broke below its recent trend-line. By itself, not a cause for major concern, just a key to notice. The question is whether it can get back above that level, or will this be the start of a more meaningful correction?

It is also worth noting that the MACD indicator is showing more downside momentum than it did at the same price level earlier in April.

A Peek Over the Wall.

Is

China's Shanghai Index sending a warning about the world economy or just

their economy?

Unless things change in a hurry, China's Shanghai

Composite could drop significantly. This chart shows the triangle

pattern that played-out over the past nine months.

You can think of the Triangle as a well-contested battle

between the bulls and the bears. Inside the pattern, neither side

gives-up much ground. However, when one side loses conviction, the

market surges in the direction the winners push it.

Triangles

are often continuation patterns. So, be wary that this move is a

head-fake down to trigger a big rally. Otherwise, the target is pretty

far below.

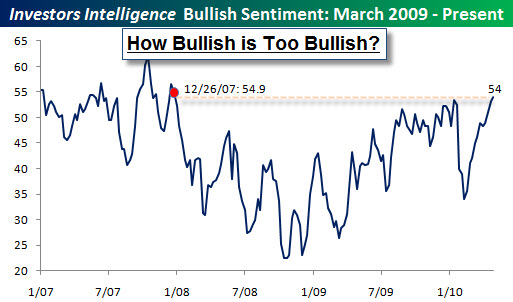

Sentiment Here in the United States is Still Very Bullish.

While stocks have certainly become more volatile in the last two weeks, newsletter writers seem to be taking it in stride. According to Bespoke, the latest Investors Intelligence survey of newsletter writers found that 54% of those surveyed are now bullish on the market. The last time bullish sentiment was this high was back in December 2007, before the crash.

Another important to measure of the crowd’s extreme bullish sentiment is that fewer than 20% of advisors are currently bearish. According to Prieur du Plessis, these are first indications of a market top.

Another Sign of a Potential Top?

The U.S. Treasury Department plans to sell “up to” 1.5 billion

shares of Citigroup in the government’s

biggest step yet to exit the 27 percent ownership of the bank it rescued

during the financial crisis. Bloomberg quotes Geithner as saying: "We’re

putting TARP

out of its misery," and "the government is withdrawing from the

financial industry after forcing lenders to recapitalize with private

money."

If you think that is funny, then so is this cartoon.

Business Posts Moving the

Markets that I Found Interesting This Week:

- Hussman: Rally Has Ignored Fundamentals & Will Be Corrected

Painfully. (BizInsider) - Earnings Growth: Are the Gains Too Good to Last? - (BusinessWeek)

- The Looming De-Leveraging Challenge. (McKinsey

Quarterly) - UBS to Retail Clients: Stock Boom Is Over. (InvestmentNews)

- Worried about the PIIGs: Was Greece's Rescue Futile & is

Portugal

Next? (WikInvest) - More Posts

Moving the Markets.

Lighter Ideas and

Fun Links

that I Found Interesting This Week

- Microsoft Won 10 Times More Patents Than Apple In 2009.

(BusinessInsider) - Peek at Tomorrow: Ten Technology Incubators Changing The World.

(Forbes) - Computer Science Loses to Math in New Hiring Formulas. (WSJ)

- Bacterial Colonies Show Intelligence Coping with a Hostile

Environment. (Seed) - World Air Traffic Time-Lapse Video Over a 24-Hour Period.

(HuffingtonPost) - More

Posts with Lighter Ideas and Fun Links.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=2206e9c8-142d-4775-b2bf-449da0f3ae8c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=cc764fba-3ca3-4840-a5d4-dd9968439010)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=87460f6c-55a1-4482-b6ef-3f61e3509956)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=efb0999c-d45e-4fdd-bd4e-b4ba370af4bb)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=651a4310-9bed-4199-9851-db6917289feb)