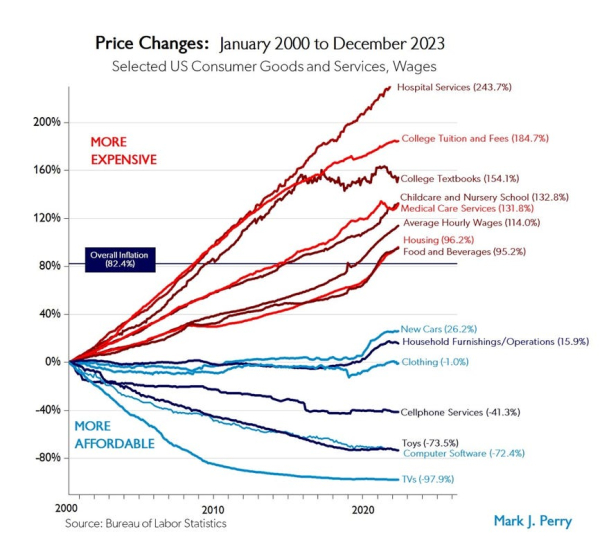

This post considers the “Chart of the Century” created and named by Mark Perry, an economics professor and AEI scholar. This chart has received considerable attention because it contains extensive information about the challenges faced by the Fed and other Washington policymakers.

The most current version reports price increases from 1998 through the end of 2023 for 14 categories of goods and services, along with the average wage and overall Consumer Price Index.

It shows that prices of goods subject to foreign competition — think toys and television sets — have tumbled over the past two decades as trade barriers have come down worldwide. Meanwhile, the costs of so-called non-tradeable items — hospital stays and college tuition, to name two — have surged.

From January 1998 to now, the CPI for All Items has increased by over 90% (up from 59.6% in 2019, when I first shared this chart).

Lines above the overall inflation line have become functionally more expensive over time, and lines below the overall inflation line have become functionally less expensive.

via Human Progress

At the beginning of 2020 (when I shared the 2019 post), food, beverages, and housing were in line with inflation. They’ve now skyrocketed above inflation, which helps to explain the unease many households are feeling right now. College tuition and hospital services have also continued to rise over the past few years—even in relation to inflation.

There are many ways to interpret this chart. You can point to items in red whose prices have exceeded inflation as government-regulated or quasi-monopolies. You can point to items in blue as daily commodities that have suffered from ubiquity, are subject to free-market forces, or are goods subject to foreign competition and trade wars.

Looking at the prices that decrease the most, they’re all technologies. New technologies almost always become less expensive as we optimize manufacturing, components become cheaper, and competition increases. From VisualCapitalist, at the turn of the century, a flat-screen TV would cost around 17% of the median income ($42,148). In the early aughts, though, prices began to fall quickly. Today, a new TV will cost less than 1% of the U.S. median income ($54,132).

Compare “tradable” goods like cell phones or TVs (with lots of competing products) to less tradable “goods” like hospital stays or college tuition, and unsurprisingly, they’ve gone in opposite directions. In 2020, I asked what the Coronavirus would do to prices, and the answer was less than expected. If you don’t look at the rise in inflation but instead the change in trajectories, very few categories were heavily affected. While hospital services have skyrocketed since 2019, they were already skyrocketing.

At this point, we’re pretty far removed from quarantine’s most extreme forces. Textbooks have come back down, as have childcare and medical care services. New cars and household furnishings have leveled out. Otherwise, the trajectories have been pretty unaffected.

We can look one step deeper if we consider average hourly income. Since 2000, overall inflation has increased by 82.4%, while average hourly income has increased by 114%. This means that hourly income increased 38% faster than prices (which indicates a 14.8% decrease in overall time prices). You get 17.3% more today for the same amount of time worked ~24 years ago.

It’s interesting to look at data like that, knowing that the average household is feeling a “crunch” right now. My guess is that few consumers distinguish between perception and reality. However, feeling a crunch isn’t necessarily the same as being in a crunch.

For instance, we must account for ‘quality of life creep,’ where people tend to splurge on luxuries as their standard of living improves. With the ease of online shopping and access to consumer credit, it’s become increasingly easy to indulge in impulse purchases, leading to reduced savings and feelings of financial scarcity. This phenomenon is a function of increased consumption (rather than inflation), yet it still leaves consumers feeling like they’re struggling to make ends meet.

Perry’s ‘Chart of the Century’ reveals the complex relationships between inflation, consumption, and economic growth. While households may feel financial strain, the data shows that income has outpaced inflation, and technology has made many goods more affordable. Nonetheless, our tendency to splurge on luxuries and increased consumption have contributed to a sense of financial struggle.

How can policymakers address the sectors experiencing significant price hikes, like healthcare and education, without stifling innovation in tradable goods and services?

How do you think these issues will impact the Election?

Don't Walk Out On A.I. Just Yet

Amazon's 'Just Walk Out' technology has revolutionized shopping convenience, but whispers suggest there might be more to it than meets the eye...

For years, shoppers have been able to walk into one of their Amazon Fresh grocery stores, walk out, and never have to talk to a single person, or even check out.

This feat was supposedly made possible solely using machine intelligence.

However, they just announced that they're removing technology from their stores and switching to smart shopping carts.

Along with that announcement came rumors that the technology only worked due to a team of 1000 out of India. Apparently, this team was required to verify orders and correct the technology when it missed items.

On the one hand, that seems like a classic case of overpromising and underdelivering, but it's also very common. Many public-facing AI systems rely on human moderators and data labelers.

So why is Amazon being flogged in the media?

The problem for me is two-fold.

First, Artificial Intelligence is at the peak of inflated expectations on Gartner's Hype Cycle. That means the average user has high hopes and is being disappointed. It also means the average user is likely overwhelmed with apps and technologies that fail to deliver on their promises.

Second, transparency is the name of the game, especially in a black-box situation like most AI. The technology Amazon is creating is impressive—but they're also Amazon. Eyes are on them to be leaders, so when they fall short, it's a chance for naysayers to pile on.

Public perception is likely to trend downward in the next news cycle, which is to be expected. After the peak of inflated expectations comes the trough of disillusionment.

Regardless, AI will continue to become more capable, ubiquitous, and autonomous. The question is only how long until it affects your business and industry.

While Amazon has "walked out" on that technology in its stores, it's not time to "walk out" on AI just yet. Numerous stores still use that or similar technologies.

Posted at 09:00 PM in Business, Current Affairs, Food and Drink, Gadgets, Ideas, Market Commentary, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Reblog (0)