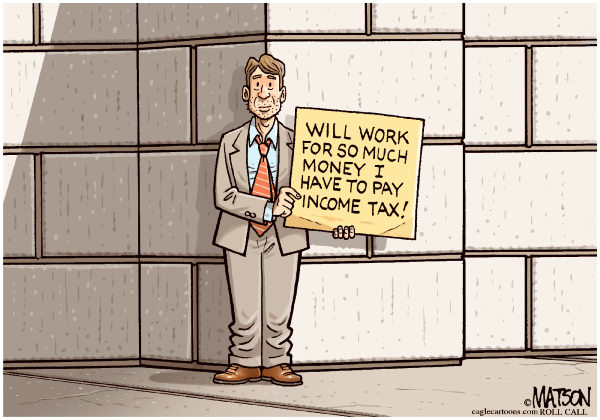

This photo would be so "perfect" …

However, all you see on the Internet is not necessarily true. Oh well, it is still funny.

Here are some of the posts that caught my eye. Hope you find something interesting.

- 12

Blogs Every Small Business Should Be Reading. (SmallBizTrends) - How

NFL Scouts Evaluate Real Talent. (OpenForum) - Why

Political Convention Speeches Should Be More Like TED Talks. (Slate) - Anything

to Win: Romney Apologizes To Nation's 150 Million 'Starving, Filthy Beggars'.

(Onion) - 30

Pictures of People Freaking Out in a Haunted House. This is so telling …

look at how most people respond to the unexpected. (Funny)

- Welcome

to Lehman Brothers. We're Open for Business. (Businessweek) - CEOs’

Vision Darkens. 34% More Apt to Fire than Hire as Fiscal Cliff Approaches.

(Daily) - Mysterious

Algorithm Recently Accounted for 4% of Trading Activity. (Kurzweil AI) - Cyber-Pearl

Harbor: Panetta Warns of Dire Threat of Cyber-Attack on U.S. (NYTimes) - Apple

Has Quietly Created the World’s Largest Hedge Fund, Worth $117 Billion. (Yahoo!

Finance)