I recently participated on several panel discussions about AI and trading. This picture was taken at The Trading Show in New York.

I speak at a number of events every year because I enjoy meeting people pushing the envelope and shaking things up. It is also a great opportunity to feel the pulse of the industry (by paying attention to the titles of the sessions, the types of sponsors and vendors attracted, and of course, the makeup of the audiences).

Big changes are coming! Technical innovations and data science insights continue to impress, but the use of alternative data and advanced AI is at a tipping point. I describe these shifts in the book I’m finishing up, called “Next On Wall Street – Understanding AI’s Inevitable Impact on Trading”. Let me know if you want to know more about the book.

In the 90s, when I’d go to conferences, I would pay attention to speakers. Now, when I go to conferences, I'm paying attention to the audience. The players are changing so fast, the game itself is changing.

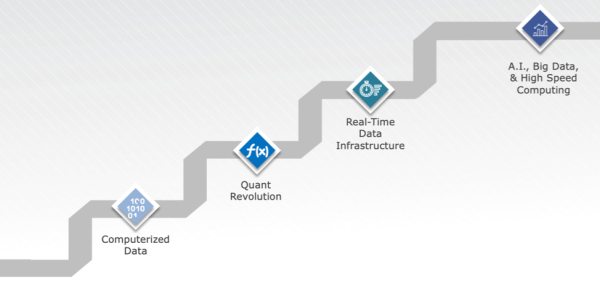

There have been various generations of trading built on different innovations. When computerized data became available, simply understanding how to download and use it generated Alpha. The same could be said for each later evolution: the adoption of complex algorithms, access to massive amounts of clean data, and the adoption of AI strategies.

Each time a new shift happens, traders pivot or fail. The scale of innovation increases, but the pattern remains.

At this most recent conference, I was excited to see people recognizing the pivot toward AI, Big Data and high-speed computing.

Change happens slowly, and then all at once, and we’re getting close to that inflection point.

Onwards!

Leave a Reply