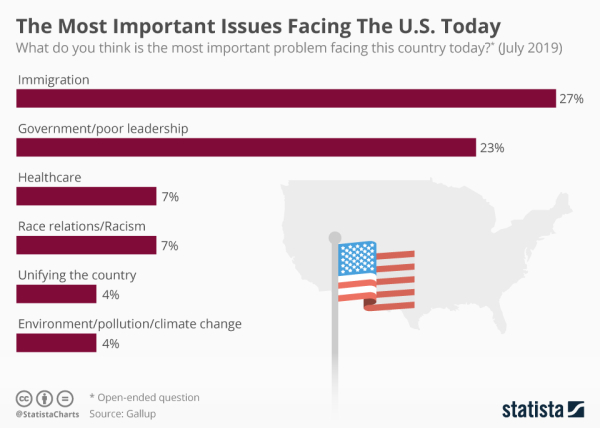

According to a Gallup poll, these are the most important issues facing the U.S. today.

via Statista

In July, immigration topped the list, presumably by people on one side of the political spectrum, followed by the government (likely by people on the other side of the spectrum).

Surprisingly to me, the economy and the trade war were nowhere to be found.

Whether or not we have to worry, they seem fairly germane issues. I started writing an article on yield curves and the fear of recession before realizing our Chief Investment Officer, John DeTore, was already writing his own letter on it. So, I'll deal with some of the surrounding issues here.

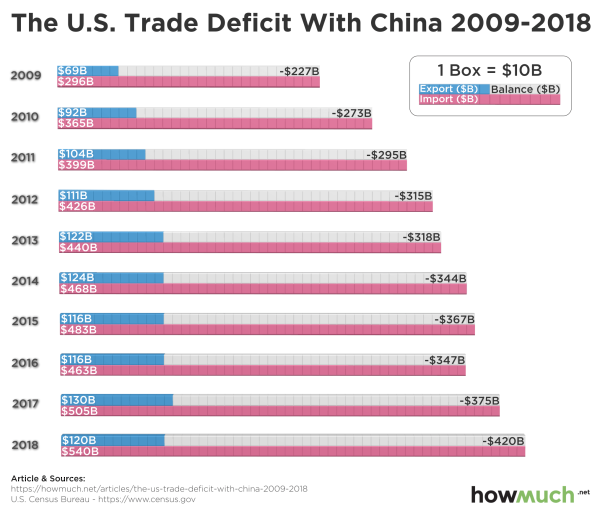

To start, the U.S. imports nearly 4.5x what it exports to China.

via howmuch

via howmuch

While the USA's GDP is the highest globally, China is gaining quickly.

Meanwhile, China is still the biggest holder of U.S. debt – and is currently allowing the Yuan to weaken to try and make its products more competitive and offset tariffs.

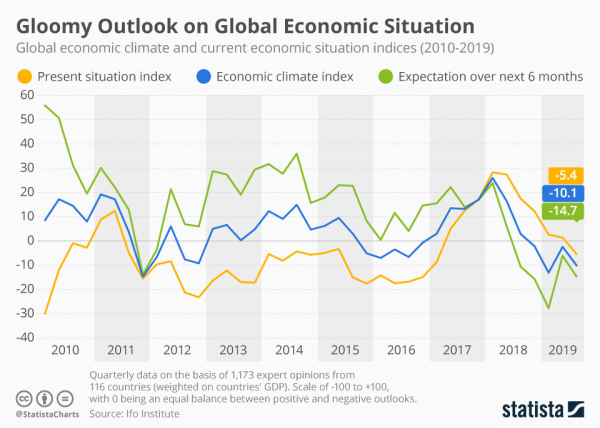

It feels like we're losing some ground. But, everybody seems to feel that right now. The next chart shows that sentiment about the economic situation has been globally gloomy.

via Statista

Everything seems different, yet everything seems the same. Markets tend to climb a wall of worry before falling off a cliff … and then repeating the cycle.

Trends continue until broken.

Seems like a time for caution. But, historically, times like these seem to have great opportunities hidden in them.

Onwards!

Leave a Reply