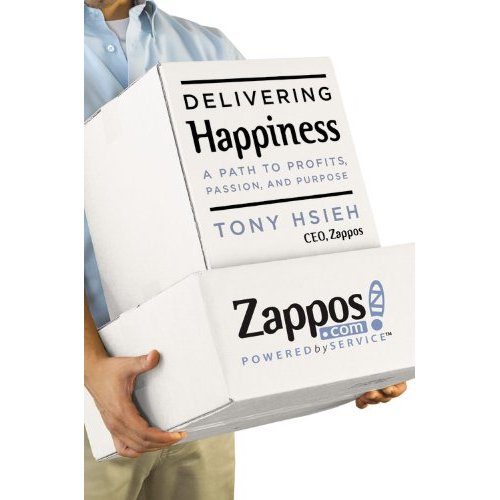

I've been reading a pretty good new book that is an interesting mix of stories, life-lessons, and business content. It combines a behind the scenes peek into the situations, emails, checklists, sample interview questions, and "Happiness Framework" that led to some surprising results.

I've been reading a pretty good new book that is an interesting mix of stories, life-lessons, and business content. It combines a behind the scenes peek into the situations, emails, checklists, sample interview questions, and "Happiness Framework" that led to some surprising results.

For example, here are Zappos' Core Values from which they develop their culture, brand, and business strategies:

- Deliver

WOW Through Service - Embrace

and Drive Change - Create

Fun and A Little Weirdness - Be

Adventurous, Creative, and Open-Minded - Pursue

Growth and Learning - Build

Open and Honest Relationships With Communication - Build

a Positive Team and Family Spirit - Do

More With Less - Be

Passionate and Determined - Be

Humble

Why Should You Care?

In 1999, Tony Hsieh (pronounced Shay) sold LinkExchange, the company he co-founded, to Microsoft for $265 million. He then joined Zappos as an adviser and investor, and eventually became CEO.

In 2009, Zappos was listed as one of Fortune magazine's top 25 companies to work for, and was acquired by Amazon later that year in a deal valued at over $1.2 billion on the day of closing.

So, you might guess that he learned a few things about what worked, and what didn't.

In his first book, Tony shares the different business lessons he learned in life, from a lemonade stand and pizza business through LinkExchange, Zappos, and more. Ultimately, he shows how using happiness as a framework can produce profits, passion, and purpose both in business and in life.

Here is a video of Tony Hsieh on Delivering Happiness.

Zappos is Famous For Their Culture. Here's a Taste of It.

Here is Tony's BigThink video explaining his company's culture and belief that managers should "hang-out" with staff after work.

Other Resources.

- Here is a link to the book Delivering Happiness.

- Here is a link to the Delivering Happiness Blog site.

- Here is a link to other Delivering Happiness resources.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=ac21ca56-b8e3-4e7a-9398-a4b0a42477d1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=97b3a39f-6455-4649-86b0-ffac919dc6f3)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=ec27b3c3-941a-4be0-a097-93d3870005d2)