I've recently posted about the rise in global & national debt and the increasing dissonance between markets and the economy. This post is about inflation and the long-term economic effects of 2020.

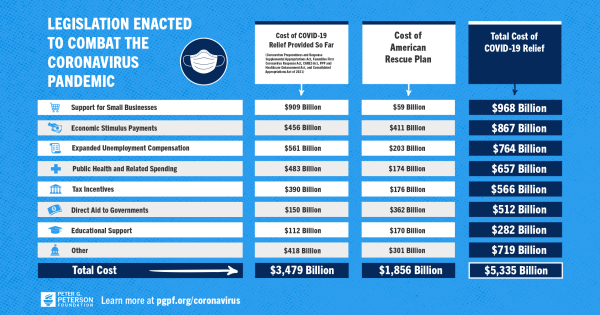

We're currently operating on $6 trillion of stimulus. The Trump administration approved the first 4 trillion dollars, and Biden's administration added another $1.9 trillion. Around $3.5 trillion of that went to purchasing government securities. Meanwhile, the U.S. Treasury also printed another $2B in dollars (more than they produce in a normal year).

Here is an infographic showing the programs enacted to counteract the pandemic's economic impact.

via PGPF (3/15/21)

via PGPF (3/15/21)

These strategies make credit easier to get by growing the money supply and lowering interest rates with banks having more reserves. Without these and the Fed's other emergency measures, the economy likely would have crashed ... but was it a "fix" ... or did it just delay the inevitable?

In the short term, the stimuli did a pretty good job of creating liquidity, preventing a substantial market crash, and increasing faith in the system.

Markets became more erratic and harder to predict. And other ripples are starting to show in the economy.

Inflation: Temporary?

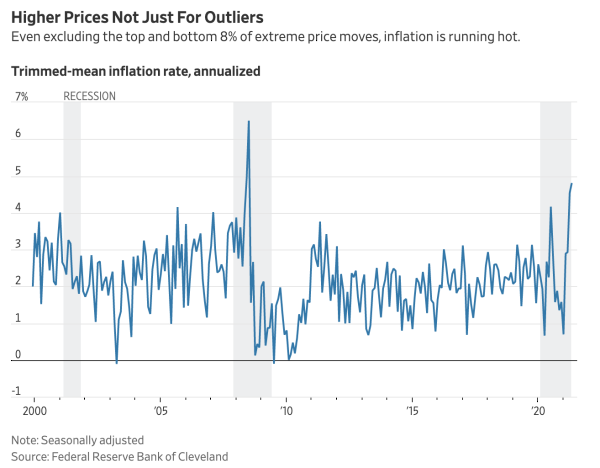

It's not hard to tell that prices have risen recently. But, while consumer prices have risen 2%, on average, investors continue to invest in treasuries and push the price of 10-year yields down to where they were in February of last year. That seems to imply that despite inflation and stimulus, investors still have faith in the Fed.

The hope would then be that the inflation is transitory and not a long-term effect of the stimulus.

via Wall Street Journal

via Wall Street Journal

It's possible that this inflation is the result of a post-Covid demand surge (and not the beginning of a larger trend). You can also assume that the surge in prices of airfares, hotels, and sports games will drop once they become "normal" again. And, even if they don't, if wages don't rise with that new demand, it's easy to picture demand returning to normal.

The last time the Fed created money on a similar scale (the Great Recession), high long-term inflation didn't materialize, so it might not happen again.

Conclusion

I think it's unlikely that we see another 1970s style surge – and I think it's equally unlikely we see major deflation. With that said, I still don't think we've seen the end of the effects of the pandemic and the pandemic stimulus either.

One of the practical results of the Fed's bond purchases is that it creates money to finance the gigantic debt run up by Congress. With the national debt at almost $25 Trillion, it gets harder to pick a measuring rod of financial health that isn't woefully inefficient. The idea of "sound money" or a sustainable fiscal path seems increasingly questionable. But, if you believe in Modern Monetary Theory and in the United States' amazing ability to borrow, it's possible that there truly is no worry. Japan is a potential example of that - with a debt-to-GDP ratio of double the U.S.

So, even if inflation continues, it's hard to judge how bad a sign it is.

Whether or not there's a crash tomorrow (or 7 years from now), at some point, we know there will be a "correction."

Predicting the future is hard!

Curious to hear what you think.

Humans Need Not Apply

While we all know that pop culture representations of AI aren't accurate - I'm still surprised how often I see people who are against Artificial Intelligence. It seems that many people are focus on science fiction's dystopian depictions of sentience and omniscience, while the reality is exciting (and much less scary).

In my office, we use a lot of what seems like "futuristic" artificial intelligence approaches to understanding financial markets and enhancing decision-making. Most of my team are technical or data-science specialists that develop and drive the systems that create our systems. Despite the exponential growth of AI and its supporting technologies, I still believe the heart of AI is human.

Of course, I'm not sure how long that will be true. But I'd bet it remains true for the next 25 years.

The video below was shot in 2014 and gives a great perspective on how quickly automation, robots, and eventually autonomous robots, are becoming pervasive.

via CGPGrey

Automation used to mean big, bulky machines doing manual and repetitive work. Today, however, automation can land an aircraft, diagnose cancer, and trade. I'm fascinated by what is becoming possible ... and how, even when the A.I. is little more than an elegant use of brute force, incredible results are becoming commonplace.

In many cases, the results coming from machines coding other machines are matching or exceeding the work done by humans.

And it's only getting better.

In the past, innovation created new industries or allowed increased scale ... nonetheless, people are worried that the number of jobs the internet and Artificial Intelligence create isn't matching the number of jobs they're making obsolete.

According to this study, approximately 50% of jobs will be automated by 2034.

Personally, I believe that freeing us to elevate our perspective and do more has always been a boon to society. Electricity put a lot of people out of work as well. Nonetheless, look what it made possible.

To date, human progress has been based on the division of labor. As our society progressed, our jobs have become increasingly specialized. Now, machines will be able to break down complex jobs into simple parts and complete them faster than we can.

So, yes, the same technology that's currently creating opportunities could eventually put you out of a job ... but it also creates an opportunity for something new.

There's a lot of change coming, and that can be scary, but there's reason to be excited as well.

We live in a golden era of innovation, and we have longer life expectancies than ever before. Humans are immensely adaptable, and I'm sure we'll continue to grow to meet the challenges and opportunities we face.

The reality is, we've been working symbiotically with "machines" since the very beginning. Our definition of a "machine" simply continues to improve. It's fractal, and each time the technology we're adopting gets bigger, so does the eventual positive effect on day-to-day life.

AI adoption is a big step, but the positive effect it can have on our lives is astronomical.

Onwards!

Posted at 05:38 PM in Business, Current Affairs, Gadgets, Healthy Lifestyle, Ideas, Market Commentary, Personal Development, Science, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)