This past week, Korea released two papers claiming to have created a material (LK-99) that is superconductive at ambient temperatures. Before you get too excited, other scientists are still skeptical and cannot replicate their results fully.

Hyun-Tak Kim—ScienceCast via TIME

Whether this ends up being the breakthrough (or not), there's reason to be excited about where this technology is going.

Semiconductors are the unsung heroes of the tech world, and they power everything from your smartphone to your car. A semiconductor, colloquially a "chip," is a substance that falls somewhere on the continuum between conductor and insulator. Manufacturers process silicon and other materials into semiconductors for all kinds of devices that rely on harnessing electricity for processing power. They're the underpinning of technology, and the 4th industrial revolution is built on the development of better and more connected chips.

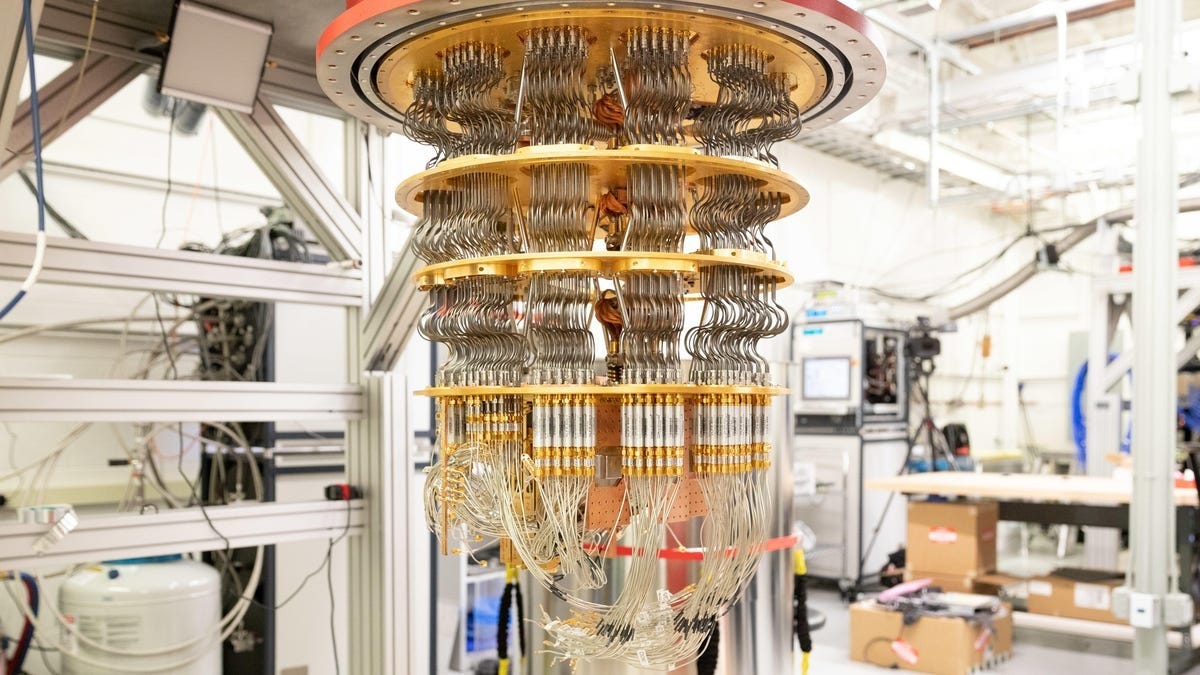

That's just a semiconductor, though. What we're talking about now are superconductors. Superconductors have (you guessed it) very high electrical conductivity, allowing lossless or semi-lossless transfer. Up until now, superconductors were only possible at very specific temperatures. A common example of this technology is an MRI machine.

In 2021, I posted an article on which technologies I thought would impact us most over the next 5-10 years.

Before I get back to superconductors, here's what I wrote in 2021 about my top 5 technologies:

- Compute Power is going to increase, and the ability to brute force problems will create new possibilities. Quantum computing will become more important and likely available for commercial use.

- New and better AI platforms will transition AI from a tool for specialists to a commodity for everyday people - it won't just be Artificial Intelligence, it will be Amplified Intelligence (helping people make better decisions, take smarter actions, and continually measure and improve performance).

- Blockchain and authenticated provenance are going to become more important as the world becomes increasingly digital. Trust and transparency will be important as indelible logs are needed for finance, medical, armies, etc.

- IoT will become more pervasive, enabling near digital omniscience as everything becomes a sensor that transmits data up the chain.

- Mass customization will become the norm instead of simple mass production as hardware, data, and AI continues to improve products, medicine, custom supplements, and just about everything else.

via - "What Technologies Are Going To Most Impact The Next 5-10 Years?" - August 2021

At that same time, the chip shortage massively affected the supply chain. My takeaway was that building and running intelligent AI systems takes a lot of computing power, and as more competitors enter the scene, the cost to play will increase, and so do the stakes of winning and losing.

To a certain extent, the AI arms race has become a chip arms race. To nations, it is a cold-war-level existential threat.

Advancements in room-temperature superconductors would create a snowball of changes that would affect technology everywhere, and change the makeup of that chip arms race.

Better conductivity means less heat dissipation, smaller wires, more efficient and faster movement, and smaller tools. That means your processors won't heat up, motors will be able to handle higher torque/weight, and it also becomes a step in making quantum processors a reality. More practically, it means better and longer-lasting batteries, significantly less waste, and a massive jump in robotics. It also means 50x-100x faster chips.

You could argue it's the "holy grail" of material science. But, we haven't addressed the implications of those new technological possibilities. Electrical grids would be more efficient. Data centers would not only be cheaper but more efficient. And on the more sci-fi side of it, we could create superfast levitating trains which would travel with less friction.

The chip arms race would still exist because human nature means we will always fight for the best technology and advantages. However, when new technologies are created, their predecessors get cheaper and more accessible. That means more people experimenting with better technology, which often leads to unexpected boons.

Every technological advancement makes technology as a whole more accessible and prevalent.

Whether this breakthrough ends up being scalable and sustainable is up for debate, but it's already a sign of progress.

Onwards!

Understanding Industrial Revolutions

Last week, I talked about the potential for room-temperature superconductors.

In that discussion, I noted that we are now in the 4th Industrial Revolution, in part because of better and more connected chips (semiconductors).

I want to dive back into Industrial Revolutions because we're at an inflection point in AI and chips.

A Look at Industrial Revolutions

There are several turning points in our history where the world changed forever. Former paradigms and realities became relics of a bygone era.

Tomorrow's workforce will require different skills and face different challenges than we do today. You can consider this the Fourth Industrial Revolution. Compare today's changes to our previous industrial revolutions.

Each revolution shared multiple similarities. They were disruptive. They were centered on technological innovation. They created concatenating socio-cultural impacts.

Since most of us remember the third revolution, let's spend some time on that.

Here's a map of the entire "internet" in 1973.

Reddit via @WorkerGnome.

Most of us didn't use the internet at this point, but you probably remember Web1 (static HTML pages, a 5-minute download to view a 3Mb picture, and of course ... waiting for a website to load over the dialup connection before you could read it). It was still amazing!

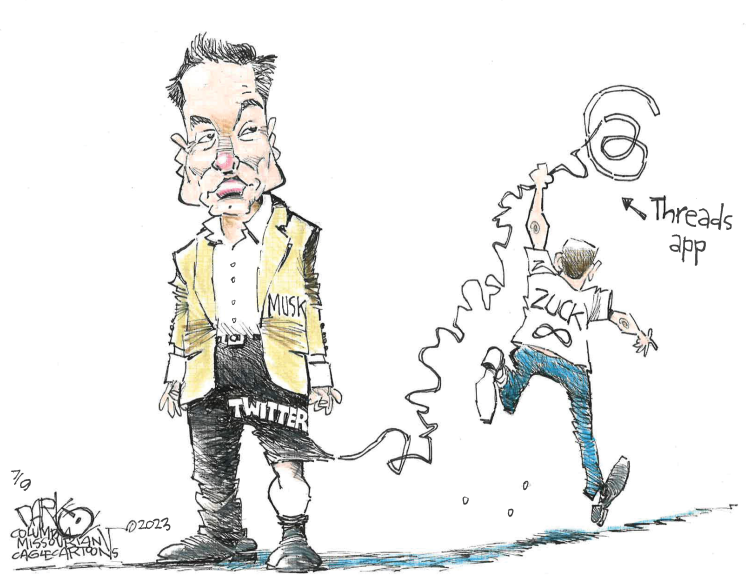

Then, Web 2.0 came, and so did everything we now associate with the internet; Facebook, YouTube, ubiquitous porn sites, and Google. But, with Web 2.0 also came user tracking and advertising, which meant that we became the "product." Remember, you're not the customers of those platforms - advertisers are. And if you're not the customer, you're the product. And when you're not the customer, there's no reason for the platforms not to censor what you see, hear, or experience to control the narrative.

Now we're seeing a focus on the Blockchain, and its reliant technologies, with Web3.

Where we are and where we are going

With Web3, A.I., better chips, and more, we're at the apex of another inflection point. As a result, the game is changing, as are the rules, the players, and what it means to win.

At significant transition points, it is easy to see fear, resistance, and a push to keep things the same. Yet, time marches on. Much of the pain felt during these transitions occurs because people hesitate to adapt. As a result, the wave crashes on them instead of them riding it to safety.

Robots can do many things, but they've yet to match humanity's creativity and emotional insight. As automation spreads to more jobs, the need for management, creativity, and decision-making won't go anywhere … data and analytics might augment them, but they won't disappear.

Our uniqueness and flexibility rightly protect our usefulness. AI and automation free us up to be our best selves and to explore new possibilities.

All of these changes bring about a decentralization of power - and a new set of freedoms for people – including the ability to discover and adopt capabilities in less time and with less effort. But, to bring it back to my skepticism again, there are a lot of roadblocks, interferences, and time between now and the consumer being in control again.

We can shorten that distance, though. This reminds me of a quote by Elon Musk:

One of an entrepreneur's most powerful capabilities is the ability to shorten time - and get more done than others thought possible.

Onwards!

Posted at 09:16 PM in Business, Current Affairs, Gadgets, Ideas, Market Commentary, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)