Here are some of the posts that caught my eye. Hope you find something interesting.

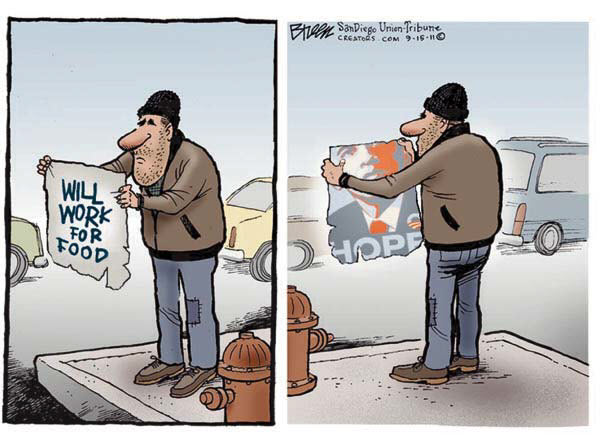

- Poverty Hits 50-year High, in the U.S. but don't worry, it's totally under control. (LATimes)

- Food Prices Soar by 13.2% in August. (Economic Policy Journal)

- The 2 Billion UBS Incident – 'Rogue Trader' My Ass. by Matt Taibbi (RollingStone)

- What Microsoft Did For Cantor Fitzgerald After 9/11. (BusinessInsider)

- Algorithmic Stock Trading Rapidly Replacing Humans, Warns Govt. Paper. (CW)

- How to Focus: Some Ideas in a Mind Map. (MindmapArt)

- Using Social Software for Business Performance. (Deloitte)

- A User's Guide to the Best TED Talks. (DailyDot)

- Universal Intelligence: Developing a True Standard Test of Smarts. (NewScientist)

- A Look at 313 Apple Patents that List Steve Jobs as an Inventor. (NYTimes)