This week I went to Chicago to speak at my old alma mater - Kellogg.

It was great to talk with professors and spend time with MBA students interested in trading and how the business of trading is changing.

I plan on spending more time there to benefit research and recruiting.

Unsurprisingly, deep dish pizza is still delicious. We were going to eat at a steakhouse. However, Jennifer and I remembered that the only thing better than gorging on meat ... is gorging on meat and cheese.

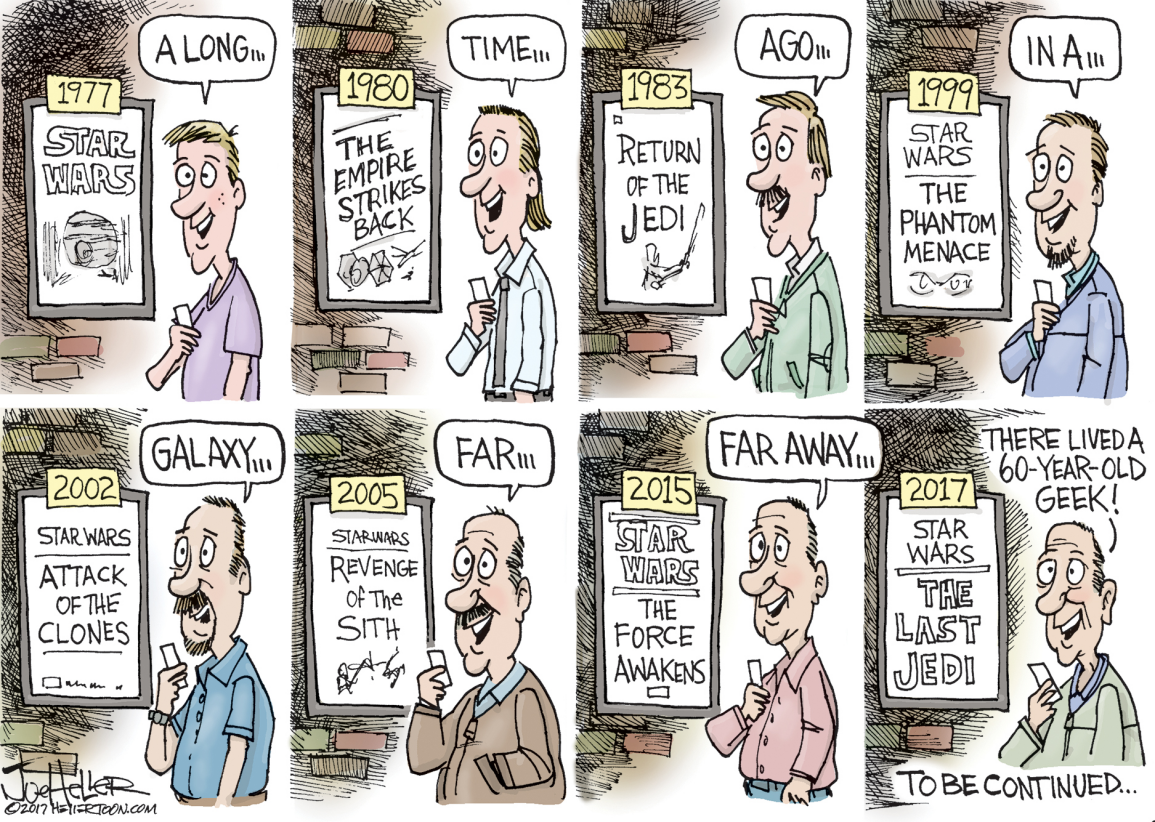

While some things haven't changed, others have.

The Universe must be trying to tell me something. The day I got back, I found my old ID card ... and, apparently, some things have changed in the past thirty years.

Onwards.

Here Are Some Links For Your Weekly Reading - January 21st, 2018

It's day 2 of the government shutdown; but what does that actually mean?

In short:

Efficiency at its finest ... or a force function to get the children to play nicer with each other?

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 04:39 PM in Business, Current Affairs, Gadgets, Healthy Lifestyle, Ideas, Just for Fun, Market Commentary, Personal Development, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)