We are in the dog-days of summer. Perhaps it is a good time to travel, just so you are not tempted to watch the news.

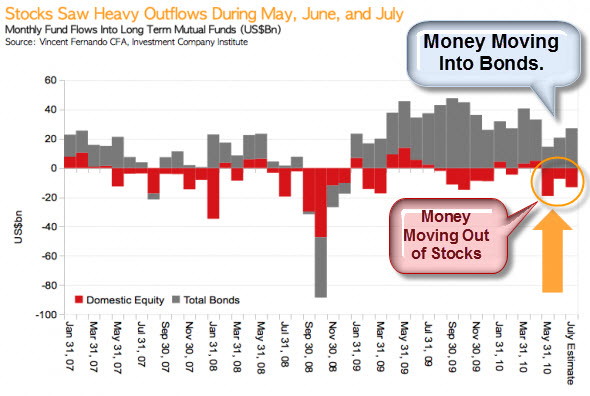

Biggest Negative Fund Flow Out of U.S. Stocks Since During the Crisis.

Money is flowing out of equity markets into the bond market. According to the NYTimes, investors withdrew a staggering $33.12 billion from domestic stock market mutual funds so far this year.

In the chart, below, the red bars represent fund flows for U.S. equity mutual funds, and the gray bars represent fund flows for bond mutual fund. The data for this chart is based on the fund flow data of long term mutual funds tracked by the Investment Company Institute.

Likewise, according to Rasmussen research, consumer & investor confidence has fallen to a 2010 low.

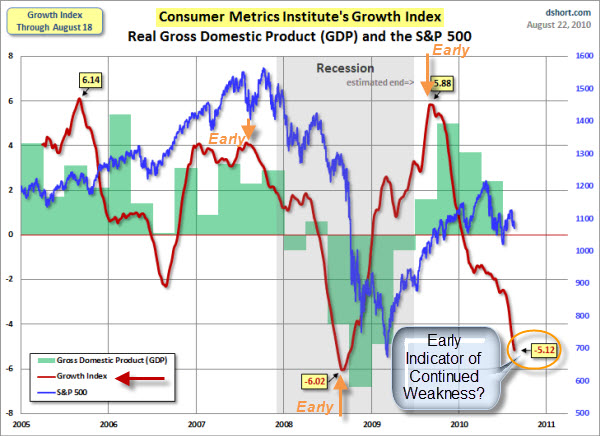

The Consumer Metrics Institute's Growth Index.

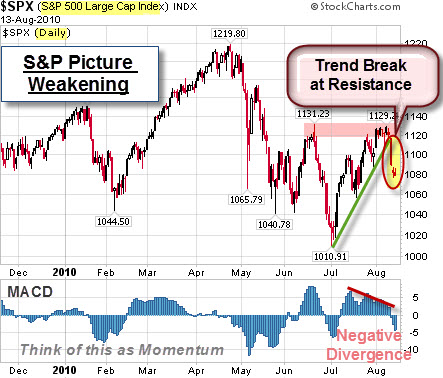

It's easy to get distracted by other data, but (for the most part) price is the primary indicator to use when analyzing a stock chart. Of course, it's still useful to try and get an early indicator of how a well-followed metric may perform.

The chart below shows three different data points. The S&P 500 index, GDP, and the Consumer Metrics Institute's Growth Index. Historically, the Growth Index has given an early indication of what GDP and the stock market are likely to do soon after. So, its recent decline might be an early indicator of continued weakness.

This is something that bears watching. If you're interested, here's a link from dshort.com that covers this topic in more detail.

As more people worry that our economy is not changing as hoped; some things are changing … technology and legislation.

How Does Technology Change the Investment Landscape?

Duncan Niederauer, NYSE Euronext CEO, sat down with Maria Bartiromo at the "Techonomy Conference" in Lake Tahoe to talk about technological advancements and what they mean for the future of trading.

My guess is that we are going to see a whole new round of cries for regulation of financial technology.

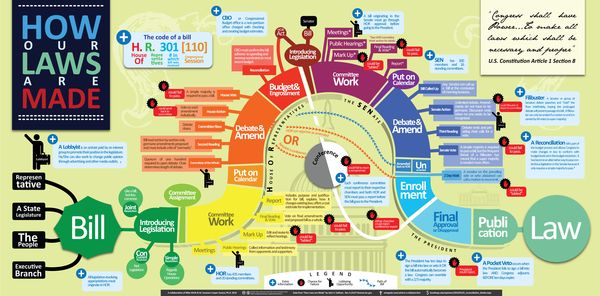

Here is an Explanation of How Laws Are Made.

For the past two years, Financial Reform has been in the news. Here is is a link to a discussion of what it can accomplish. Now that the Dodd-Frank Bill has become law, I thought it might be helpful to show the path it had to take? Here is an informative infographic put together by Mike Wirth that lays out how a Bill becomes a Law. Click the image to see a larger version.

Business Posts Moving the Markets that I Found Interesting This Week:

- Market Data Firm Spots the Tracks of Bizarre Robot Traders. (Atlantic)

- Will the New Financial Reform Law Affect Big Bank Profits? (RollingStone)

- Soros Flees Stocks, Yet Remains Bullish On 'The Ultimate Bubble' in Gold. (BI)

- Rising Profits Are Good, But Sales Haven't Kept Pace. (NYTimes)

- More M&A: Why Did Intel's Pay $7.68 Billion to Purchase of McAfee? (Newser)

- Following Jobs Report, Consumer & Investor Confidence Falls to 2010 Low.

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week:

- Surprising Research on the Effect of Interruptions on Your Work. (BothSides)

- 10 Amazing James Bond Gadgets That You Can Actually Buy. (BusinessInsider)

- Big Brother is Watching: Judges Divided Over Growing GPS Surveillance. (NYTimes)

- At Least It Wasn't Cancer: Doctors Find Pea Growing In Man's Lung. (NPR)

- Class of 2014 Doesn't Know Cursive: Snapshot of a Generation. (Newser)

- More Posts with Lighter Ideas and Fun Links.