While some people believe that markets are random, others make money by using rule-based trading systems that rely on certain patterns to identify favorable trading conditions.

Traders, at every level, search for a tradable edge. Some find it in fundamental analysis; others find it in technical analysis or chart-based patterns; still others find an algorithmic or execution-based edge.

So, is there some magic unifying equation that defines the Market? Personally, I doubt it. However, there is always "something" working in the markets. The challenge is to identify what that is and to ignore the rest.

Though many many patterns work, from time-to-time, when a particular pattern comes into play may seem random; and here is why.

Understanding the Markets.

There is no such thing as a "Market" … It is really just a collection of separate traders.

There is no such thing as a "Market" … It is really just a collection of separate traders.

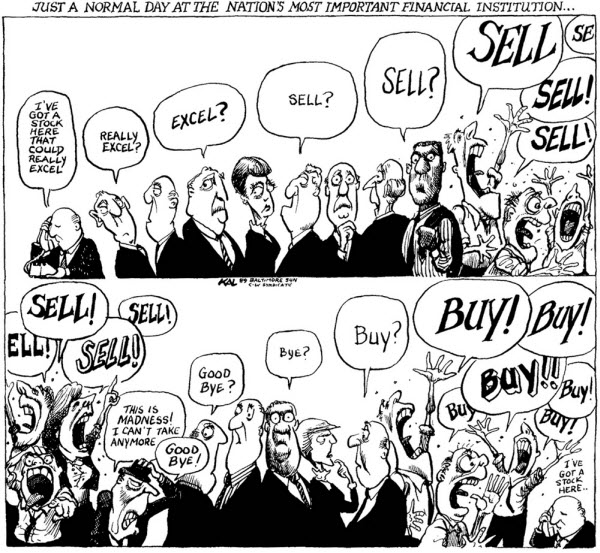

One of the reasons that markets experience great volatility is that different groups buy or sell for different reasons at different times.

Consequently, even if one group trades using a consistent set of rules, a strategy that effectively combats it only works until that group stops trading those rules.

Elephants Leave Tracks.

Smart traders follow the big money.

Smart traders follow the big money.

Large traders like governments, sovereign wealth funds, or a mutual fund can affect markets while they buy or sell.

However, when they're done, some other group's strategy becomes the dominant force.

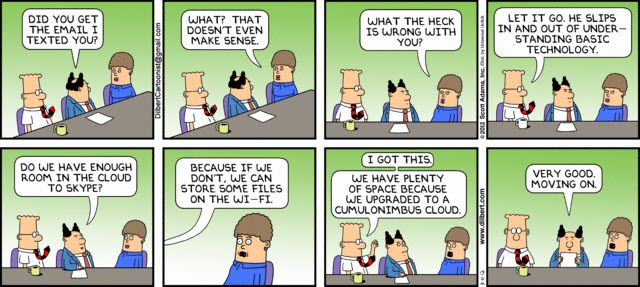

Experienced traders recognize that it is important to understand "who is in control" … not necessarily why they are trading.

That means you don't have to figure out every bit of information or rationale behind their strategy in order to make money. For example, if you were about to walk into a movie theater, but were suddenly confronted with hundreds of people running in the other direction screaming, you don't have to understand exactly why it's happening in order to respond intelligently.

On a superficial level, that's the basis of trend following. It is also an example of pattern recognition.

Most hedge funds now use some form of pattern recognition in their trading systems. In the next article, I'll delve into this topic a little more deeply.