The world’s stock markets are more intertwined and unpredictable than ever. As we step into 2025, the landscape is dominated by record highs, emerging uncertainties, and shifting regional dynamics. What forces are redrawing the map—and how should forward-looking investors respond?

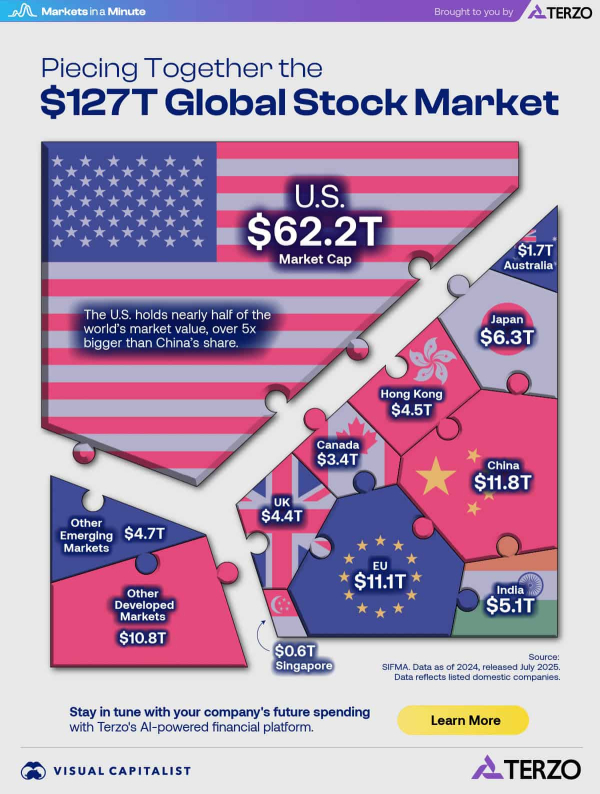

Here is a look at global stock markets. Worldwide, they represented $127 trillion in value in 2024, with U.S. markets accounting for nearly half of that amount.

via visualcapitalist

Global Market Snapshot

For comparison, the global market has grown over 14% since 2023, when its value was approximately $111 trillion.

U.S. Dominance vs. Global Opportunity. While U.S. markets account for nearly half of the global value, it’s striking how far behind China and the EU lag. It is worth examining why … and what may lie ahead.

Regional Comparisons

Let’s consider how other major regions are faring.

China’s stock market growth remains sluggish, held back by cautious consumers and the unpredictability of shifting government policies. The EU’s performance declined slightly in 2024, and faces headwinds from high interest rates and shifting energy dynamics. Meanwhile, emerging markets show wide variation—technology-driven countries outperform, while others lag due to policy or global uncertainty.

Here is a slightly deeper look at each.

China: Stimulus and Uncertainty. China’s government is attempting to stimulate its economy by reducing interest rates, repurchasing stocks, and increasing spending. That sounds positive, but people are still spending less, houses aren’t selling well, and the government often changes rules unexpectedly. Most regular Chinese don’t own stocks. For global investors, China is an intriguing yet risky market — one where outside forces frequently cause sudden shifts.

Europe: Value Amid Headwinds. Europe’s economy is diverse—its markets are a mix of banks, factories, and some technology. Wages are rising, and governments are spending. Sounds positive, but factors such as higher interest rates and global events continue to hinder progress. As a result, European stocks are generally cheaper than U.S. stocks, almost like a “value menu.” For investors, Europe remains a "safe harbor" steady option that can help balance out a portfolio, but don’t expect fireworks unless a few key factors break in their favor.

Emerging Markets: Technology’s Outliers. Meanwhile, emerging markets are more complex and susceptible to the influence of changing factors. Some countries, such as Taiwan and South Korea, are thriving thanks to strong technology growth. Others, such as Russia and Brazil, face challenges due to limited investment and instability. These markets are volatile, offering both high risk and potentially high reward..

Takeaways for Investors

The global market’s leadership is not set in stone; it is a rolling contest shaped by policy, innovation, and disruption. For investors and strategists, now is the time to reexamine assumptions, rebalance risks, and prepare for whatever comes next. In this era of constant change, adaptability—not allegiance—will be the source of enduring advantage.

Savvy investors spread their bets, recognizing that overconcentration in any single market can amplify both gains and risks.

For all the varied fears in Americans’ minds, U.S. dominance is driven not only by the strength of tech giants, but also by resilient consumer sectors and deep capital markets that set global standards.

As a result, America’s share of the global market increased approximately 7% over the past year, while China’s share has remained stable, and the EU’s share has declined slightly.

The good news for U.S investors is that global market capitalization is rising, and so is our share of it.

It’s easy to find reasons to be afraid or tentative … but it’s just as easy to find reasons to take confident action.

Looking ahead, rising interest rates, geopolitical tensions, and new technology breakthroughs could all shift the balance of global market leadership. So could the growth of digital assets. Investors must consider what will happen next if these trends continue (or suddenly reverse).

Policy shifts in China or the EU could spark sudden capital flows, triggering domino effects that shape the next phase of market evolution.

Market leadership can change in an instant. In this climate, agility wins. Prepare, diversify, and stay alert—because in the world of investing, standing still is the biggest risk of all.

History has shown that the most prosperous periods are those that encourage creative destruction and reinvention.

You can't predict the future, but you can prepare for it.

Leave a Reply