The World seems very “Us” versus “Them”... But are we really that different?

The six largest religions in the world are Christianity, Islam, Judaism, Hinduism, Buddhism, and Sikhism.

If you stripped away doctrine, what patterns might emerge in the world’s great sacred texts?

Similarity in Diversity.

We often think about the differences between religions. However, a deep review of their sacred texts shows striking similarities (and may be indications of a more integral “truth”).

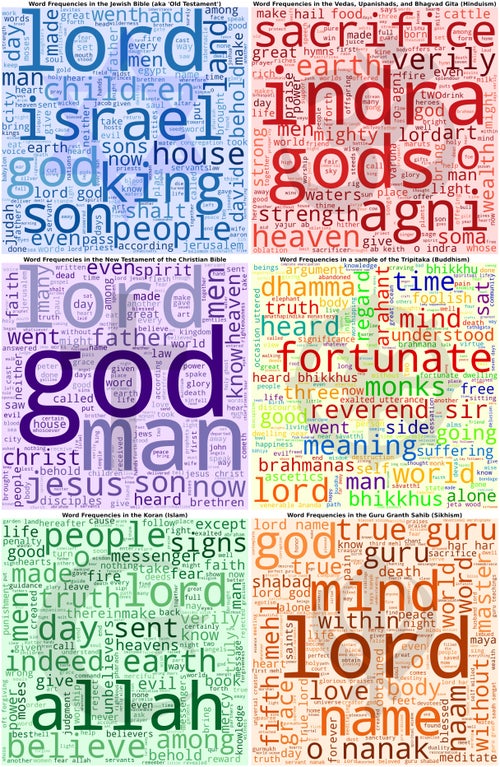

Below is a word cloud for each of those religions based on their primary religious text. A word cloud is a visual map of language where the size and boldness of a word reflect its frequency in the text. In this case, the image spotlights the most frequent words across different religious texts (e.g., Jewish Bible, Christian New Testament, Quran, Hindu Vedas, Buddhist Tripitaka, Sikh Guru Granth Sahib).

Each panel highlights high-frequency terms like Lord, God, man, people, Israel, Indra, Agni, Allah, fortunate, Guru, etc., with the most frequently used words appearing larger and bolder. A visualization, like this, makes it easy to identify the recurring themes or focal points of each tradition.

So, here is a closer look at what a word cloud of the world’s religions reveals if we strip away doctrine and focus only on frequency.

teddyterminal via Reddit

On one level, this post explores both the similarities and limits of religious texts via word clouds.

As historian Yuval Harari notes, “Humans think in terms of stories, not statistics.” Those word clouds are the beginnings of narratives that go beyond the numbers. For example, shared words don’t mean shared values. The word ‘love’ in one tradition may imply obedience, while in another it means self-transcendence.

The Power and Pitfalls of Translation

Likewise, translating sacred texts into English makes them more accessible, but can distort meaning and nuance. As an illustration, if you noticed the name “Keith” at the bottom of the Hinduism word cloud, it’s because that was the translator’s name. You might also have seen the word “car” in the Hinduism cloud, that is not an anachronism or prophecy... it is just another old-fashioned word for “chariot”.

It’s also worth acknowledging that this word cloud is from the English translations, so some words that may mean slightly different things in other languages can be all translated to one word in English. For example, it’s very common in Biblical Hebrew to see different words translated into the same English word. Examples include Khata, Avon, and Pesha – three different “ways of committing a wrong” that may all be translated to the same English word.

Distortions like these occur across many texts and cultures. In other words, similarities in word usage do not always reflect shared values. Recognizing this helps us navigate between the boundaries of certainty and uncertainty.

This brings to mind an ancient parable …

The Parable of Perspectives – Lessons from the Elephant

I’ve always loved the parable of the blind men and the elephant. While there are many versions, here’s broadly how it goes:

A group of blind men heard that a strange animal, called an elephant, had been brought to the town, but none of them were aware of its shape and form. Out of curiosity, they said: "We must inspect and know it by touch, of which we are capable". So, they sought it out, and when they found it they groped about it. The first person, whose hand landed on the trunk, said, "This being is like a thick snake". For another one whose hand reached its ear, it seemed like a kind of fan. As for another person, whose hand was upon its leg, said, the elephant is a pillar like a tree-trunk. The blind man who placed his hand upon its side said the elephant, "is a wall". Another who felt its tail, described it as a rope. The last felt its tusk, stating the elephant is that which is hard, smooth and like a spear.

This parable highlights that even when everyone is “blind” to the whole truth, each perspective still holds real insight. Recognizing that partial views are still valuable can drive innovative, integrative thinking.

The blind men and the elephant parable also reminds us of the limitations of individual perspectives and the value of integrating multiple viewpoints. Interestingly, that integration is one of the things large language models are best at ... and helping humans access a perspective of perspectives might be a step towards enlightenment.

Future societies may see it as obvious that synthesizing perspectives (religious, cultural, strategic) can be done by advanced AI at scale, transforming how we resolve complex disputes.

Hope that helps.

Oh, and as a thought experiment ... What would the word cloud of your own guiding beliefs look like?

Is Luck Something You Create?

This article explores the fine line between luck and skill in business, trading, and life. You’ll learn why success often comes from preparation and adaptability—not just fortunate timing—and discover actionable strategies for identifying and nurturing genuine skill in any competitive arena.

Picture a trader making millions in a raging bull market. Are they a genius, or just riding a wave of market luck? Now, picture yourself in their shoes. How do you know if tomorrow’s market crash will expose a lack of skill or confirm your edge?

Distinguishing luck from skill isn’t just a Wall Street problem—it’s the secret sauce behind enduring careers, resilient businesses, and long-term success stories everywhere.

Introduction: The Illusion of Streaks

Imagine achieving an unbroken streak of successes—so improbable that it seems almost magical. Was it raw talent, or was the universe simply smiling on you?

It’s human nature to believe it was your skill.

Now, imagine someone else achieved that streak. It is comforting to attribute some of that to luck.

What about a series of coin flips that land on heads twenty-five times in a row? Was that lucky, or have you discovered a new law of probability?

Easy, that was just luck.

This highlights a common trap known as confirmation bias: when things go well, we tend to attribute our success to our skill; when they don’t, we blame it on bad luck. Recognizing this bias is essential if we want to improve; otherwise, we risk falling into blind spots that prevent us from learning.

In 2016, I wrote an article about differentiating between luck and skill in trading. Those concepts seem even more relevant today as I spend more time talking with entrepreneurs and AI enthusiasts.

The Psychology of Success: Luck, Skill, and the Illusion of Mastery

Luck comes in many flavors. Most people prefer good luck to bad luck.

Focusing on the good, there are many lucky individuals in the business world. Perhaps they made a good decision at the right time – and are now on top of the world. Luck isn’t a bad thing — but building your entire strategy around it is a risky bet for lasting success. Why? Because you might get lucky once, but it’s unlikely you’ll get lucky every time.

As the saying goes, luck favors the prepared mind—especially those capable of discerning where skill ends and luck begins.

The Coin Flipping Contest: A Case Study in Probability

Suppose you followed the contest from beginning to end. As you approached the Championship Round, can you imagine the Finalists doing articles or interviews about how their mindfulness practice gives them an edge ... or, how the law of attraction was the secret.... or, how the power of prayer makes all the difference.

Occam’s Razor often applies: the best explanation is usually the simplest—someone had to win, and this time, it was luck, not mastery.

In any competition, someone will always win, but that doesn’t mean the winner is always the most skilled.

Luck isn’t just in trading or tech. Think of sports — sometimes, a championship hinges on a referee’s call or an unexpected bounce, not just one team’s superior skill. In music, countless talented musicians remain undiscovered, while some viral videos catapult their creators into overnight stardom. That’s the unpredictable role of luck at work in every field.

Warren Buffett once remarked: ‘It’s only when the tide goes out that you discover who’s been swimming naked.’ Success in a favorable market can look like skill — but only real skill endures when times get tough.

Likewise, just because a product or business generates revenue doesn’t necessarily prove it has a competitive edge. Every day, countless new AI-based apps are released. Many make money, some even become popular, but how many of them will still be here 5 years from now? Often, the businesses that are doing the best aren’t actually the ones providing the best service; they’re the ones with the best marketing & the most luck.

Lessons from Dot-Coms and Startups

Remember the dot-com era in the late ’90s? For every Amazon or Google that survived, hundreds like Pets.com and Webvan didn’t. Success often wasn’t about being the best; it was about timing, adaptability—and, sometimes, pure luck.

Focusing solely on current profitability can mean you might have a genuine edge—or you might have simply experienced a streak of good luck. If it isn’t just a matter of winning, how do we determine if we’re skillful? In trading, we refer to this as “Alpha” — the measure of a strategy’s returns attributable to genuine skill, rather than market trends or lucky breaks. Thus, the search for alpha is the search for clues that help identify systems with an edge (or at least an edge in certain market conditions).

Unfortunately, I cannot provide you with a single rule to follow in distinguishing between skill and luck. Still, it’s much easier to find the answer if you actively seek to differentiate between the two. Recognizing whether preparation or fortune played the bigger part requires conscious, continuous examination.

The reality is that most situations aren’t as purely luck-based as a coin-flipping contest. Many people appear lucky because they put themselves in the right situations and did the gritty work behind the scenes to prepare themselves for opportunities.

Do You Really Have an Edge? Validation Matters

That’s where skill (and the ability to filter out bad opportunities) comes in.

Internally, we’ve built validation protocols to help filter out systems that got lucky or those that cannot replicate their results on unseen data.

It is exciting as we solve more of the bits and pieces of this puzzle.

What we have learned is that one of the secrets to long-term success is (unsurprisingly) adaptability.

What that looks like for us is a library of systems ready to respond to any market condition — and a focus on improving our ability to select the systems that are “in-phase dynamically”. The secret isn’t predicting the future, but responding faster — and more reliably — to changing environments.

From a business perspective, this means being willing to adapt to and adopt new technologies without losing sight of a bigger ‘why,’ as we discussed in this article.

A Practical Example

When we first wrote about this, one of Capitalogix’s advisors wrote back to confirm their understanding of the coin-flipping analogy.

Well, that is correct. If we were developing coin-flipping agents, that would be as far as we could go. However, we are in luck because our trading “problem” has an extra dimension, which makes it possible to filter out some of the “lucky” trading systems.

Determining Which are the Best Systems.

There are several ways to determine whether a trading system has a persistent edge. For example, we can examine the market returns during the trading period and compare them with the trading results. This is significant because many systems have either a long or short bias. That means even if a system does not have an edge, it would be more likely to turn a profit when its bias aligns with the market. You can try to correct that bias using math and statistical magic to determine whether the system has a predictive edge. It Is a Lot Simpler Than It Sounds.

Imagine a system that picks trades based on a roulette spin. Instead of numbers or colors, the wheel is filled with “Go Long” and “Go Short” selections. As long as the choices are balanced, the system is random. But what if the roulette wheel had more opportunities for “long” selections than “short” selections?

This random system would appear to be “in-phase” whenever the market is in an uptrend. But does it have an edge?

One Way To Calculate Whether You Have An Edge.

Let’s say that you test a particular trading system on hourly bars of the S&P 500 Index from January 2000 until today.

According to the law of large numbers, in the case of the “roulette” system illustrated above, correcting for bias this way, the P&L of random systems would end up close to zero … while systems with real predictive power would be left with significant residual profits after the bias correction. While the math isn’t complicated, the process is still challenging because it requires substantial resources to crunch that many numbers for hundreds of thousands of Bots. Luckily, RAM, CPU cycles, and disk space continue to become cheaper and more powerful.

If your success can’t be replicated with new data, it may have been luck all along.

Conclusion: Tipping the Odds In Your Favor

Anyone can tally a win-loss column; far fewer can tell whether it was smarts, skill, or serendipity that made the difference. This is where rigorous analysis becomes invaluable.

Obviously, luck and skill affect every aspect of experience (from adopting technology, starting a business, transitioning from a product-based to a platform-based business model, or countless other scenarios).

In most situations, the secret is to determine what data is relevant to your industry, as well as what data you’re creating. Figure out how to analyze it. Figure out how to do that consistently, autonomously, and efficiently. Then ... test.

It’s not sexy, and it’s not complicated.

We live in a ready, fire, aim era. The speed of innovation is staggering, and the capital and energy required to create an app or start a business are at an all-time low. A bias for action is powerful.

Luck and a bias for action will take you further than most - but it still won’t take you far enough.

If you want to explore this topic further, consider reading “Fooled by Randomness” by Nassim Nicholas Taleb or “Thinking, Fast and Slow” by Daniel Kahneman. Both offer deeper insights into the psychology of luck and skill in markets and life.

Staying Honest

To conclude, I’ll leave you with a question...

If you’re reading this, you’ve almost certainly been lucky and skillful. Take a minute to list at least one thing you attribute to luck — and one to skill — in your career and life. With that in mind, what could you do differently in the future to tip the odds in your favor?

Try this, too: Next time you celebrate a big win, ask: Did I make my own luck, or did I simply wait for it to strike? In the end, the real edge belongs to those who learn to prepare, adapt — and still stay humble enough to know when fortune lent a hand.

Posted at 09:42 PM in Business, Current Affairs, Games, Ideas, Market Commentary, Science, Trading, Trading Tools | Permalink | Comments (0)

Reblog (0)