Do you want the bad news first, or the good news?

Let's start with the bad.

We're now two days into August. U.S. GDP is down 33% on an annualized basis, the largest quarterly decline since the series began in 1947. For context, 1% is a recession, "The Great Recession" peaked with 8.4% in December 2008, and 15% was The Great Depression.

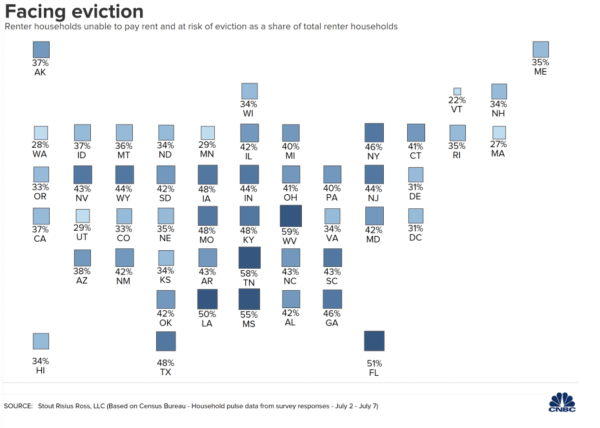

Adding insult to injury, approximately 40% of renter households are at risk of eviction. On Friday, the federal moratorium on evictions expired. Consequently, 25 million Americans have stopped receiving their $600 weekly unemployment checks. Many states have stopped or are rolling back their reopening plans.

Jobless rates, which have been trending downward since March, and credit card spending, which had been trending upward, have both reversed. The corrections weren't nearly as pronounced as the initial shocks.

via CNBC

via CNBC

So there's the bad news, but let's try and find some silver linings:

- First, the prediction for the contraction was 35%, so we're below that number, and job creation in May and June surpassed expectations by almost 12 million.

- Compared to previous contractions, we entered it on a much stronger footing as a result of the long-term expansion.

- As well, remember that 33% number is based on an annualized rate (which assumes the trend will continue, meaning the economy is really only about 10% smaller than in the first quarter).

- Many states are still reopening, and the rest have various recovery efforts underway.

- Big-ticket spending (homes and other long-lasting purchases) has continued to rise. So has daily shipping volume.

The economic consequences of the public health crisis and the measures taken in response will continue to affect the course of the economy for a long time. The recovery will be protracted. But, we're resilient, and we know how to dig ourselves out of this hole. In addition, the whole world is going through a similar crisis. For the most part, I'd rather be here than almost anywhere else. My sense is that people with capital feel the same way, and that is a very positive indicator of why our economy will suffer less and recover faster than other economies.

As I've mentioned before, fear plays as much a role in the recovery as other factors. If people believe in the future, their habits affect the economy differently than if they're at home, hoarding what they have left.

Personally, I believe we're about to see a tough time, with increased volatility and a lot of noise. It is increasingly likely that we will see another push downwards in the markets. I believe that America is well-positioned to adapt and recover. As a company, my sense is the strongest are not the most likely to survive and thrive in times like these. This is a time where adapting and responding to new opportunities and threats will separate the winners from the losers.

Have faith and carry on! Onwards!

Leave a Reply