This video from The Economist is a great metaphor for where we are in the market.

The Economist is one of those magazines that piles-up in my office. I don't want to throw it out; but I also don't read it as often as I want to, or should. I tell myself it is because I want to read it thoroughly. Then, when I finally read them, I think that I should read them when they come in (rather than putting them in the pile).

Nonetheless, The Economist always seems to provoke thought, and they throw-in something funny more often than you might expect. I like that they often talk about the "bigger" ideas … and as a trader, I too often get sucked-in by the Siren's Call of urgency and "news".

So, this week I thought I'd write about two of the bigger ideas that the markets are provoking me to think about recently.

The first is how much stock to put into China's recent economic growth? The second, perhaps related, is really a question about how much can we trust the recent rally, in light of what happened just beforehand. With regard to the second question, I'm talking about the U.S. Markets too.

First, Let's Look at China.

The Chinese market and economy seem to have rebounded quickly. However, there are some signs that all might not be well behind the Great Wall. For example, here is a chart that shows a dramatic decrease in electric power usage. It leads to this question. Although Chinese government officials claim GDP is well, are they lying or making things out of thin air (meaning, without electricity).

When confronted with this inconsistency, China had a quick response; it stopped releasing that data.

With tongue-in-cheek, here is a video where China celebrates its status as the world's biggest polluter, as proof of its productivity and prosperity.

China Celebrates Its Status As World’s Number One Air Polluter

Getting back to our markets, I continue to be surprised by the length and strength of the rally.

Apparently, Artificial

Apparently, Artificial

Intelligence is a good substitute for lack of the real thing. So at least

my trading systems have been comfortably "long"… even though I'm feeling bearish.

Could The Recent Rally Simply Be a World-Wide Reflex?

At its simplest, most people try to create a diverse portfolio by trying to buy different types of assets. For example, banks, utilities, tech, staples, and cyclicals. Other classes of assets include things like real estate, precious metals, currencies, and energy. Common sense says that some things go up, while other things go down; that is called "Sector Rotation". However, during times of economic and financial market distress, a surprising number of things move in the same direction, resulting in few safe havens.

At its simplest, most people try to create a diverse portfolio by trying to buy different types of assets. For example, banks, utilities, tech, staples, and cyclicals. Other classes of assets include things like real estate, precious metals, currencies, and energy. Common sense says that some things go up, while other things go down; that is called "Sector Rotation". However, during times of economic and financial market distress, a surprising number of things move in the same direction, resulting in few safe havens.

This asset class correlation was prevalent during the past year. There were days when virtually everything, around the globe, seemed to fall. I saw unusual correlation in our trading systems, too. When the markets really broke down, the diversity we normally see in our trading signals disappeared. It is tough to be long and wrong when trading models say it is more likely that the next move is back up, but the markets keep falling. Discipline says follow the model; but common sense says the model was designed for normal (or at least "mostly normal") market conditions … and that was not the type of market we were in at the time.

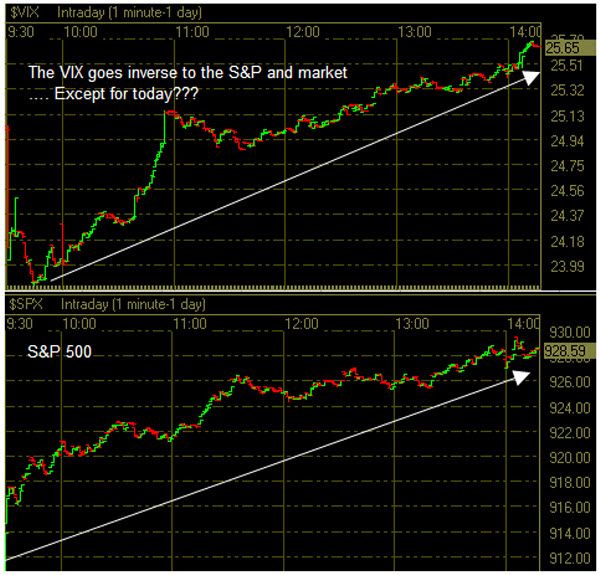

Not surprisingly, research shows that high correlations were a result of the steep fall in market prices and investor sentiment. An interesting article about this is "Do Correlations Matter When the World is On Fire". In addition, Felix Salmon poses a disturbing question: since we're still seeing such a high correlation, even as so many things are going up … is it possible that this is a natural artifact of the recent financial crisis, and perhaps another sign that the market is still in a time of economic and market distress. Likewise, Bloomberg points out that investors are moving in-lockstep like never before, driving up stocks, commodities and emerging markets.

The point is this high correlation actually creates a risk of replaying last year. In other words, the herd mentality threatens to leave investors with little refuge once again.

Business Posts Moving the Markets that I Found Interesting This Week:

- Buffett’s Goldman Stake Pays Richly. (DealBook)

- Morgan Stanley Compensation Soars to 72% Of Revenues. (Business Insider)

- Europe Falls Behind Silicon Valley In VC Deal Flow. (WSJ)

- Implications of High-Speed Trading Systems On Markets & Investors. (NYTimes)

- What Went Wrong with Economics? Avoiding the Mistakes of the Past. (Economist)

- Investors in India Bet on the Weather. (WSJ)

- Superstition & Finance: A Total Eclipse of the Brain. (Economist)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- What Makes the Dalai Lama … well, the Dalai Lama? (NYTimes)

- Trading Psychology Is Psychological Capital. (Trader Psyches)

- Two Dallas Cowboys Players Tackle The Smashburger Restaurant Chain. (WSJ)

- Combining Facial Recognition & Augmented Reality. (Gizmodo)

- Amazon Cripples Mobile That Use Their Data. (WebMonkey)

- Clean-Up Your MP3 Collection Automatically. (WSJ)

- Top VC Blogs, Based On Number of Readers. (TechCrunch)

- More Posts with Lighter Ideas and Fun Links.