Almost every event I go to nowadays ends up focused on AI. At a recent event, conversations ranged from use cases for generative AI (and the ethics of AI image creators) to the long-term effects of AI and its adoption.

Before I could chime in, the conversation had gone to the various comparisons from past generations. When electricity was harnessed, articles claimed that it would never catch on, it would hurt productivity – and woe be unto the artisans it would potentially put out of business if it were to gain traction.

When the radio or TV was released, the older generation was sure it would lead to the death of productivity, have horrible ramifications, and ultimately lead to the next generation's failure.

People resist change. We're wired to avoid harm more than to seek pleasure. The reason is that, evolutionarily, you have to survive to have fun.

On the other hand, my grandmother used to say: "It's easy to get used to nice things."

Here's a transcript of some of my comments during that discussion:

With AI, getting from "Zero-to-One" was a surprisingly long and difficult process. Meaning, getting AI tools and capabilities to the point where normal people felt called to use it because they believed it would be useful or necessary was a long and winding road. But now that everybody thinks it's useful, AI use will no longer be "special". Instead, it will become part of the playing field. And because of that, deciding to use AI is no longer a strategy. It becomes table stakes.

But that creates a potential problem and distraction. Why? Because, for most of us, our unique ability is not based on our ability to use ChatGPT or some other AI tool of the day. As more people focus on what a particular tool can do, they risk losing sight of what really matters for their real business.

Right now, ChatGPT is hot! But, if you go back to the beginning of the Internet, MySpace or Netscape (or some other tools that were first and big) aren't necessarily the things that caught on and became standards.

I'm not saying that OpenAI and ChatGPT aren't important. But what I believe is more important is that we passed a turning point where, all of a sudden, tons of people started to use something new. That means there will be an increase of focus, resources, and activity concentrated on getting to next in that space.

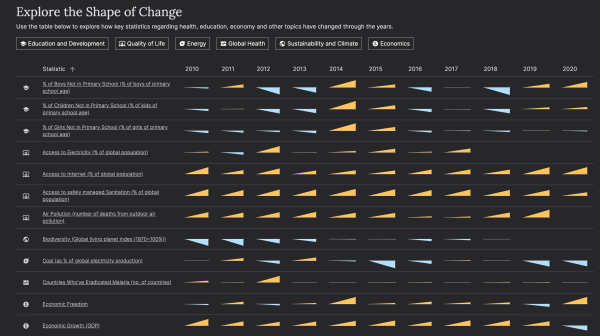

You don't have to predict the technology; it is often easier and better to predict human nature instead. We're going to find opportunities and challenges we wouldn't because of the concentration of energy, focus, and effort. Consequently, AI, business, and life will evolve.

For most of us, what that means is that over the next five years, our success will not be tied to how well we use a tool that exists today, but rather on how we develop our capabilities to leverage tools like that to grow our business and improve our lives.

Realize that your success will not be determined by how well you learn to use ChatGPT. It will be determined by how well you envision your future and recognize opportunities to use tools to start making progress toward the things you really want and to become more and more of who you really are. Right?

So, think about your long-term bigger future. Pick a time 5, 10, or even 20 years from now. What does your desired bigger future look like? Can you create a vivid vision where you describe in detail what you'd like to happen in your personal, professional, and business life? Once you've done that, try to imagine what a likely midpoint might look like. And then, using that as a directional compass, try to imagine what you can do in this coming year that aligns your actions with the path you've chosen.

Ultimately, as you start finding ways to use emerging technologies in a way that excites you, the fear and gloom fade.

The best way to break through a wall isn't with a wide net … but with a sharp blow. You should be decisive and focused.

Commit to using AI in ways that give you energy, which may be entirely different from how you use it now.

So much of what we do now is anchored in the past. This is an opportunity to transcend the old ways you did things and to shape and transform your future (and perhaps even what you believe is possible).

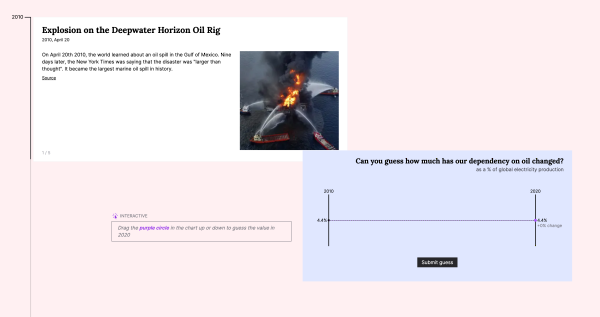

I was an entrepreneur in the late 90s (during the DotCom Bubble). And I remember watching people start to emulate Steve Jobs … wearing black faux-turtlenecks and talking about how they were transforming their business to be in an Internet company – or which Internet company would be the "next big thing." Looking back, an early sign that a crash was coming was that seemingly everybody had an opinion about what would be hot, and too many people were overly confident in their views because seemingly everyone was saying the same things.

Human nature has remained stubbornly consistent through many waves of technology.

The point is that almost nobody talks about the Internet with the focus and intensity they did in the late 90s … in part because the Internet is now part of the fabric of society. At this point, it would be weird if somebody didn't use the Internet. And you don't really even have to think about how to use the Internet anymore because there's a WHO to do almost all those HOWs (and many of them are digital WHOs that do those HOWs for you without you even knowing they were needed or being done).

The same is going to be true for AI. Like with any technology, it will suffer from all the same hype-cycle blues of inflated expectations and then disillusionment. But, when we come out the other side, AI will be better for it … and so will society.

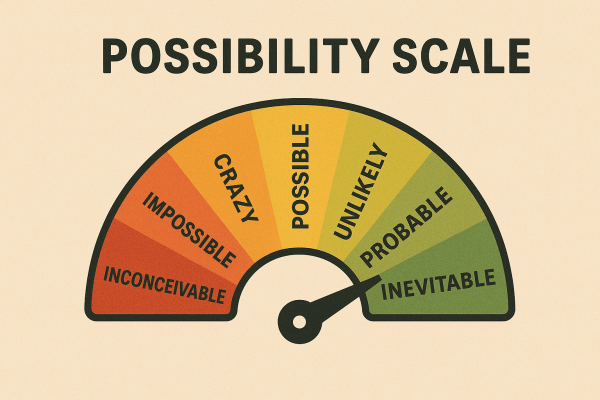

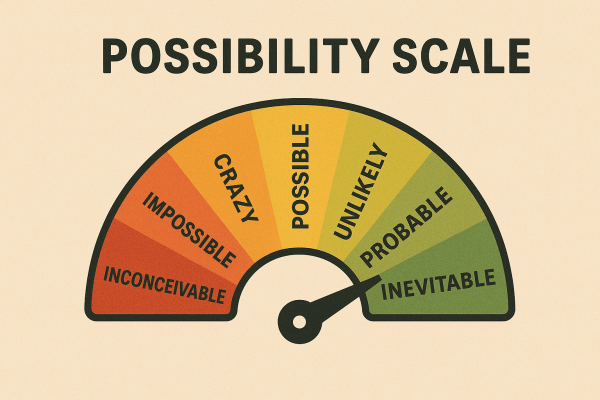

Understanding the Possibility Scale

It helps to understand how we bring things into existence. To start, it's nearly impossible to manifest something you can't first imagine. And there is a moment just before something happens – when it becomes inevitable.

I created this Possibility Scale to help envision the stages of becoming.

As an aside, before today, I would not have attempted to create an image for a post like this. While I love thinking and writing, image creation was outside my area of expertise or unique ability. But now things are different. Today, I simply asked ChatGPT to create that image. Yes, it took me four tries … each retry starting with "that was great, now help me improve the prompt to (fix the thing I wanted done differently)." At the end, I asked it to give me the complete prompt I could reuse. Contact me if you want the prompt.

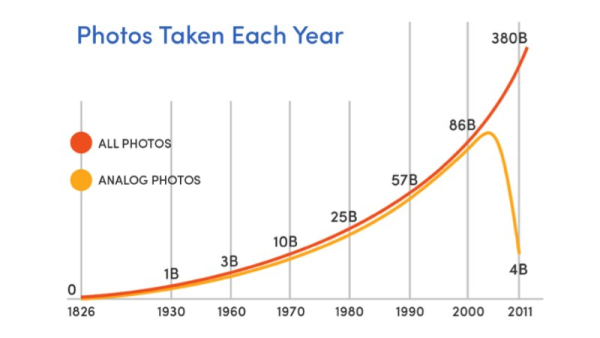

Earlier, I mentioned how long it took to get from "Zero-to-One" with AI. But don't fret; things are speeding up, and we're just at the beginning of the process. If I created a scale to show the capabilities of AI, and set the endpoint at 100 to represent AI's potential when I die – even though I'm in my early 60s, I'd put us at only a 3 or 4 on that 100-point scale. Meaning, we are at the beginning of one of the biggest and most asymptotic curves that you can imagine. That also means that you're not late. You're early! Even the fact that you're thinking about stuff like this now means that you are massively ahead of most.

The trick isn't to figure out how to use AI or some AI tool. The trick is to keep the main thing the main thing. Build your ability to recognize when and how to use these new capabilities to bring the future forward faster.

Investing resources into your company is one thing. Realize that there are 1000s of these tools out there, and many more coming. You don't have to build something yourself. It is often faster and better to acquire a tool than it is to spend money on developing and building it.

Think of the Medici family. They invested in people, which in turn triggered the Renaissance. A key to moving forward in the Age of AI will be to invest in the right WHOs, seeking to create the kind of world you want to see or the types of capabilities you desire. Think of this as a strategic investment into creators and entrepreneurs with a vision or who are on a path that aligns with yours.

As you get better and better at doing that, you'll see increasing opportunities to use tools to engage people to collaborate with and create joint ventures. Ultimately, you will collaborate with technology (like it's your thought partner and then your business partner). We are entering exciting times where AI, automation, and innovation will make extraordinary things possible for people looking for opportunities to do extraordinary things.

As my grandmother said, it's easy to get used to nice things.

Onwards!

Three Generations of Getsons

Three Generations of Getsons