When I think about World Leaders (in places like North Korea, Russia, or Syria), I recognize how lucky we are to be able to elect our leaders in fair and free elections.

Unfortunately, that's not an opportunity that we take advantage nearly enough.

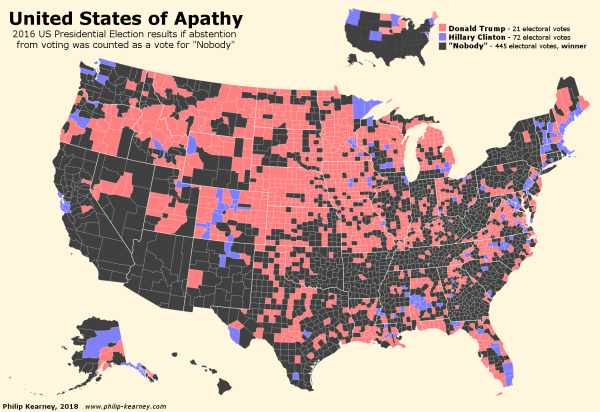

America has a two-party system, and we count our votes down district and state lines to decide which candidate will end up with the electoral votes for that state ... but what if abstention was counted as a vote for nobody?

via Philip Kearney

via Philip Kearney

It's an interesting exercise to visualize what our absenteeism in voting looks like ... in the last presidential election, four times as many voted for nobody as for Trump and Hilary (combined!).

For all the people who whine and moan in any Presidency, you'd expect more people would have taken action to support their beliefs.

Now, try to imagine how few people vote in the more minor election cycles.

There are many interesting practical and theoretical discussions to be had about voting - engagement, education, etc. - but looking at this graph certainly puts one of the problems into perspective.

It's easy to point out a problem. It's more productive to propose a solution.

- Making election day a national holiday?

- Allowing mail-in or digital ballots?

Many individuals feel they don't need to vote because their state uses an "all or none" electoral college approach, or because they feel they already know how their state is going to vote.

In addition, unless you're in a battleground state - it can often feel pointless - whether or not it is.

What do you think it would take to increase turnout?

via ideainstruction

Trading Eyeballs... What Comes After "As Seen On TV!" with Shark Tank's Kevin Harrington

It's a lot easier to manage something you measure.

Here at Capitalogix, we measure the expectancy score of trading systems.

Former "Shark" Kevin Harrington does something similar with eyeballs.

For years he killed it on TV with products like Ginsu Knives, the George Foreman Grill, etc.

But TV viewership has dropped over 50% ... and that's not a sustainable model anymore.

Luckily, like a true "Shark" he realized something that many people don't...

You have to be committed to your goals, not the tools you use to accomplish that goal.

I shot a video with Kevin where we talk about that ... and more. Check it out

If you have been doing the same thing for 18 months (or longer), chances are the practical realities of time, technology, and a changing competitive landscape implies that you should be doing something different (or at least differently).

What are you doing to stay relevant in your space?

Posted at 07:45 PM in Business, Current Affairs, Gadgets, Ideas, Market Commentary, Television, Trading Tools, Web/Tech | Permalink | Comments (1)

Reblog (0)