Innovation means a lot of different things. It changes based on where we are in history, the amount of time we're considering, and the scale.

Language was an innovation, the piece of plastic on the edge of your shoelaces was an innovation (called the Aglet), changing time signatures in music was an innovation in history, and so is artificial intelligence.

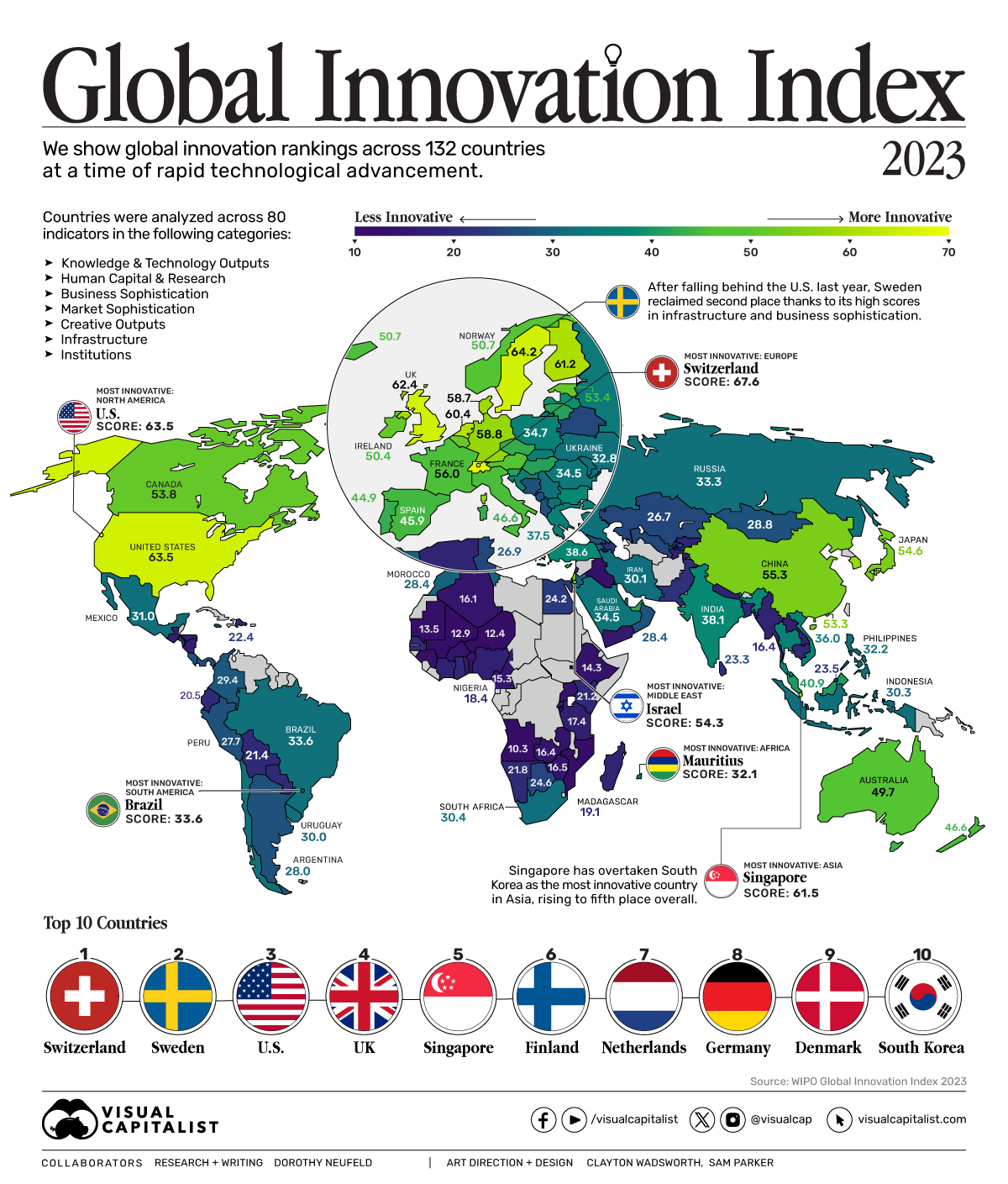

Defining and measuring innovation is difficult even in your business ... but the Global Innovation Index attempts to do it globally. It does so by measuring several factors, like:

- Knowledge and Technology Outputs - patents & high-tech manufacturing

- Human Capital & Research - number of researchers & global corporate R&D investment

- Business & Market Sophistication - knowledge-intensive employment & financing/VCs for startups

- Creative Output, Institutions, and Infrastructure - trademarks, access to resources, and policy

via visualcapitalist

By this metric, Switzerland and Sweden take the top two spots - followed by the U.S. and the U.K.

Honestly, the list surprised me some. Some names I expected to be on the list - or higher on the list - didn't crack the top ten. Though Switzerland and Sweden have dominated this list for many years.

A topic I'm very passionate about right now is patents - and how valuable they can be to your business. Here's a previous article I wrote on the subject, but I'll revisit it soon with new ideas and distinctions.

Why You Need Patents ...

I shared an article titled “Who’s The Most Innovative?” a few weeks ago. That post alluded to the power of patents. Here, we'll discuss the importance and value of intellectual property in more detail.

Historically, profitable companies often built or sold some tangible product. Consequently, the Titans of industry were automobile manufacturers, oil producers, landowners, etc.

However, over the past 20 years, the Titans have changed dramatically. Now, the leaders are in tech, intellectual property, and other intangible assets.

As business becomes more digital, you will see an increasing shift towards creating and protecting intellectual property.

When most people hear that, they probably think about patents. So, let's start there.

Patents and trademarks are a great way to build a moat between you and your competitors ... but they’re more than that. They help you create partnerships and an ecosystem. Ecosystems & communities have proven to be the difference between legacy businesses and flash-in-the-pans. It’s the difference between having a product and having a platform.

Patents add dimensionality and revenue streams.

Take Tesla. They’re not just in the business of making cars or pushing the proliferation of electronic vehicles. They’re creating a suite of capabilities that are patentable and licensable. In the future, they can license the self-driving capability (because why would someone build it when they can license it?). They can license the ability to update a car’s operating system over the Internet (or by their Starlink Satellite offering). They can also grow into a clean energy business. I’m sure there are other strategic byproducts I’m missing – but you get the idea.

As they develop these tools and create intellectual property, these same inventions can also become a weighing and measuring tool to find out where people are interested, and identify where people are spending time, money, and energy. Here is a 60-second video that explains the concept.

Patents make the intangible, tangible.

They provide a concrete form to innovative concepts, enabling businesses to protect and capitalize on their intellectual property.

This mindset also creates the infrastructure for change and anticipating future needs, and ensures companies remain adaptable and positioned for long-term sustained growth.

Getting Started

When I help people understand how to move forward with AI, the first thing I ask them is “What’s your why?”. I ask that because as soon as you lose sight of why you built your business in the first place, you’re lost.

After you understand yourself and your business, you have to understand the industry-wide ecosystems, and where the low-hanging fruit are.

If you know the low-hanging fruit, your problem statement, your value proposition, and your “why” you’re in a great place to move forward.

You can use that understanding to stack some easy wins and create bandwidth for larger endeavors.

The effort-to-impact ratio is a great way to think of how you get started. As you begin thinking about staking ground, you don’t want to do the flashy and cost-intensive stuff first. You want to keep a low profile and start to create walls that will help you in the future.

You can use trade secrets, instead of patents, when you don't want to disclose what you do and how you do it. A trade secret is any non-public information that provides a business with a competitive edge and is subject to reasonable steps taken by the business to keep it secret. The protection of trade secrets does not require registration or disclosure to the public. The information remains protected as long as it is kept secret and continues to provide a competitive advantage.

You can also use your intellectual property as part of an attraction strategy to find potential partners or collaborators – creating what Dan Sullivan calls the “Freezone Frontier”.

Final Thoughts

In essence, patents are not just legal safeguards—they are strategic instruments that can shape the future trajectory of businesses. By embracing a holistic approach that combines legal protection, market intelligence, and strategic foresight, companies can harness the full potential of patents, unlocking new dimensions of success in an ever-evolving business landscape.

Posted at 11:41 AM in Business, Current Affairs, Gadgets, Ideas, Market Commentary, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)