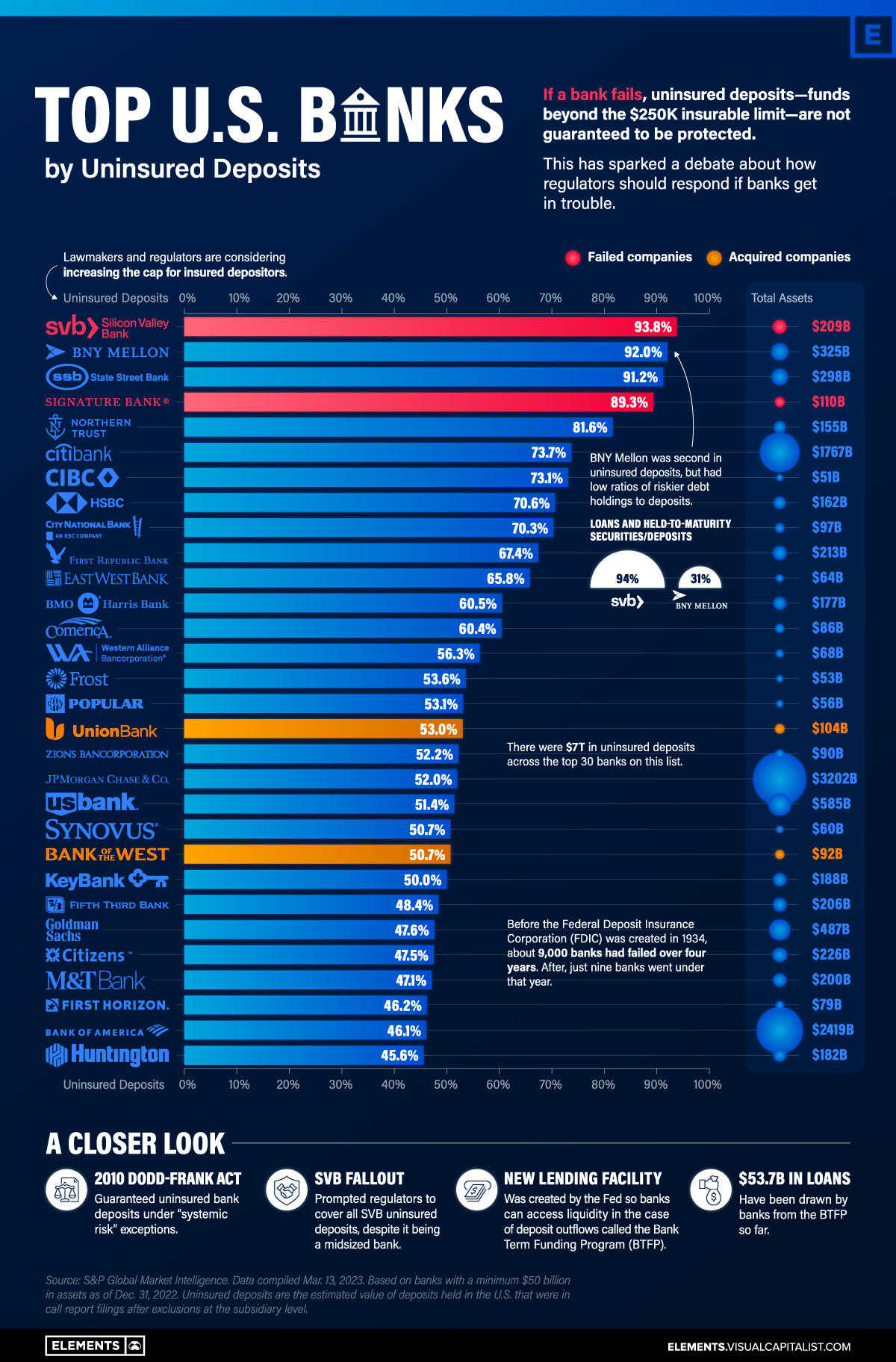

Currently, there are $7 trillion sitting uninsured in American banks. VisualCapitalist put together a list of the 30 biggest banks by uninsured deposits.

via visualcapitalist

Many of the banks on this list are systemically important to the banking system … which means the government would be more incentivized to prevent their collapse.

It's important to make clear that these banks differ from SVB in several ways. To start, their userbase is much more diverse … but even more importantly, their loans and held-to-maturity securities are much lower as a percentage of total deposits. Those types of loans took up the vast majority of SVB's deposits, while they make up less than 50% of the systemically important banks on this list. But, according to VisualCapitalist, 11 banks on this list have ratios over 90%, just like SVB, which brings them to a much higher risk level.

Regulators stepped up in the wake of the SVB collapse, and the Fed also launched the Bank Term Funding Program (BTFP), as we discussed in the last article on this subject. But, it remains to be seen what will happen in the future.

Does the Fed have another option besides saving the banks and backing deposits? If not, market participants will start to rely on the Fed to come to the rescue, making even riskier decisions than they already were.

It feels like the Fed is stuck between a rock and a hard place, but hopefully, we will start to see some movement in the right direction.

Leave a Reply