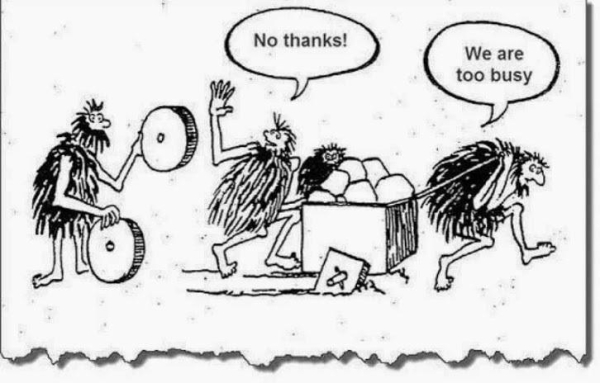

When I think about the invention of the wheel, I think about cavemen. But that isn't how it happened.

Lots of significant inventions predated the wheel by thousands of years. For example, woven cloth, rope, baskets, boats, even the flute were all invented before the wheel (and apparently not invented by cavemen).

While simple, the wheel worked well (and still does). Even now, the phrase "reinventing the wheel" is used derogatorily to depict needless or inefficient effort. But how does that compare to sliced bread (which was also a pretty significant invention)?

Despite being a hallmark of innovation, it still took more than 300 years for the wheel to be used for travel. With a bit more analysis, it makes sense. In order to use a wheel for travel it needs an axle, and it needs to be durable, and loadbearing, requiring relatively advanced woodworking and engineering.

All the aforementioned products created before the wheel (except for the flute) were necessary for survival. That's why they came first. As new problems arose, so did new solutions.

Necessity is the mother of invention.

Unpacking that phrase is a good reminder that inventions (and innovation) are often solution-centric.

Too many entrepreneurs are attracted to an idea because it sounds cool. They get attracted to their ideas and neglect their ideal customer's actual needs.

If you want to be disruptive, cool isn't enough. Your invention has to be functional, and it has to fix a problem people have (even if they don't know they have it.) The more central the complaint is to their daily lives the better.

Henry Ford famously said: “If I had asked people what they wanted, they would have said faster horses.”

Innovation means thinking about and anticipating wants and future needs.

Your customers may not even need something radically new. Your innovation may be a better application of existing technology or a reframe of best practices.

Uber didn't create a new car, they created a new way to get from where you want with existing infrastructure and less friction.

The Gig Economy: Uber's Woes

I enjoy looking at great disruptive companies and great examples of industries that are primed for disruption.

Think about how many companies have failed due to myopia... Radioshack couldn't understand a future where shopping was done online and Kodak didn't think digital cameras would replace good ol' film. Blockbuster couldn't foresee a future where people would want movies in their mailboxes, because "part of the joy is seeing all your options!" They didn't even make it long enough to see "Netflix and Chill" become a thing.

The Taxi industry had been ready for disruption way before Uber came along, yet, Uber may have mismanaged their opportunity. Taxis now have a chance to innovate back.

To run a taxi in New York you need a medallion. There are approximately 13.5 thousand medallions in NYC. In 2013, prices peaked at over 1.3 million dollars for a single medallion.

The medallion system has been broken for a long time. NYC taxis, in particular, were corrupt and the prices of medallions were artificially inflated by Bloomberg and de Blasio, and built on a debt bubble.

Taxis offered mediocre service, high rates due to artificial caps/greed, and often didn't take credit cards.

They didn't adapt and got disrupted. It's an age-old tale. The same tale as Blockbuster or Kodak; companies thinking linearly in an age of exponential change.

Taxi agencies had the infrastructure to edge ridesharing out and adopt friendlier policies but were slow to adopt the apps and convenience that modeled ridesharing.

via chartr

It's clear that there's an increased demand for rides. Increased demand is likely caused by access in places that didn't previously have enough demand for a full taxi-service. Ridesharing means you can have drivers in small towns, rural areas, etc. Almost all the new demand is being monopolized by ridesharing.

Should it be, though?

Posted at 05:31 PM in Business, Current Affairs, Ideas, Market Commentary, Trading, Travel, Web/Tech | Permalink | Comments (0)

Reblog (0)