See what the World searched with Google's 2011 Zeitgeist.

Here is the video.

See what the World searched with Google's 2011 Zeitgeist.

Here is the video.

See what the World searched with Google's 2011 Zeitgeist.

Here is the video.

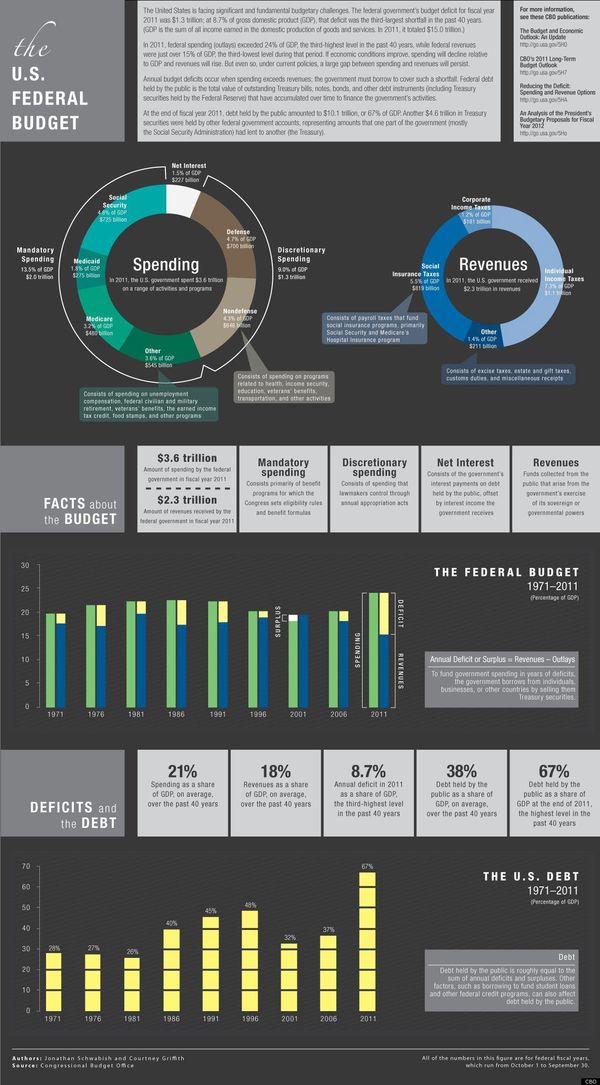

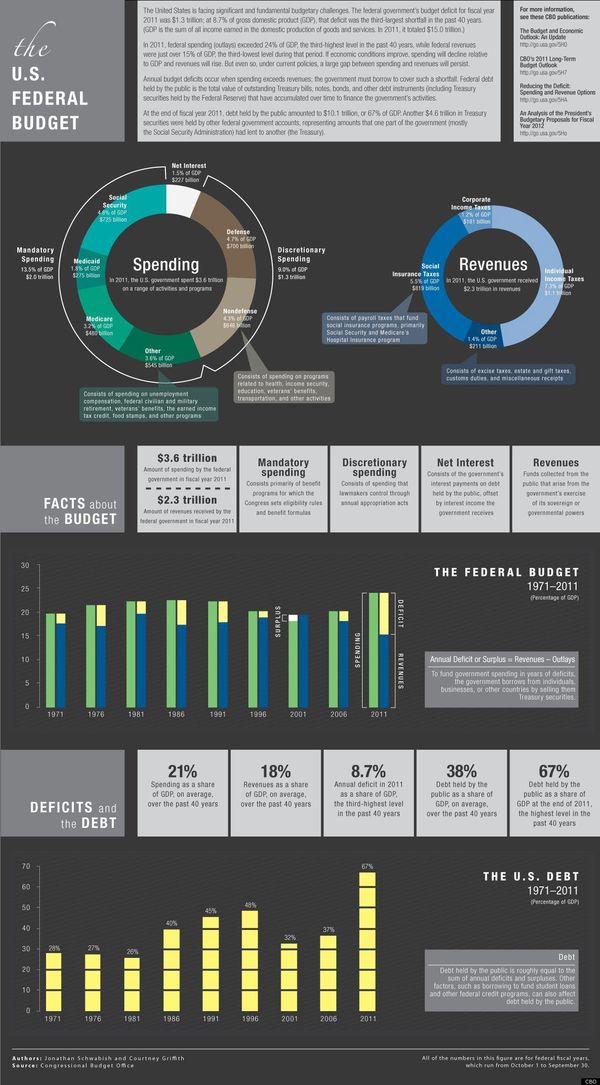

Here is a picture of our Federal Budget as we close out 2011.

Since last August, it's been clear that the United States federal deficit would top $1 trillion in 2011 for the third year in a row. At 8.7 percent of the nation's Gross Domestic Product, the debt-to-GDP ratio is one of the worst in the past 40 years, according to the Congressional Budget Office.

Government spending far outweighs, government revenues by a difference of nine percentage points in favor of spending, according to a CBO infographic .

The graphic also shows that individual's debt has grown especially large in recent years; debt held by the public accounted for 67 percent of U.S. GDP in 2011, the highest level in four decades.

Here is the U.S. federal budget infographic from the Congressional Budget Office.

via Huffington Post.

Here is a picture of our Federal Budget as we close out 2011.

Since last August, it's been clear that the United States federal deficit would top $1 trillion in 2011 for the third year in a row. At 8.7 percent of the nation's Gross Domestic Product, the debt-to-GDP ratio is one of the worst in the past 40 years, according to the Congressional Budget Office.

Government spending far outweighs, government revenues by a difference of nine percentage points in favor of spending, according to a CBO infographic .

The graphic also shows that individual's debt has grown especially large in recent years; debt held by the public accounted for 67 percent of U.S. GDP in 2011, the highest level in four decades.

Here is the U.S. federal budget infographic from the Congressional Budget Office.

via Huffington Post.

Heads we get a Santa Claus Rally … Tails we get a recession.

Here are some of the posts that caught my eye. Hope you find something interesting.

Heads we get a Santa Claus Rally … Tails we get a recession.

Here are some of the posts that caught my eye. Hope you find something interesting.

This infographic shows you what happens in 60 seconds on the Internet.

I just came from the malls, and based on the number of close parking spaces I found, a lot of people are doing their holiday shopping online.

This chart displays a wide range of actions taken (like e-mails checked, Tweets posted, or songs downloaded) each minute on the Internet.

Interesting.

Don't get into a fight you can't win.

Here are some of the posts that caught my eye. Hope you find something interesting.

Don't get into a fight you can't win.

Here are some of the posts that caught my eye. Hope you find something interesting.

David Stendahl sent me some stats that point to some diversification opportunities.

Does the following chart look like a bunch of scribbles? Good; it shows the diversified returns of the S&P 500 Index, Gold, Euro, 10-Year Note, Corn and Crude.

Keep these markets in mind as trading options that often offer performance not highly correlated with the S&P 500 Index.

What follows are a similar set of comments for various markets.

Gold

|

Over the past 14 yrs, the top 20 winning mos. in Gold produced an avg return of 8.3% … |

|

Since 1997 Gold generated a total return of 165.3% based on its top 20 grossing mos. … |

|

Gold generated an avg return of 8.3%/mo based on its top 20 grossing mos. since 1997 … |

|

FYI: Gold generated an avg return of 0.6%/mo based on its top 20 grossing mos. since 1997 … |

|

14 year perspective … top 3 monthly returns for Gold 13.4%, 13.2% & 12.3% vs. those for the S&P 500 index 11%, 10.1% & 9.3%. |

|

The short advantage … top 3 negative monthly returns for Gold -17.9%, -11.4% & -9.2% vs. those for the S&P 500 index -18.1%, -12.2% & -11.5%. |

Crude Oil

|

Over the past 14 yrs, the top 20 winning mos. in Crude Oil produced an avg return of 9% … |

|

Since 1997 Crude Oil generated a total return of 179.2% based on its top 20 grossing mos. … |

|

Crude Oil generated an avg return of 9%/mo based on its top 20 grossing mos. since 1997 … |

|

FYI: Crude Oil generated an avg return of 1.8%/mo based on its top 20 grossing mos. since 1997 … |

|

14 year perspective … top 3 monthly returns for Crude Oil 19.2%, 17.3% & 11.6% vs. those for the S&P 500 index 11%, 10.1% & 9.3%. |

|

The short advantage … top 3 negative monthly returns for Crude Oil -23.3%, -15.1% & -13.6% vs. those for the S&P 500 index -18.1%, -12.2% & -11.5%. |

Corn

|

Over the past 14 yrs, the top 20 winning mos. in Corn produced an avg return of 10.7% … the same mos for the S&P 500 returned 1.9%. |

|

Since 1997 Corn generated a total return of 214.7% based on its top 20 grossing mos. … the S&P 500 index returned 37.7% for the same mos. |

Euro

|

Over the past 14 yrs, the top 20 winning mos. in Euro produced an avg return of 5.5% … |

|

Since 1997 Euro generated a total return of 109.2% based on its top 20 grossing mos. … |

Ten Year

|

Over the past 14 yrs, the top 20 winning mos. in 10 Yr. T-Note produced an avg return of 2.1% … |

|

Since 1997 10 Yr. T-Note generated a total return of 42.3% based on its top 20 grossing mos. … |

|

10 Yr. T-Note generated an avg return of 2.1%/mo based on its top 20 grossing mos. since 1997 … |

|

FYI: 10 Yr. T-Note generated an avg return of -1.5%/mo based on its top 20 grossing mos. |

|

14 year perspective … top 3 monthly returns for 10 Yr. T-Note 5%, 2.7% & 2.4% vs. those for the S&P 500 index 11%, 10.1% & 9.3%. |

|

The short advantage … top 3 negative monthly returns for 10 Yr. T-Note -3.7%, -2.6% & -2.5% vs. those for the S&P 500 index -18.1%, -12.2% & -11.5%. |