Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 09:46 PM | Permalink | Comments (0)

In cities across America, the familiar outline of office towers and shopping malls is giving way—not to new shops or workplaces, but to silent, humming data centers. This hidden infrastructure boom is quietly reshaping both our skylines and our society.

Today, the US spends almost as much building data centers as it does building offices. It’s not just because data centers are a basic part of our infrastructure.

This shift represents a growing trend that's both obvious and easily ignored. Advances in exponential technologies are causing the virtual workforce to outpace the physical one, fundamentally shifting how and where productivity happens.

Data center investment is on track to overtake that of office buildings, signaling a fundamental redefinition of economic productivity.

via voronoi

As of June 2024, 34 million Americans worked remotely—a figure that highlights how deeply work habits have changed. For extra context, half of those 34 million are entirely remote. Even as hybrid and in-office work gradually recover, office vacancies remain historically high.

via Statista

While I still prefer being in an office and connecting with employees and partners, this does raise important questions about the state of productivity, labor, capital, and land.

As economic output becomes increasingly digital, we must ask: How much work will soon be handled entirely by AI agents, independent of both physical offices and remote workers?

For cities, this shift means rethinking energy grids, job distribution, and urban planning priorities.

Offices once defined our cities and daily rhythms ... we built subways, downtown cores, cafés, and restaurants around them. People moved to the city to have better access to opportunities. They even dictated what we wore to work.

Now, data centers are taking that role. They will impact our energy grids, water usage, land use, and even global relations. Largely invisible in daily life, yet quietly directing our futures.

How will our physical landscapes evolve as digital realities become the core drivers of economic life?

For many, shopping malls were once the heart of community life. Now, their quiet halls reflect broader economic and social changes. Historically, malls defined social life and commerce. It’s where families did a lot of their shopping, it’s where you went to the movies, or kept in touch with trends, and it’s where we hung out on weekends when we had nowhere else to be.

Even my children grew up with malls as a central part of their experience. But today, malls look entirely different.

The rise of online shopping hollowed out many of America’s malls. As e-commerce grew, foot traffic declined, leaving behind cavernous buildings that no longer justified their original purpose. Anchor tenants vanished, food courts emptied, and the very concept of the mall as a social and commercial center began to unravel.

Many malls have closed down, while others have changed their models, and some remain mostly empty, eking out a survival through continued investment.

Yet, hope remains. Some malls are reinventing themselves as mixed-use complexes, serving the evolving needs of their communities with features such as medical centers, schools, or co-working spaces.

Looking ahead, malls could be repurposed as community assets, such as affordable housing, cultural venues, green indoor parks, or even data centers. The bones of these buildings remain; it’s the imagination behind their reuse that will determine their second life.

In time, we’ll have to consider the same consequences for downtowns, office parks, and potentially even city planning.

The change is inevitable. With the increasing use of AI comes a greater need for data centers. More data centers also make AI more accessible to teenagers with innovative ideas, small entrepreneurs, and agentic businesses. It’s a snowball effect that we don’t yet truly understand, including its promise and peril.

I find it exciting. Office spaces aren’t going away. The need to gather people and work together as a collective will always be present. It’s the same with the concept of “downtown”.

The places once filled with shoppers, workers, and daily commutes are giving way to spaces filled with servers—quietly sustaining the new economy. As technology continues to change where and how we live, our ability to adapt will shape not just skylines, but what’s possible for communities everywhere.

I’m excited to see what else becomes “normal” in the next 20 years as our lifestyles and needs continue to evolve.

It never gets old to say ... but we live in interesting times!

Posted at 05:00 PM | Permalink | Comments (0)

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 09:27 PM | Permalink | Comments (0)

The world’s stock markets are more intertwined and unpredictable than ever. As we step into 2025, the landscape is dominated by record highs, emerging uncertainties, and shifting regional dynamics. What forces are redrawing the map—and how should forward-looking investors respond?

Here is a look at global stock markets. Worldwide, they represented $127 trillion in value in 2024, with U.S. markets accounting for nearly half of that amount.

via visualcapitalist

For comparison, the global market has grown over 14% since 2023, when its value was approximately $111 trillion.

U.S. Dominance vs. Global Opportunity. While U.S. markets account for nearly half of the global value, it’s striking how far behind China and the EU lag. It is worth examining why ... and what may lie ahead.

Let’s consider how other major regions are faring.

China’s stock market growth remains sluggish, held back by cautious consumers and the unpredictability of shifting government policies. The EU’s performance declined slightly in 2024, and faces headwinds from high interest rates and shifting energy dynamics. Meanwhile, emerging markets show wide variation—technology-driven countries outperform, while others lag due to policy or global uncertainty.

Here is a slightly deeper look at each.

China: Stimulus and Uncertainty. China’s government is attempting to stimulate its economy by reducing interest rates, repurchasing stocks, and increasing spending. That sounds positive, but people are still spending less, houses aren’t selling well, and the government often changes rules unexpectedly. Most regular Chinese don’t own stocks. For global investors, China is an intriguing yet risky market — one where outside forces frequently cause sudden shifts.

Europe: Value Amid Headwinds. Europe’s economy is diverse—its markets are a mix of banks, factories, and some technology. Wages are rising, and governments are spending. Sounds positive, but factors such as higher interest rates and global events continue to hinder progress. As a result, European stocks are generally cheaper than U.S. stocks, almost like a “value menu.” For investors, Europe remains a "safe harbor" steady option that can help balance out a portfolio, but don’t expect fireworks unless a few key factors break in their favor.

Emerging Markets: Technology’s Outliers. Meanwhile, emerging markets are more complex and susceptible to the influence of changing factors. Some countries, such as Taiwan and South Korea, are thriving thanks to strong technology growth. Others, such as Russia and Brazil, face challenges due to limited investment and instability. These markets are volatile, offering both high risk and potentially high reward..

The global market’s leadership is not set in stone; it is a rolling contest shaped by policy, innovation, and disruption. For investors and strategists, now is the time to reexamine assumptions, rebalance risks, and prepare for whatever comes next. In this era of constant change, adaptability—not allegiance—will be the source of enduring advantage.

Savvy investors spread their bets, recognizing that overconcentration in any single market can amplify both gains and risks.

For all the varied fears in Americans’ minds, U.S. dominance is driven not only by the strength of tech giants, but also by resilient consumer sectors and deep capital markets that set global standards.

As a result, America’s share of the global market increased approximately 7% over the past year, while China’s share has remained stable, and the EU’s share has declined slightly.

The good news for U.S investors is that global market capitalization is rising, and so is our share of it.

It’s easy to find reasons to be afraid or tentative ... but it’s just as easy to find reasons to take confident action.

Looking ahead, rising interest rates, geopolitical tensions, and new technology breakthroughs could all shift the balance of global market leadership. So could the growth of digital assets. Investors must consider what will happen next if these trends continue (or suddenly reverse).

Policy shifts in China or the EU could spark sudden capital flows, triggering domino effects that shape the next phase of market evolution.

Market leadership can change in an instant. In this climate, agility wins. Prepare, diversify, and stay alert—because in the world of investing, standing still is the biggest risk of all.

History has shown that the most prosperous periods are those that encourage creative destruction and reinvention.

You can't predict the future, but you can prepare for it.

Posted at 04:30 PM in Business, Current Affairs, Ideas, Market Commentary, Trading, Trading Tools | Permalink | Comments (0)

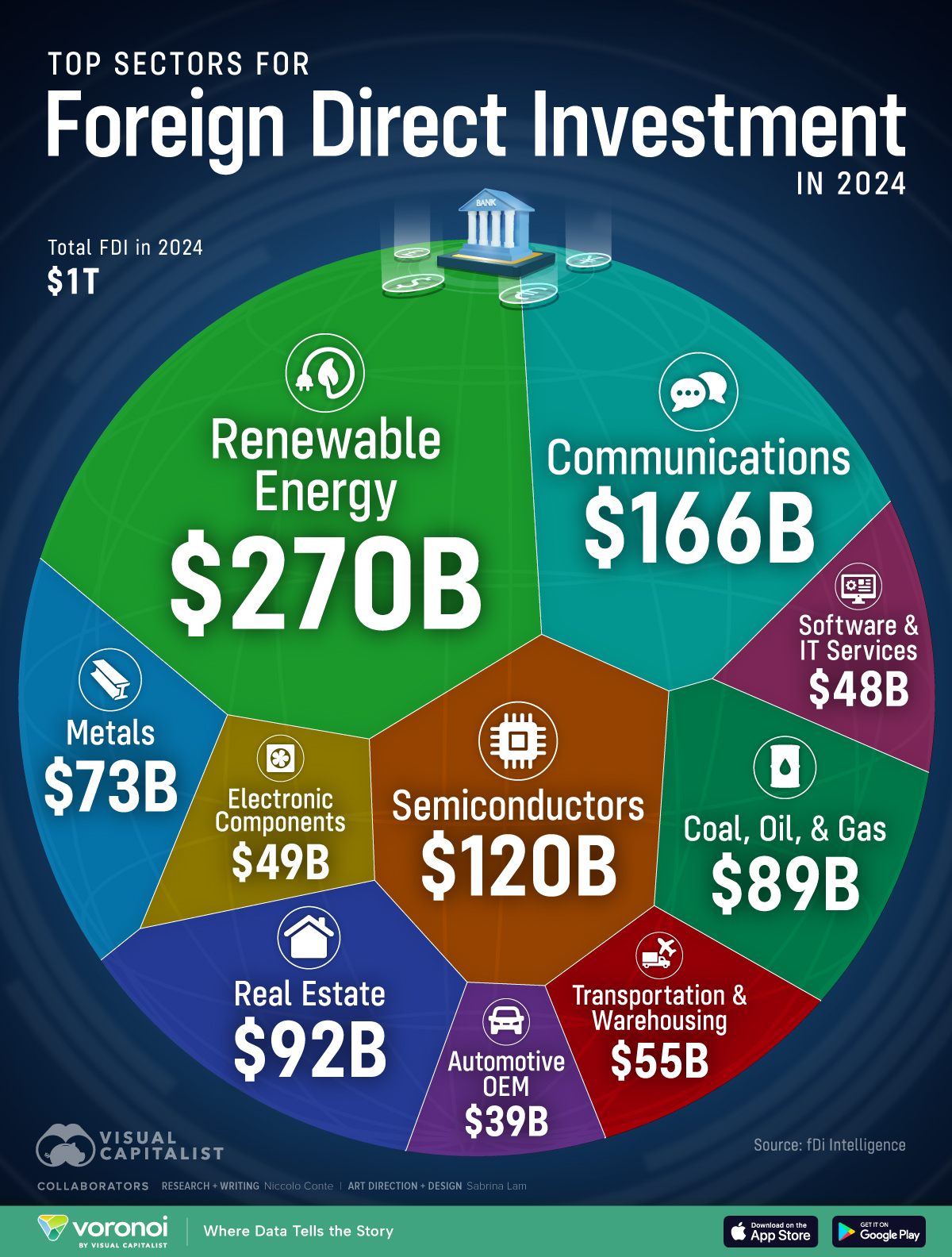

Against a backdrop of economic uncertainty, supply chain upheaval, and rapid technological transformation, foreign direct investment remains a bellwether of global confidence and strategic priorities.

Looking back to 2024, the patterns of FDI offer a window into what the world’s investors value most—and what new risks and opportunities are on the horizon.

In a rapidly shifting global landscape, investors are constantly on the hunt for both opportunity and resilience. Which sectors and regions captured the lion’s share of foreign direct investment in 2024—and what fueled these evolving priorities?

Visual Capitalist created an infographic that shows Foreign Investors allocated more than $1 trillion across the top 10 global sectors in 2024, highlighting the scope and realignment of worldwide capital movements.

via visualcapitalist

Now let’s zoom into specific industries.

Renewable energy topped the list, drawing $270.1 billion in FDI. Even so, renewable energy FDI declined — mainly due to rising material costs, tougher regulations, and delayed projects. Despite these setbacks, long-term prospects in renewables are robust.

Perhaps the most surprising winner of 2024, the communications sector not only rebounded but grew by an astonishing 84%, far outpacing previous years. This likely reflects accelerated 5G rollouts and infrastructure expansions in both developed and emerging markets.

Semiconductors followed closely, likely reflecting the growing infrastructure requirements of global reliance on AI.

Notably, FDI in real estate increased despite a critical labor shortage, sparking questions about how investment is responding to workforce constraints.

Meanwhile, traditional manufacturing showed minimal growth, as investors appear wary of ongoing supply chain disruptions and increasing automation across the industry.

Regionally, the FDI tide was far from even. Asia emerged as the dominant destination for FDI. While India, alone, attracted investment across more than 1,000 distinct projects, driven by robust economic reforms and a burgeoning market.

FDI patterns are not static reflections but dynamic forecasts of the next big global moves. Consequently, geopolitics and regulatory shifts impact FDI as well.

As global investment patterns continue to evolve, the next wave of foreign direct investment will likely redefine which strategies (and which regions) lead. Will emerging trends hold, or will new surprises shift the map again next year?”

Where would you bet global capital will go next?

Posted at 04:16 PM in Business, Current Affairs, Ideas, Market Commentary, Science, Trading, Trading Tools, Travel, Web/Tech | Permalink | Comments (0)

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 03:51 PM | Permalink | Comments (0)

We are living through the fastest period of technological change in history — a fact that demands not just awareness, but active engagement. Here’s how to recognize this shift, and what you can do to succeed in it.

Our ancestors survived by thinking locally and linearly. Yet today, this mindset often leaves us struggling to anticipate the sweeping, unpredictable effects of technology.

To predict the future of technology, you must understand where we are and where we are headed ... but it also helps to recognize how far we’ve come—and how quickly things are now accelerating.

Our World In Data put together a great chart that shows the entire history of humanity in relation to innovation. It shows how fast we are moving by telling the story with milestones.

Innovation isn’t only driven by scientists. It’s driven by people like you or me having a vision and making it into a reality.

To see just how far we’ve come — and how quickly things now change — let’s look at some milestones.

3.4 million years ago, our ancestors supposedly started using tools. 2.4 million years later, they harnessed fire. Forty-three thousand years ago (almost a million years later), we developed the first instrument, a flute.

The innovations we just discussed happened over an astonishing expanse of time. Compare that to this: In 1903, the Wright Brothers first took flight ... and just 66 years later, we were on the moon. That’s less than a blink in the history of humankind, and yet our knowledge, technologies, and capabilities are expanding exponentially.

Technology was like a snowball gathering speed, but it’s become an avalanche—hurtling forward, accelerated by AI. Here are some fun facts to back that up.

ChatGPT’s Explosive Growth: In 2025, OpenAI’s ChatGPT will hit 700 million weekly active users—a fourfold increase over the previous year. In its first year, ChatGPT reached 100 million monthly active users in just two months, a milestone that took Instagram 2.5 years.

Workforce Shift: About 97 million people will work in the AI sector by the end of 2025, and the value of the U.S. AI sector already exceeds $74 billion.

Usage Surge: As of July 2025, users submit 2.5 billion prompts to ChatGPT every day, and analysts expect OpenAI to reach 1 billion users by the end of the year.

Yesterday’s stable footing guarantees nothing; you must constantly adjust or get swept away.

While AI dominates headlines, the same story of acceleration is unfolding in fields like biotechnology, climate tech, and robotics. It’s happening everywhere all at once. From nanotechnologies to longevity and age reversal, and from construction to space exploration ... exponential change is becoming a constant.

Though I lead an AI company, I’m not an engineer or a data scientist — I am a strategist. My role is to envision bigger futures, communicate them clearly, and leverage tools that free me to create greater value. Ultimately, that’s going to become everybody’s job.

I don’t believe that AI will replace people like us quickly, but common sense tells us that people who use AI more effectively might replace us faster than we’d like.

Start by experimenting with new AI tools. When was the last time you tried a new tool or technology? Even though our company works on AI every day, I’ve challenged myself to continually expand my ability to use AI to create the things I want.

You’ll probably find that the things you want most are just outside your current comfort zone — or you’d already have them.

The next level of impact and value lies just beyond your current habits—comfort is the enemy of reinvention.

A good start is to think about what routine task you could automate next week.

Leaders must move from certainty-seeking to rapid experimentation. Encourage nimble, high-frequency experimentation with emerging tech.

Focus on skillsets that complement, not compete with, automation. And vice versa, focus on automation that complements (rather than competes with) unique abilities.

Share your learnings with your team or community. Set the expectation of progress, and make regular sharing and reporting part of your process. Reward the sharing of learnings over the accumulation of dead knowledge.

Prepare teams not only technologically, but culturally and psychologically, for relentless reinvention.

Brene Brown, a noted leadership expert, says, “Vulnerability is the birthplace of innovation, creativity, and change.”

Don’t let perfectionism hold you back. You don’t need to know every destination before boarding the train; what matters is that you get on. Waiting too long is no longer safe—the train is leaving, and the cost of inaction is climbing.

Success now means hopping on and adapting while in motion—not waiting for all the answers.

Onwards!

Posted at 08:19 PM in Business, Current Affairs, Gadgets, Healthy Lifestyle, Ideas, Market Commentary, Personal Development, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

New technologies fascinate me ... As we approach the Singularity, I guess that is becoming human nature.

Ray Kurzweil (who is a well-respected futurist, inventor, and entrepreneur) optimistically predicts accelerating returns and exponential progress, where the technological advancements experienced in the 21st century will be vastly more significant and disruptive than those in previous centuries. Kurzeil believes: “The next century won’t feel like 100 years of progress—it will feel like 20,000."

However, there is a tension between our ability to imagine grand futures and our struggle to execute the how—the messy, uncertain work of getting there.

Nassim Nicholas Taleb (a noted expert on randomness, probability, complexity, and uncertainty) reminds us that, “We often overestimate what we know and underestimate uncertainty.” There is a risk that “continuous forward motion” sometimes leads to dead ends and that speed without thoughtful direction can be dangerous. This is true in part because technology adoption is often more about human nature than the absolute value of technology.

This post is about embracing the paradox of accepting both the value of vision and the discipline of small, progressive steps.

Dreaming vs. Doing

Recognize that the future is co-authored by dreamers and doers.

To get us started, here is a video, put together by Second Thought, that looks at various predictions from the early 1900s. It is a fun watch – Check it out.

via Second Thought

The Fascination With and Challenges of Prediction

It’s interesting to look at what they strategically got right compared to what was tactically different.

In a 1966 interview, Marshall McLuhan discussed the future of information with ideas that now resonate with AI technologies. He envisioned personalized information, where people request specific knowledge and receive tailored content. This concept has become a reality through AI-powered chatbots like ChatGPT, which can provide customized information based on user inputs.

Although McLuhan was against innovation, he recognized the need to understand emerging trends to maintain control and know when to “turn off the button.”

In 1966, media futurist Marshall McLuhan envisioned a form of digital research eerily similar to the customized queries now answered by AI. Then he makes a surprising admission about why he studies technological change—with a lesson I think many need to hear. pic.twitter.com/yEBJv95GvP

— Benjamin Carlson (@bfcarlson) March 22, 2023

Prophecy vs. Navigation

While we revere “prophetic” moments, most successful outcomes arise from continuous adjustment—not perfect foresight.

Peter Drucker famously said, “The best way to predict the future is to create it.”

I’ll say it a different way ... It’s more useful to view innovation as navigation, rather than prophecy.

Like evolution, Success isn’t about strength or certainty—it’s about the ability to adapt quickly and course-correct as conditions change. This mindset urges leaders to embrace agile, resilient strategies that can respond rapidly to emerging opportunities and threats.

With that said, activity is not progress if it doesn’t lead you in the right direction. There are times when continuous course-correction can lead a team in circles. Pausing for periodic reflection and creating feedback loops helps prevent innovation drift.

While not all predictions are made equal, we seem to have a better idea of what we want than how to accomplish it.

The farther the horizon, the more guesswork is involved. Compared to the prior video on predictions from the mid-1900s, this video on the internet from 1995 seems downright prophetic.

via YouTube

The Distinction Between Envisioning Outcomes and Creating Practical Paths to Them.

There’s a lesson there. It’s hard to predict the future, but that doesn’t mean you can’t skate to where the puck is moving. Future success goes to those who can quickly sense shifts, reorient, make decisions, and take action.

Even if the path ahead is unsure, it’s relatively easy to pick your next step, and then the next step. As long as you are moving in the right direction and keep taking steps without stopping, the result is inevitable.

In Uncharted Territory, It’s Better to Use a Compass Than a Map

The distant future may be fuzzy, but it’s our willingness to keep moving—and keep learning—that tips the odds in our favor.

Reflect on the value of looking ahead, not for certainty but for direction.

Don’t worry if you can’t see your intended destination. Just focus on your next step and trust the journey.

Remember, there is always a best next step.

Onwards!

Posted at 11:00 PM in Business, Current Affairs, Gadgets, Ideas, Market Commentary, Personal Development, Science, Trading, Web/Tech | Permalink | Comments (0)

Is Luck Something You Create?

This article explores the fine line between luck and skill in business, trading, and life. You’ll learn why success often comes from preparation and adaptability—not just fortunate timing—and discover actionable strategies for identifying and nurturing genuine skill in any competitive arena.

Picture a trader making millions in a raging bull market. Are they a genius, or just riding a wave of market luck? Now, picture yourself in their shoes. How do you know if tomorrow’s market crash will expose a lack of skill or confirm your edge?

Distinguishing luck from skill isn’t just a Wall Street problem—it’s the secret sauce behind enduring careers, resilient businesses, and long-term success stories everywhere.

Introduction: The Illusion of Streaks

Imagine achieving an unbroken streak of successes—so improbable that it seems almost magical. Was it raw talent, or was the universe simply smiling on you?

It’s human nature to believe it was your skill.

Now, imagine someone else achieved that streak. It is comforting to attribute some of that to luck.

What about a series of coin flips that land on heads twenty-five times in a row? Was that lucky, or have you discovered a new law of probability?

Easy, that was just luck.

This highlights a common trap known as confirmation bias: when things go well, we tend to attribute our success to our skill; when they don’t, we blame it on bad luck. Recognizing this bias is essential if we want to improve; otherwise, we risk falling into blind spots that prevent us from learning.

In 2016, I wrote an article about differentiating between luck and skill in trading. Those concepts seem even more relevant today as I spend more time talking with entrepreneurs and AI enthusiasts.

The Psychology of Success: Luck, Skill, and the Illusion of Mastery

Luck comes in many flavors. Most people prefer good luck to bad luck.

Focusing on the good, there are many lucky individuals in the business world. Perhaps they made a good decision at the right time – and are now on top of the world. Luck isn’t a bad thing — but building your entire strategy around it is a risky bet for lasting success. Why? Because you might get lucky once, but it’s unlikely you’ll get lucky every time.

As the saying goes, luck favors the prepared mind—especially those capable of discerning where skill ends and luck begins.

The Coin Flipping Contest: A Case Study in Probability

Suppose you followed the contest from beginning to end. As you approached the Championship Round, can you imagine the Finalists doing articles or interviews about how their mindfulness practice gives them an edge ... or, how the law of attraction was the secret.... or, how the power of prayer makes all the difference.

Occam’s Razor often applies: the best explanation is usually the simplest—someone had to win, and this time, it was luck, not mastery.

In any competition, someone will always win, but that doesn’t mean the winner is always the most skilled.

Luck isn’t just in trading or tech. Think of sports — sometimes, a championship hinges on a referee’s call or an unexpected bounce, not just one team’s superior skill. In music, countless talented musicians remain undiscovered, while some viral videos catapult their creators into overnight stardom. That’s the unpredictable role of luck at work in every field.

Warren Buffett once remarked: ‘It’s only when the tide goes out that you discover who’s been swimming naked.’ Success in a favorable market can look like skill — but only real skill endures when times get tough.

Likewise, just because a product or business generates revenue doesn’t necessarily prove it has a competitive edge. Every day, countless new AI-based apps are released. Many make money, some even become popular, but how many of them will still be here 5 years from now? Often, the businesses that are doing the best aren’t actually the ones providing the best service; they’re the ones with the best marketing & the most luck.

Lessons from Dot-Coms and Startups

Remember the dot-com era in the late ’90s? For every Amazon or Google that survived, hundreds like Pets.com and Webvan didn’t. Success often wasn’t about being the best; it was about timing, adaptability—and, sometimes, pure luck.

Focusing solely on current profitability can mean you might have a genuine edge—or you might have simply experienced a streak of good luck. If it isn’t just a matter of winning, how do we determine if we’re skillful? In trading, we refer to this as “Alpha” — the measure of a strategy’s returns attributable to genuine skill, rather than market trends or lucky breaks. Thus, the search for alpha is the search for clues that help identify systems with an edge (or at least an edge in certain market conditions).

Unfortunately, I cannot provide you with a single rule to follow in distinguishing between skill and luck. Still, it’s much easier to find the answer if you actively seek to differentiate between the two. Recognizing whether preparation or fortune played the bigger part requires conscious, continuous examination.

The reality is that most situations aren’t as purely luck-based as a coin-flipping contest. Many people appear lucky because they put themselves in the right situations and did the gritty work behind the scenes to prepare themselves for opportunities.

Do You Really Have an Edge? Validation Matters

That’s where skill (and the ability to filter out bad opportunities) comes in.

Internally, we’ve built validation protocols to help filter out systems that got lucky or those that cannot replicate their results on unseen data.

It is exciting as we solve more of the bits and pieces of this puzzle.

What we have learned is that one of the secrets to long-term success is (unsurprisingly) adaptability.

What that looks like for us is a library of systems ready to respond to any market condition — and a focus on improving our ability to select the systems that are “in-phase dynamically”. The secret isn’t predicting the future, but responding faster — and more reliably — to changing environments.

From a business perspective, this means being willing to adapt to and adopt new technologies without losing sight of a bigger ‘why,’ as we discussed in this article.

A Practical Example

When we first wrote about this, one of Capitalogix’s advisors wrote back to confirm their understanding of the coin-flipping analogy.

Well, that is correct. If we were developing coin-flipping agents, that would be as far as we could go. However, we are in luck because our trading “problem” has an extra dimension, which makes it possible to filter out some of the “lucky” trading systems.

Determining Which are the Best Systems.

There are several ways to determine whether a trading system has a persistent edge. For example, we can examine the market returns during the trading period and compare them with the trading results. This is significant because many systems have either a long or short bias. That means even if a system does not have an edge, it would be more likely to turn a profit when its bias aligns with the market. You can try to correct that bias using math and statistical magic to determine whether the system has a predictive edge. It Is a Lot Simpler Than It Sounds.

Imagine a system that picks trades based on a roulette spin. Instead of numbers or colors, the wheel is filled with “Go Long” and “Go Short” selections. As long as the choices are balanced, the system is random. But what if the roulette wheel had more opportunities for “long” selections than “short” selections?

This random system would appear to be “in-phase” whenever the market is in an uptrend. But does it have an edge?

One Way To Calculate Whether You Have An Edge.

Let’s say that you test a particular trading system on hourly bars of the S&P 500 Index from January 2000 until today.

According to the law of large numbers, in the case of the “roulette” system illustrated above, correcting for bias this way, the P&L of random systems would end up close to zero … while systems with real predictive power would be left with significant residual profits after the bias correction. While the math isn’t complicated, the process is still challenging because it requires substantial resources to crunch that many numbers for hundreds of thousands of Bots. Luckily, RAM, CPU cycles, and disk space continue to become cheaper and more powerful.

If your success can’t be replicated with new data, it may have been luck all along.

Conclusion: Tipping the Odds In Your Favor

Anyone can tally a win-loss column; far fewer can tell whether it was smarts, skill, or serendipity that made the difference. This is where rigorous analysis becomes invaluable.

Obviously, luck and skill affect every aspect of experience (from adopting technology, starting a business, transitioning from a product-based to a platform-based business model, or countless other scenarios).

In most situations, the secret is to determine what data is relevant to your industry, as well as what data you’re creating. Figure out how to analyze it. Figure out how to do that consistently, autonomously, and efficiently. Then ... test.

It’s not sexy, and it’s not complicated.

We live in a ready, fire, aim era. The speed of innovation is staggering, and the capital and energy required to create an app or start a business are at an all-time low. A bias for action is powerful.

Luck and a bias for action will take you further than most - but it still won’t take you far enough.

If you want to explore this topic further, consider reading “Fooled by Randomness” by Nassim Nicholas Taleb or “Thinking, Fast and Slow” by Daniel Kahneman. Both offer deeper insights into the psychology of luck and skill in markets and life.

Staying Honest

To conclude, I’ll leave you with a question...

If you’re reading this, you’ve almost certainly been lucky and skillful. Take a minute to list at least one thing you attribute to luck — and one to skill — in your career and life. With that in mind, what could you do differently in the future to tip the odds in your favor?

Try this, too: Next time you celebrate a big win, ask: Did I make my own luck, or did I simply wait for it to strike? In the end, the real edge belongs to those who learn to prepare, adapt — and still stay humble enough to know when fortune lent a hand.

Posted at 09:42 PM in Business, Current Affairs, Games, Ideas, Market Commentary, Science, Trading, Trading Tools | Permalink | Comments (0)

Reblog (0)