The last time I drove in New York City traffic, I complained that "I didn’t understand why people came here" because it was too crowded.

That reminds me of one of Yogi Berra’s famous quotes. “Nobody goes there anymore because it’s too crowded.”

He said that about a famous restaurant where he used to work.

The same is true in business. Opportunity draws a crowd … but the best opportunities are often in areas of less competition.

For entrepreneurs, oversaturation can turn products into commodities, reducing profit potential. Conversely, many shy away when a challenge seems insurmountable, creating unexpected opportunities for those willing to take the risk.

As an entrepreneur, I’m drawn to projects others might dismiss as science fiction. These are the challenges that often lead to the most groundbreaking and rewarding outcomes.

Moonshot Projects

Moonshot projects offer a unique advantage. While they may seem daunting, their audacious nature often means less competition and greater potential for transformative impact and extraordinary profits.

A moonshot project is a highly ambitious, transformative endeavor that seeks to solve a significant problem or create a revolutionary innovation. These projects are characterized by:

- Audacious Goals: They aim for breakthroughs that seem nearly impossible to achieve.

- Disruptive Impact: They strive to create solutions that are vastly superior to existing offerings, often by introducing entirely new paradigms.

- High-Risk, High-Reward: These projects embrace the potential for failure in pursuit of groundbreaking results.

- Long-Term Focus: They prioritize long-term impact over short-term gains.

- Technological Advancements: They leverage cutting-edge or even nascent technologies.

- Paradigm Shifts: They challenge conventional wisdom and industry norms.

Moonshot projects are inherently challenging. They demand significant resources, interdisciplinary collaboration, and a willingness to venture into the unknown. This perceived difficulty often deters potential competitors, creating a unique opportunity for those willing to take the risk.

When successful, they push the boundaries of what is possible and redefine the landscape of their respective fields.

In part, that is why a 10X mindset is particularly well-suited for Moonshot projects. By aiming for a tenfold improvement over existing solutions, you’re essentially operating in a space with little to no competition or opposition. This allows you to redefine the rules of the game and establish a sustainable competitive advantage.

Our strategy of creating a unique, sustainable competitive advantage aligns perfectly with the Moonshot approach. By choosing to play a different game (with an asymmetric edge), we’re not just competing; we’re fundamentally changing the playing field.

I’m not interested in going head-to-head with tech giants on their turf. Instead, the goal is to carve out our own niche, focused on using our unique abilities to push boundaries and extend our edge. Being slightly ahead of the competition can be a powerful attractor. It often leads potential competitors to seek collaboration rather than confrontation. They might approach you with ideas, money, or opportunities, aspiring to share in your advanced position and capabilities. This dynamic can create unexpected partnerships and accelerate progress in ways that benefit everyone involved.

When interviewing potential team members, I often share a crucial insight: if you’re seeking a job where you work 9-to-5 solving problems so you can go home feeling satisfied, this might not be the right fit.

We tackle challenges of a different magnitude. Our projects rarely have quick solutions. Instead, we focus on making steady progress towards ambitious goals.

I sometimes joke that our motto should be: “We suck less.” Nevertheless, the underlying truth is more profound. It’s about understanding your ultimate objective and recognizing that each step moves you in the right direction, no matter how small.

This approach aligns with our belief in playing a different game. We don’t just compete; we redefine the rules of engagement, creating our own metrics for success and pushing boundaries in ways that traditional thinking often overlooks. Kind of like this quote:

“I have not failed. I've just found 10,000 ways that won't work.” - Thomas Edison

It doesn’t make sense to challenge a bigger and better-funded competitor in an area where they have an asymmetric advantage. In other words, don’t compete with giants at their own game.

Choose to play a game you expect to win.

Playing a different game is a theme at Capitalogix. We believe that you control the game you’re playing, the rules, how you keep score, and even how you evaluate success. These things inform where to spend time, where to invest money, and even what looks like an opportunity to you.

Wouldn’t you rather compete in areas where you can create a unique, sustainable competitive advantage? Personally, I want to invest in the things that extend the edges that let us win.

Why? Because … Mediocrity Is Expensive!

What you lack in size or computer power, you can make up for in creativity, agility, and innovation.

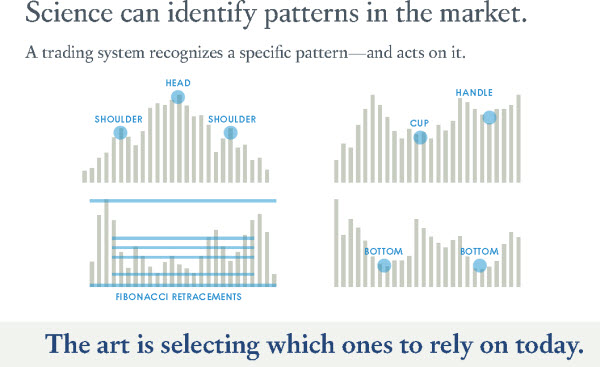

We sought to create a niche in the investment industry, not through computing power, but through unique approaches to age-old problems. We use AI and data science to enhance decision-making.

We have an incredibly narrow and consistent focus. Within that area, we are willing to take on problems others avoid and pursue goals that others say are impossible.

Our niche limits risk and lets us fail faster … and learn faster. This allows us to take confident action while others are tentative.

Most big companies – and most of our competitors – are afraid to be wrong. They have to protect their infrastructure, cash cows, and short-term performance metrics. It makes sense (from their perspective) that playing it safe means they’re secure. – but that’s not how it works.

You can’t challenge the status quo when you are the status quo.

10x Improvement Is Often Easier To Achieve Than 10%

Astro Teller via TED

"In 1962 at Rice University, JFK told the country about a dream he had, a dream to put a person on the moon by the end of the decade.The eponymous moonshot. No one knew if it was possible to do, but he made sure a plan was put in place to do it if it was possible.That's how great dreams are. Great dreams aren't just visions, they're visions coupled to strategies for making them real." – Astro Teller

Incremental change is hard – it’s finding new ways to do the same thing, and you often end up competing in very red oceans – saturated markets where you’re competing on price.

Moonshots sound harder, but you create your own niche, and the constraints of a new idea force creativity and energy. If you’re going after a goal that no one has accomplished before, it’s impossible to be in a red ocean, and it’s easier to mobilize a team around something exciting and new than decreasing some arbitrary metric by 2%.

There are a couple of important lessons to keep in mind when pursuing the unknown.

- Forget what you know – self-reported “experts” are limited by their worldview. If you’re trying to get a different result, you won’t do it by playing by the same rules your predecessors followed. Heuristics are great for making life easier – but they’re very limiting when trying to create something new.

- Attack the hardest problems first – your biggest problems are your biggest opportunities. If you don’t deal with the big problems now, you’ll never get around to it, and you’ll waste time, energy, and potentially realize you have to pivot much too late.

- Be comfortable being uncomfortable – Most people find failure taboo, and they’re deathly afraid of it. Tony Robbins talks about our tendency to avoid pain more actively than we pursue pleasure, and it’s true in business. But failure is a part of business. The people I consider most successful got there through incredible pain tolerance and increasingly intense problems that they continued to conquer.

- Have a short memory for pain – Focus on the gain, not the pain. People often focus on not having enough money, not enough time, or simply not having enough. That scarcity mindset is dangerous and can lead to getting lost in pain and fear. Acknowledging the pain/fear and moving forward from a place of abundance and opportunity helps create opportunities.

As well, a clear identity is important. You have to understand what you’re pursuing and how you want to attack the problem. At Capitalogix, we’ve gotten very in tune with our goals.

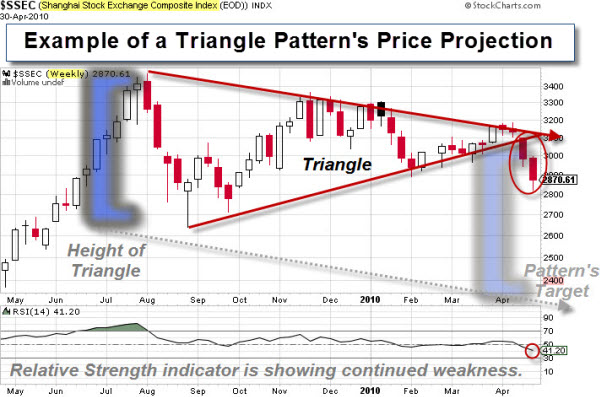

We invent techniques that identify and adapt to what happens in markets. We apply the lessons learned from past experiences, data science breakthroughs, and hard work to eliminate the fear, greed, and discretionary mistakes that are the downfall of most traders and decision-makers.

Small businesses don’t have a monopoly on these mindsets and these opportunities, but companies like Y Combinator, X(and no, I don't mean the company formerly known as Twitter), or HeroX are few and far between … Elon Musk is famous for moonshots like Tesla, SpaceX, Starlink, Neuralink, Xai, etc. Google and Microsoft pursue moonshots as well.

Good news … the future is big enough for them and you.

Choose something that lights you up and leverages what you already know and who you already are.

So what’s your moonshot?

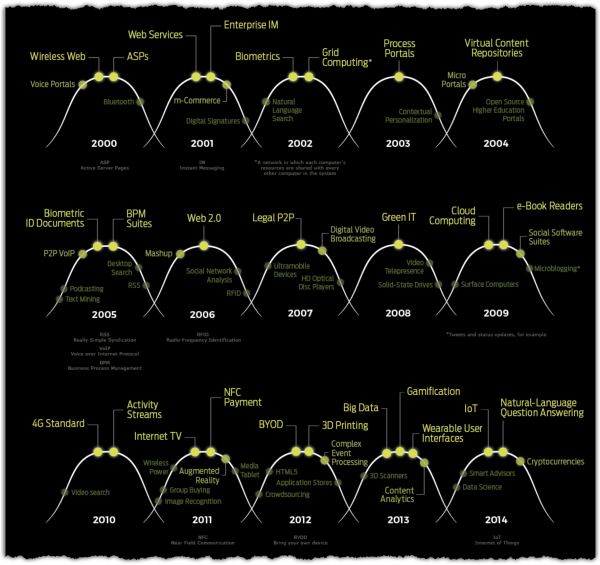

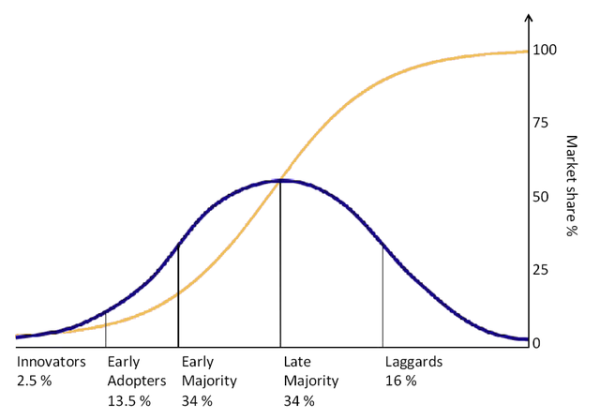

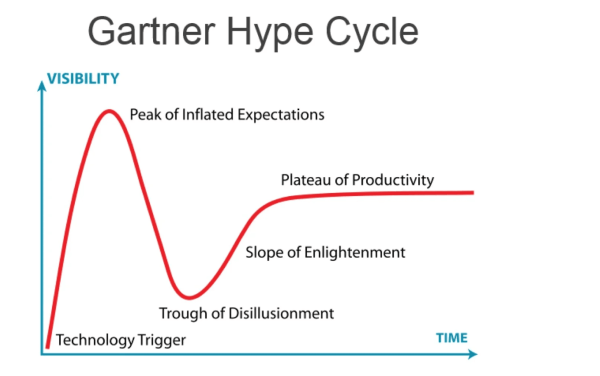

via Gartner

via Gartner