Walmart just re-instated its Layaway plan for cash-starved consumers. That sends an interesting message; but so did billionaire investor George Soros. Speaking on the sidelines of the International Monetary Fund meeting, Soros said that the crisis is worse than the global financial crisis in the wake of the collapse of Lehman Brothers in the fall of 2008.

Is It Really That Bad?

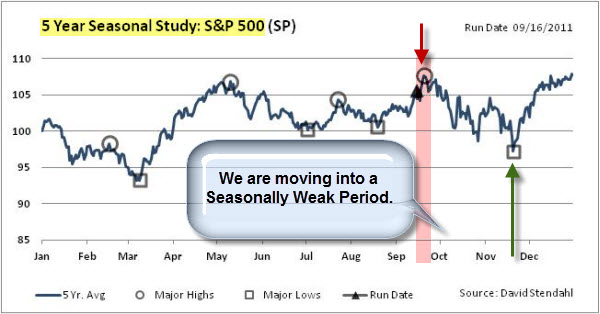

Thought this was helpful in setting context (sort of an "X" marks the spot; "we are here" graphic) for several key economic and market indicators.

Summary of Market indicators.

So, in general, corporate debt has moved to the high end of the historical range and the VIX has risen aggressively higher, just above the historical range. Interest rates remain in typical ranges. Meanwhile, mortgage delinquencies continue to come down slightly in second quarter 2011. Overall, U.S. equity markets continued to fall in August, with the Russell 3000® Index returning -6.0% for the month.

Yet, things might be getting a little bumpier.

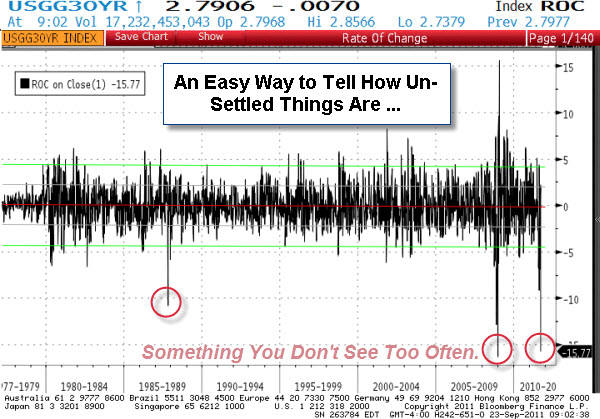

Another Indicator Shows How Volatile Things Have Become.

We just saw the biggest weekly move in 30 year bond since Black Monday (which happened way back in 1987).

30-Year bond rates moved more than three standard deviations this week. Zero Hedge points out that this move can be looked at as a 7 standard deviations of a percentage move basis, given how low rates are at this point.

So much for stability.

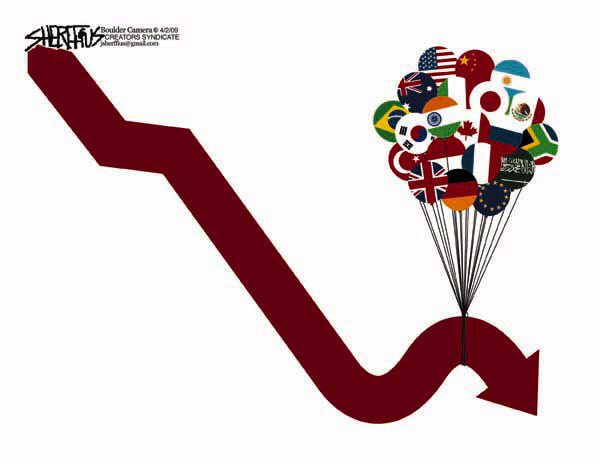

Maybe this will make you feel better? Global economic policy-makers gathered, this weekend, for the annual meeting of the IMF. Publicly, they tried to sound united as they try to calm financial market concerns about European sovereign debt and the region’s fragile banks. Word is Europe would do “whatever is necessary” to resolve the crisis. Feeling better already; don't you?

Imagine being lost deep in the woods, only to hear "Hello" or "What's Happening" come at you from afar. Hikers in Australia have increasingly been surprised to find no one there. Rather than hallucination, the calls have been coming from birds.

Imagine being lost deep in the woods, only to hear "Hello" or "What's Happening" come at you from afar. Hikers in Australia have increasingly been surprised to find no one there. Rather than hallucination, the calls have been coming from birds.