I just got back from the Genius Network Annual Event. It was a great event. Members and guests included Verne Harnish, Dan Sullivan, and Daymond John.

This year, Joe Polish interviewed Robert F. Kennedy Jr. at the conference. To make it didn't seem like a political event, they didn't tell people he was coming until after the event was sold out.

Kennedy stayed to have dinner with a few members later that night. At the dinner, he answered questions from the attendees.

RFK is an interesting guy ... he's a newly declared Independent who was a lifelong Democrat. Democrats think he's a conservative. Conservatives think he's a liberal.

It is a little confusing. And most people probably don't know what to think.

I'll be frank. He did much better than I expected. He's undoubtedly a politician. Answers were prudent; he gave nuanced opinions to avoid stepping on too many toes. He was clearly knowledgeable about foreign policy and history. He was sharp. And it is easy to argue that he is more coherent than some of our other options.

I'm still making my own decisions about who I'll vote for in the coming election. But I hope there's a space in modern politics for comment sense and bipartisanship - something I think RFK offers.

At this point in history, can decent ideas and a centrist approach from an Independent gain any real traction?

I voted for Ross Perot, but if you remember, he got 0 electoral college votes, despite getting approximately 20% of America to vote for him. Could this be another situation like that?

Politics has always been divisive, and the internet and technology have made it more so. On the one hand, it's very hard for a moderate opinion to gain traction. On the other hand, both parties are largely sick of their options.

Do you think he has a chance?

On a lighter note, the dinner was hosted at Tom Mello's house, who has bought replicas of K.I.T.T., Herbie, and the Delorean from Back To The Future.

I couldn't help myself. I had to make this video.

Buckle-Up ... Instead of heading Back to the Future, we are headed for an election year.

The Cost Of Thinking Linearly In Today's Age

Humans can’t do a lot of things.

Honestly, the fact that we’re at the top of the food chain is pretty miraculous.

We’re slow, we’re weak, and we’re famously bad at understanding large numbers and exponential growth.

Our brains are hardwired to think locally and linearly.

It’s a monumental task for us to fathom exponential growth … let alone its implications.

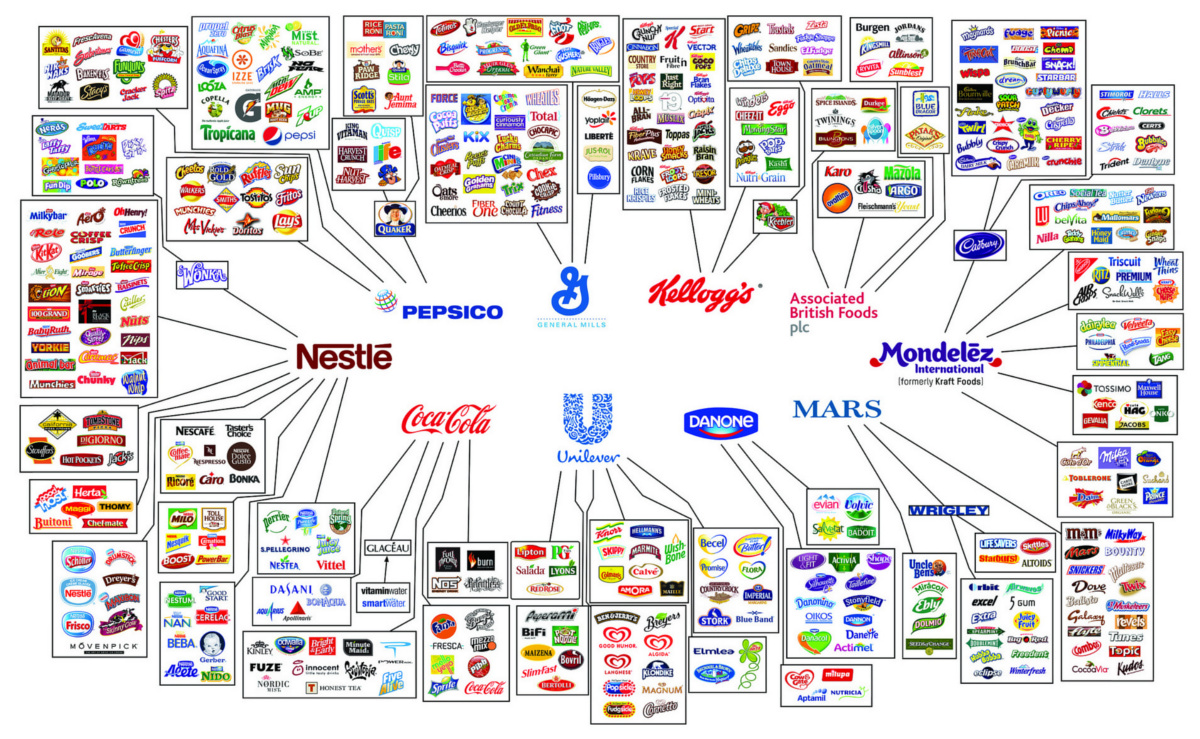

Think how many companies have failed due to that inability … RadioShack didn’t foresee a future where shopping was done online. Kodak didn’t think digital cameras would replace good ol’ film. Blockbuster dismissed a future where people would want movies in their mailboxes because they were anchored to the belief that “part of the joy is seeing all your options!” They didn’t even make it long enough to see “Netflix and Chill” become a thing.

via Diamandis

Human perception is linear. Technological growth is exponential.

There are many examples. Here is one Diamandis calls “The Kodak Moment.”

In 1996, Kodak was at the top of its game, with a market cap of over $28 billion and 140,000 employees.

Few people know that 20 years earlier, in 1976, Kodak had invented the digital camera. It had the patents and the first-mover advantage.

But that first digital camera was a baby that only its inventor could love and appreciate.

That first camera took .01 megapixel photos, took 23 seconds to record the image to a tape drive, and only shot in black and white.

Not surprisingly, Kodak ignored the technology and its implications.

Fast forward to 2012, when Kodak filed for bankruptcy – disrupted by the very technology that they invented and subsequently ignored.

via Diamandis

Innovation is a reminder that you can’t be medium-obsessed. Kodak’s goal was to preserve memories. It wasn’t to sell film. Blockbuster’s goal wasn’t to get people in their stores; it was to get movies in homes.

Henry Ford famously said: “If I had asked people what they wanted, they would have said faster horses.” Steve Jobs was famous for spending all his time with customers but never asking them what they wanted.

Two of our greatest innovators realized something that many never do. Being conscientious of your consumers doesn’t necessarily mean listening to them. It means thinking about and anticipating their wants and future needs.

Tech and AI are creating tectonic forces throughout industry and the world. It is time to embrace and leverage what that makes possible. History has many prior examples of Creative Destruction (and what gets left in the dust).

Opportunity or Chaos … You get to decide.

Onward!

Posted at 06:24 PM in Business, Current Affairs, Food and Drink, Gadgets, Healthy Lifestyle, Ideas, Just for Fun, Market Commentary, Movies, Science, Television, Trading, Web/Tech | Permalink | Comments (0)

Reblog (0)