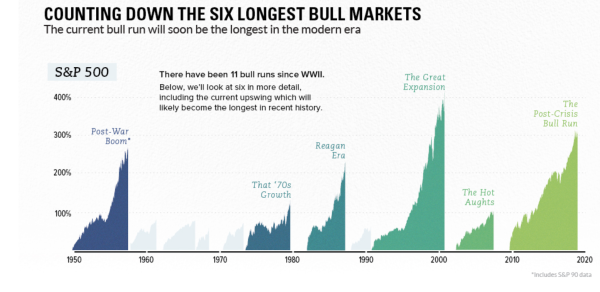

When August 2018 ends, should the trend continue, the current bull market will become the longest bull market (post-World War II,) taking over for the S&P 500 surge from November 1990 to March 2000.

Today's bull market run started after the financial crisis caused by the US housing bubble collapse.

Full Infographic via Visual Capitalist

Full Infographic via Visual Capitalist

What ended the previous runs?

Who knows why a bull market really ends? After-the-fact, it’s easy to proclaim that previous bull runs ended for a “reason”. Looking back, there was the dot-com bubble, Russia launching Sputnik, the energy crisis (and double-digit inflation), Black Monday, the housing bubble, etc.

There is an undertone of fear as interest rates rise, stimulus tightens, and debt rises.

Nonetheless:

- U.S. stock markets are at all-time highs

- U.S. housing prices are at all-time highs

- World bond markets are in a bubble

- The Fed is raising interest rates

Should we be worried?

Ultimately, the Market is not the Economy. And, traders have not been skittish recently.

In addition, markets aren’t governed by the laws of physics … so, what goes up doesn’t really have to go down (at least not all the way).

However, there are signs of underlying weakness. And while markets are impossible to predict, and history doesn’t really repeat itself (though it often rhymes) … a number of indicators are flashing that have previously signaled a recession.

A trader knows that a trend continues until it breaks. This one hasn’t broken.

Nothing works forever, but there is always something working.

Pay attention, and respond accordingly.

Let me know what you think.

Onwards!

Leave a Reply