Saw this and thought it was worth sharing.

It looks as if you can buy happiness, after all.

At least, in limited amounts, and up to a point.

That seems to be the conclusion based on a recent survey by the Pew Research Center, part of the Pew Charitable Trust.

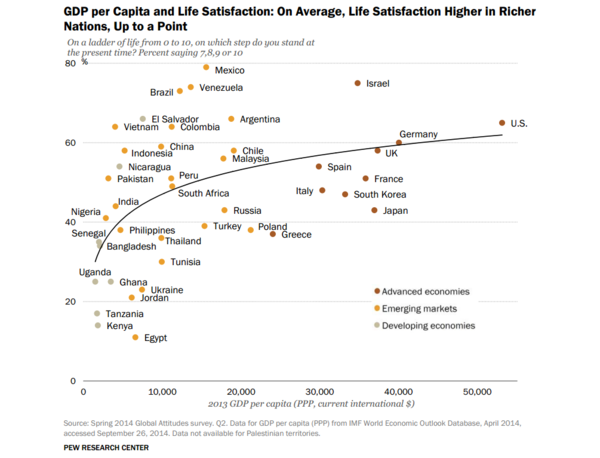

Pew notes that Israel, the U.S., Germany and the U.K. have the happiest populations among advanced economies. This can be seen in the chart below:

Pew Research Center, via Barry Ritholtz.

It should come as no surprise that in the emerging-market countries, rising income tends to be associated with substantial increases in life satisfaction. Some of the biggest gains in self-perceived life satisfaction occurred in Indonesia, China, Pakistan, Malaysia and perhaps most surprisingly, Russia.

Overall, the correlation between increasing income and happiness isn't especially surprising to psychologists and economists who study the field. Past studies have confirmed that money helps to meet the basic needs of life, and that correlates with higher life satisfaction. As different societies become increasingly wealthy, patterns of life satisfaction develop. The report notes that “Satisfaction with their material well-being, though, has the biggest positive impact on their overall happiness.”

Good health, being safe from crime, Internet access and economic opportunity all result in increased levels of happiness and satisfaction. The report, titled “People in Emerging Markets Catch Up to Advanced Economies in Life Satisfaction,” is worth perusing. It is based on 47,643 telephone and face-to-face interviews in 43 countries (See methodology here).

On average, the report found, “those people in advanced and emerging economies are considerably happier with their life situation than those in developing economies.”

Perhaps the most interesting part of the study comes from the regional differences.

Here are the key bullet points

• National income continues to be closely linked to personal-life satisfaction at the country level

• Asia and Africa are the most optimistic regions in the world about their future

• The Middle East is the least optimistic region about the future

• Richer countries tend to have greater life satisfaction

• Rising incomes and increasing happiness are correlated

• People prioritize non-material aspects of life

There is an extensive body of research looking at the impact of money on happiness; one of the takeaways has been that, up to a point, more money does improve happiness and satisfaction. However, most of the gain in satisfaction is attributable to a rather modest increase in income.

Other research suggests buying experiences over material goods is the better way to use money to obtain happiness. Other studies have found that giving away money, in the form of gifts and charitable donations, raises one’s happiness levels. See the 2008 study by Elizabeth W. Dunn, "Spending Money on Others Promotes Happiness."

Perhaps most surprisingly, many of the wealthiest Americans worry "constantly" about their financial situation, a recent report by the wealth-management researcher Spectrem Group found. In discussing the report, the Fiscal Times noted “They may travel more, go to ballgames or concerts, or buy nice jewelry, but 70 percent of those surveyed said they get more satisfaction out of saving and investing their money than from spending it.”

The bottom line remains: Money can buy basic needs and security and this is why we are seeing an increased level of happiness in many emerging markets. Meanwhile, the developing nations also are still having trouble providing the basic necessities for their populations, and that is reflected in their life satisfaction measures.

But money also allows the purchase of experiences, which in the long run people prize more than material possessions -- just as they do by giving money away.

Happy Thanksgiving.

A Look at Black Swan Market Risks - Or Not

Have you noticed that people keep using the term "Selfie" to describe tons of pictures that aren't selfies?

Same with "Spoiler Alert" ... People use the term to mean a variety of things now ... few of which are actually spoiler alerts.

There is something similar happening in the financial world. People have latched on to the term "Black Swan".

Here is an example.

Wall Street was up for the sixth straight week, despite the oil rout.

What could go wrong? What are the "potential Black Swan events"?

To annswer, Société Générale releases a quarterly chart of "Black Swan" risks.

The most recent example is below.

via BusinessInsider.

The concept of a "Black Swan" event takes its name from Nassim Taleb's 2007 book "The Black Swan."

But there's a slight problem with the chart above: acknowledging an event's possibility means it can't be a Black Swan.

The chart suggests that further deterioration in the economic situation in Europe poses a risk to the market. However, a "Black Swan" is an event or occurrence — a tail event, as Nassim Taleb would call it — that is so remote that it is completely unforeseen.

In his book, Taleb uses the Thanksgiving turkey as an example.

"Consider a turkey that is fed every day," Taleb writes. "Every single feeding will firm up the bird's belief that it is the general rule of life to be fed every day by friendly members of the human race 'looking out for its best interests,' as a politician would say.

"On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief."

Here's what it looks like in chart form.

This is basically the book's entire message wrapped up in one graphic.

"Consider that [the turkey's] feeling of safety reached its maximum when the risk was at the highest!" Taleb writes.

"But the problem is even more general than that; it strikes at the nature of empirical knowledge itself. Something has worked in the past, until — well, it unexpectedly no longer does, and what we have learned from the past turns out to be at best irrelevant or false, at worst viciously misleading."

And this is really what the problem of Black Swans is all about.

It isn't that we can't know the future, but that we delude ourselves into thinking we can ... making forecasts about events that are inherently unforecastable and giving us false belief about what can (or will, or might) happen in the future.

When a Black Swan event occurs, it seems outside what had previously seemed possible.

However, Taleb suggests, the event only seems outside previous beliefs about what was possible because of how we arrived at those possibilities ... by using the past to forecast the future.

Posted at 07:55 PM in Books, Business, Current Affairs, Market Commentary, Trading, Trading Tools | Permalink | Comments (0) | TrackBack (0)

Reblog (0)