Here is a skit from Johnny Carson and Dom DeLuise. It's funny to see how talk shows have changed.

It is a different kind of clean … and a different kind of dirty.

Here is a skit from Johnny Carson and Dom DeLuise. It's funny to see how talk shows have changed.

It is a different kind of clean … and a different kind of dirty.

Here is a skit from Johnny Carson and Dom DeLuise. It's funny to see how talk shows have changed.

It is a different kind of clean … and a different kind of dirty.

Recently, the concept of "Focus" keeps coming to mind when I try to

make sense of what's happening in the markets.

As I review

stories, news, and data, I'm trying to be more aware of where the bias

is (even if it is unintentional).

Focus,

Bias and Perspective.

The photo series, below, is an

example of how our perception can be easily shaped. The far left

version looks violent. The far right version looks compassionate. It

could be both (or neither).

Each

of us perceives the world through our own filters. It is as if we're

producing a film (which could be edited into a comedy, drama, or

thriller … based on what we focus on, highlight, or ignore). Except

that we often don't know it's just a film, edited by an amateur …

Instead, we

perceive it as truth because it is what we perceive.

The point is

that perspective matters.

Recently, the concept of "Focus" keeps coming to mind when I try to

make sense of what's happening in the markets.

As I review

stories, news, and data, I'm trying to be more aware of where the bias

is (even if it is unintentional).

Focus,

Bias and Perspective.

The photo series, below, is an

example of how our perception can be easily shaped. The far left

version looks violent. The far right version looks compassionate. It

could be both (or neither).

Each

of us perceives the world through our own filters. It is as if we're

producing a film (which could be edited into a comedy, drama, or

thriller … based on what we focus on, highlight, or ignore). Except

that we often don't know it's just a film, edited by an amateur …

Instead, we

perceive it as truth because it is what we perceive.

The point is

that perspective matters.

It seems like everywhere I look, there is bad news about the economy. Recently, however, venture capital and M&A activities have been picking-up. Both of those are early indicators of economic optimism. In addition, here are two other signs that economic winter may soon give way to spring.

First, a Bankruptcy Partner in a major Dallas law firm just told me that he sees fewer filings in the pipeline. In addition, he says that credit has started opening-up to corporations, which is giving them the lifeline they need to start making progress again.

First, a Bankruptcy Partner in a major Dallas law firm just told me that he sees fewer filings in the pipeline. In addition, he says that credit has started opening-up to corporations, which is giving them the lifeline they need to start making progress again.

Second, speaker bookings for corporate meetings seem to be picking-up again. I suspect that this is an indicator that corporations are willing to spend money on motivation, teamwork, and culture. In Maslow's hierarchy of needs, that's certainly a tier above food and shelter. In other words, when money frees-up for these types of activities, it suggests that corporations are starting to feel more comfortable about the short-term … and more optimistic about the longer-term.

From a technical analysis perspective, optimism shows itself in the charts.

Where Are We?

In last week's commentary, I indicated that a

holiday-shortened options expiration week was a likely time to expect a

bounce. Well, even though the Fed announced a surprise discount rate hike to banks,

the markets did rally. While impressive on some levels, it happened on

low trading volume and takes us to a resistance level.

It is

decision-time for the S&P 500 Index. The weekly chart, below, shows

the downward sloping trend-line from the 2007 highs, as well as the

rally off the 2009 lows. More recently, we've seen a nice rally off the

high volume reversal bar from several weeks ago (marked by the yellow

highlight in the green circle). Nonetheless, the bigger issue is whether price will be

able to rally and hold above the down-trend line (marked by the

red arrow)?

If the markets do sell-off soon, then many eyes will shift to the 200-day moving average (similar to the 40-week average marked in blue) as a likely support level.

It Is a Matter of Perspective … But the Real Story is the Lack of Selling.

I read an article that claims to outline the three basic causes of the market rally since March of 2009.

The chart, below shows the gains and losses that occurred during the normal trading session versus during after-hours sessions.

My first reaction was that this probably was the result of government

action or manipulation by some unseen hand. Pushing the market higher

during light futures trading periods (like weekends or after-hours)

resulted in bigger gap-up openings.

After a little thought, however,

these actions make sense. Even if these after-hour pushes were the

result of the government, it was easier, took less capital (and thus

cost less to do it) after-hours than it would have during periods of

thicker trading. So, it was smart to do it that way.

More importantly,

this is a free market; so if the market "disagrees" with the push

higher, then sellers can freely take their profits or positions. The

bigger issue is that even though the markets have been pushed higher, we

still haven't gotten to the point that triggers selling volume.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

It seems like everywhere I look, there is bad news about the economy. Recently, however, venture capital and M&A activities have been picking-up. Both of those are early indicators of economic optimism. In addition, here are two other signs that economic winter may soon give way to spring.

First, a Bankruptcy Partner in a major Dallas law firm just told me that he sees fewer filings in the pipeline. In addition, he says that credit has started opening-up to corporations, which is giving them the lifeline they need to start making progress again.

First, a Bankruptcy Partner in a major Dallas law firm just told me that he sees fewer filings in the pipeline. In addition, he says that credit has started opening-up to corporations, which is giving them the lifeline they need to start making progress again.

Second, speaker bookings for corporate meetings seem to be picking-up again. I suspect that this is an indicator that corporations are willing to spend money on motivation, teamwork, and culture. In Maslow's hierarchy of needs, that's certainly a tier above food and shelter. In other words, when money frees-up for these types of activities, it suggests that corporations are starting to feel more comfortable about the short-term … and more optimistic about the longer-term.

From a technical analysis perspective, optimism shows itself in the charts.

Where Are We?

In last week's commentary, I indicated that a

holiday-shortened options expiration week was a likely time to expect a

bounce. Well, even though the Fed announced a surprise discount rate hike to banks,

the markets did rally. While impressive on some levels, it happened on

low trading volume and takes us to a resistance level.

It is

decision-time for the S&P 500 Index. The weekly chart, below, shows

the downward sloping trend-line from the 2007 highs, as well as the

rally off the 2009 lows. More recently, we've seen a nice rally off the

high volume reversal bar from several weeks ago (marked by the yellow

highlight in the green circle). Nonetheless, the bigger issue is whether price will be

able to rally and hold above the down-trend line (marked by the

red arrow)?

If the markets do sell-off soon, then many eyes will shift to the 200-day moving average (similar to the 40-week average marked in blue) as a likely support level.

It Is a Matter of Perspective … But the Real Story is the Lack of Selling.

I read an article that claims to outline the three basic causes of the market rally since March of 2009.

The chart, below shows the gains and losses that occurred during the normal trading session versus during after-hours sessions.

My first reaction was that this probably was the result of government

action or manipulation by some unseen hand. Pushing the market higher

during light futures trading periods (like weekends or after-hours)

resulted in bigger gap-up openings.

After a little thought, however,

these actions make sense. Even if these after-hour pushes were the

result of the government, it was easier, took less capital (and thus

cost less to do it) after-hours than it would have during periods of

thicker trading. So, it was smart to do it that way.

More importantly,

this is a free market; so if the market "disagrees" with the push

higher, then sellers can freely take their profits or positions. The

bigger issue is that even though the markets have been pushed higher, we

still haven't gotten to the point that triggers selling volume.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

The network is becoming the computer.

Here is a short video that puts "Cloud Computing" in perspective. In it, Ellison jokes that someone decided to change the word "Internet" to

"Cloud" because it was a lot easier than innovation.

Microsoft is spending a lot of time and money to make sure it does better gaining an early lead and monetizing this type of "Internet" service. Their cloud computing platform is called Azure.

Amazon also has a cloud offering worth a look.

Why Should You Care?

Basically, you can “rent” a current version Windows Server for as little as 12 cents per hour, and only pay for the hours you need it each month. That’s $12 bucks to use 100 servers for an hour. You also pay for data transfer and storage, but that is negligible. The nice thing is that you can fire up an army of servers to run a batch process … then stop paying when they complete their work.

You can get access even cheaper under a program where you bid on unused capacity within the cloud at any given time (Spot pricing).

I still have reservations about using cloud computing for many daily business applications. However, for “crunch on demand” processes … this model makes much more sense that investing in piles of hardware that all too soon becomes obsolete.

Most of the data from this post comes from Tim McDonald, the president of Infassure, a technology consulting and out-sourcing company in the Dallas area. They've been a big help to us on this, and many other matters.

The network is becoming the computer.

Here is a short video that puts "Cloud Computing" in perspective. In it, Ellison jokes that someone decided to change the word "Internet" to

"Cloud" because it was a lot easier than innovation.

Microsoft is spending a lot of time and money to make sure it does better gaining an early lead and monetizing this type of "Internet" service. Their cloud computing platform is called Azure.

Amazon also has a cloud offering worth a look.

Why Should You Care?

Basically, you can “rent” a current version Windows Server for as little as 12 cents per hour, and only pay for the hours you need it each month. That’s $12 bucks to use 100 servers for an hour. You also pay for data transfer and storage, but that is negligible. The nice thing is that you can fire up an army of servers to run a batch process … then stop paying when they complete their work.

You can get access even cheaper under a program where you bid on unused capacity within the cloud at any given time (Spot pricing).

I still have reservations about using cloud computing for many daily business applications. However, for “crunch on demand” processes … this model makes much more sense that investing in piles of hardware that all too soon becomes obsolete.

Most of the data from this post comes from Tim McDonald, the president of Infassure, a technology consulting and out-sourcing company in the Dallas area. They've been a big help to us on this, and many other matters.

The markets did rally, a little, last week. However, they are still beneath the overhead resistance and the longer-term downwards sloping trend-line.

The Dow Jones Industrial Average has been able to hold above the 10,000 level. Is that important?

Does

Dow 10,000 Really Mean Something?

The WSJ published an

article called "Milestone Figures Grab Attention, but Their Impact Is

Hazy". A similar message comes from Barry Ritholtz; that Dow 10,000 has become “a

meaningless number, without any impact technically or quantitatively.

It's no surprise that the Dow did not hold over 10k for very long. It's

been over 26 times, starting in 1999. And hear it is, 10 years later —

zero progress. Why anyone — other than TV producers and silly hat

manufacturers — cares about Dow 10k is quite simply beyond my

comprehension.” If you are curious, here is the chart that shows what that looks like.

If big round numbers don't mean anything, is there something to potentially point the way?

Is Lumber Sending a Bullish Signal About the Broader Market?

If you are looking for a potentially bullish early indicator, then Lumber may be sending you a signal. It has continued higher, even during the recent equity market decline (marked by the orange rectangle). Why do traders consider lumber an early indicator for the broader market? Since lumber is a primary raw material in the early stages of new construction, the logic is that lumber purchases signal new construction.

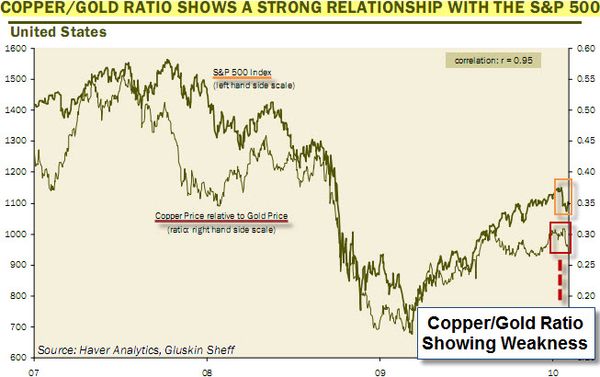

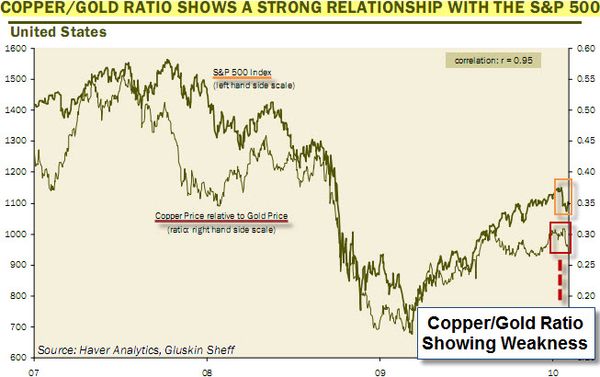

What Can Copper Tell Us?

Like Lumber, traders also look to Copper as another early indicator of new construction because it commonly used in things like wires and pipes. Recently, several commentators have mentioned that the Copper/Gold Ratio is an interesting composite measure of economic activity. The chart below shows weakness and a negative divergence of the Copper/Gold Ratio (in comparison to the S&P 500 Index) since last summer. Most recently, price has been falling steeply. We will see if that is an early indicator of broader market weakness?

A similar flattening of trading range occurred in the Financial Sector as well.

What Does the Financial Sector Tell Us?

Financials often lead rallies higher. The logic is that banks make more money when they are lending, doing deals, and helping companies go public. The past six months have shown the hesitation investors have to buy into further gains in this sector. However, price is now at the bottom of its six month trading range. In bull markets, this is where the buying comes in. So, let's see how this sector responds. A move down from here would hurt the bullish case.

This is a holiday-shortened options expiration week. Recently, those have been rally triggers. Best wishes for a great week.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

Democrats. (Newser)

The markets did rally, a little, last week. However, they are still beneath the overhead resistance and the longer-term downwards sloping trend-line.

The Dow Jones Industrial Average has been able to hold above the 10,000 level. Is that important?

Does

Dow 10,000 Really Mean Something?

The WSJ published an

article called "Milestone Figures Grab Attention, but Their Impact Is

Hazy". A similar message comes from Barry Ritholtz; that Dow 10,000 has become “a

meaningless number, without any impact technically or quantitatively.

It's no surprise that the Dow did not hold over 10k for very long. It's

been over 26 times, starting in 1999. And hear it is, 10 years later —

zero progress. Why anyone — other than TV producers and silly hat

manufacturers — cares about Dow 10k is quite simply beyond my

comprehension.” If you are curious, here is the chart that shows what that looks like.

If big round numbers don't mean anything, is there something to potentially point the way?

Is Lumber Sending a Bullish Signal About the Broader Market?

If you are looking for a potentially bullish early indicator, then Lumber may be sending you a signal. It has continued higher, even during the recent equity market decline (marked by the orange rectangle). Why do traders consider lumber an early indicator for the broader market? Since lumber is a primary raw material in the early stages of new construction, the logic is that lumber purchases signal new construction.

What Can Copper Tell Us?

Like Lumber, traders also look to Copper as another early indicator of new construction because it commonly used in things like wires and pipes. Recently, several commentators have mentioned that the Copper/Gold Ratio is an interesting composite measure of economic activity. The chart below shows weakness and a negative divergence of the Copper/Gold Ratio (in comparison to the S&P 500 Index) since last summer. Most recently, price has been falling steeply. We will see if that is an early indicator of broader market weakness?

A similar flattening of trading range occurred in the Financial Sector as well.

What Does the Financial Sector Tell Us?

Financials often lead rallies higher. The logic is that banks make more money when they are lending, doing deals, and helping companies go public. The past six months have shown the hesitation investors have to buy into further gains in this sector. However, price is now at the bottom of its six month trading range. In bull markets, this is where the buying comes in. So, let's see how this sector responds. A move down from here would hurt the bullish case.

This is a holiday-shortened options expiration week. Recently, those have been rally triggers. Best wishes for a great week.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

Democrats. (Newser)