As we moved into the July 4th long weekend, the bears remained in control. This chart comes from Breakpoint Trades. It is a long-term chart of the S&P500 Index with a 20-Month moving average.

Yes, we are deeply oversold and sentiment is sufficiently fearful that a rally is likely soon. On the other hand, we haven’t really seen capitulation, and earlier market bottoms this year had some help from the Fed.

It is certainly possible that we get a bottom without getting the “easy trade.” Lots of traders are looking for the big volume reversal and the VIX spike. But how often does the market give people clear signals?

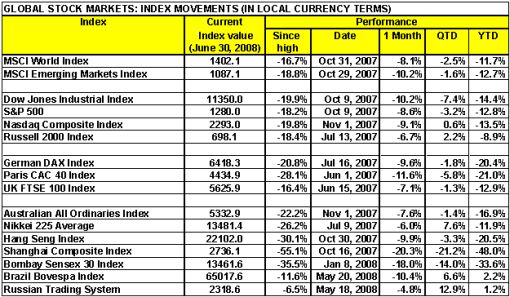

Here is a follow-up to last week’s chart showing how correlated and poorly most global markets have performed recently. This table is from an article called “Nowhere to Hide” by Prieur du Plessis.

Finally, here are a few of the posts I found interesting this week:

- That Was Ugly: The Worst First Half of a Year Since 1970 (Bespoke)

- Hot Wheels and Matchbox Cars Don’t Need Gas: Mattel’s value beats GM (Bloomberg)

- Bearish Battalions: economic growth & profits down, interest rates & inflation up (Economist)

- What Really Killed Bear Stearns? (NYTimes and Vanity Fair)

- Traders Dump Lehman (Minyanville)

- A contrarian considers whether it’s possible that we’ve seen the low for this year (Street.com)

- Financial Down 53% from Their Highs – the easier path might now be up (VIX and More)

- Former NYSE Head, Grasso, Keeps the Money in Dispute Over $187MM Pay (InvestmentNews)

- Trading volume down at CME – interest rate product volume off 17% (Financial News)

- Doug Kass Says America is in Debt and Decline, and it is Time for a Change (Street.com)

- Jobs Decline Again, for 6th Consecutive Month (Global Economic Trend Analysis)

And, a little bit extra:

- A New Middle Name: Obama Supporters Take His Name as Their Own (NYTimes)

- Woman Offers Chance to Marry Her … If You Buy Her House (MSNBC)

- Not Dead, Can’t Quit: No Limit Thinking with Ex-Navy Seal Trading Coach (TradingMarkets.com)

- Who Runs the World – wrestling for a seat at the “Grown-ups Table” (Economist)

- Adobe Makes Flash Content Searchable (BusinessWeek)

- New Flexible Electronic Paper May Change the Way You Read (NYTimes)

Leave a Reply