Some things speak for themselves.

The Patriots just came back from a 25-point second-half deficit to win the Super Bowl.

There is a difference between 'luck' and 'skill'.

Nonetheless ... luck favors the prepared.

And, in life as in sports, hard work beats talent, when talent fails to work hard.

The Patriots, under Bill Belichick, epitomize that.

Belichick has been a coach in 10 of 51 Super Bowls (seven of them with Tom Brady).

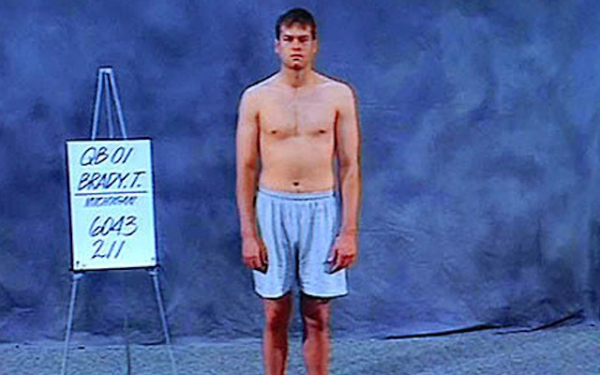

When you see this picture from the 2000 NFL Combine, it's hard to believe that Tom Brady would be a 3-time Superbowl MVP taking the Patriots to their 5th under his reign.

via CBS Sports.

It didn't happen by accident.

The Patriots are a well-oiled machine, and it's not because their players are better than the rest.

Keep in mind, the NFL is a league at the top of the food chain (their athletes are the best of the best). Moreover, the NFL actively creates rules designed to level the playing field and create parity.

So, it is hard to create a team that 'can't be beaten' – When it happens, it happens because of culture, coaching, and process. Ultimately, somehow, winners find a way to win.

Bill isn't known as the friendliest (and he's certainly not known for dishing out praise) – but he is known for discipline (and lauding hard work when it's deserved).

More importantly, Belichick created a framework of success that isn't reliant on the individual - and it is that which allows the individual to shine.

Frameworks create the structure that allows, focus, specialty, and the freedom to improvise.

The System is the 'system'; but, within it, you can measure what works, who contributes, and use it to identify the best things to try next.

Win, lose, or draw ... some things speak for themselves.

via CBInsights

March Madness: The Last Perfect Bracket Busted After Just 40 Games

March Madness is in full swing, and it feels like everyone (and their mom) has filled a bracket. But how do they do it?

More importantly, how do the people that are successful do it?

The video, below, highlights the "Bracket Busters" of 2015.

via FiveThirtyEight

So, who were they? A 13-year-old who used a mix of guesswork and preferences, a 47-year-old English woman who used algorithms and data science (despite not knowing the game), and a 70-year-old bookie who had his finger on the pulse of the betting world.

Proof that different factors can lead us to believe we have control over something with odds at 1 in 9,223,372,036,854,775,808. For those who don't wanna do the math that's 9.2 quintillion.

That's not to say that different factors don't provide an edge. Knowing the history of the teams, their ranks, how they performed historically in the playoffs, all provide important information, to humans and machines that try to make the perfect bracket.

The way people fill out their brackets often mimics the way investors pick trades or allocate assets. Some use gut feel, some base their decisions on rank and past performance, and some use predictive models.

Just as an FYI, this March Madness, the last perfect bracket busted after just 40 games. This includes reporting on tens of millions of brackets from NCAA.com, Bleacher Report, CBS, ESPN, Fox Sports and Yahoo.

People aren't as good at prediction as they predict they are.

Something to think about.

Posted at 01:02 AM in Current Affairs, Games, Ideas, Just for Fun, Market Commentary, Science, Sports, Trading, Web/Tech | Permalink | Comments (0)

Reblog (0)