I’ve given a few speeches recently and have new subscribers to our weekly commentary (click here to sign up), so I thought it was a good time to write about the importance of data.

I revisit this topic about once a year because it’s important.

The Hidden Engine: Why Data Fuels Innovation

Technology and innovation are popular topics, but people often ignore what makes it all possible … the hidden foundation, data.

Data is the lifeblood of modern businesses and the fastest-growing resource we have.

The quest to find and use data has created a modern-day “Wild West.” While AI is often positioned as a “Gold Rush,” data is the precious resource powering the race.

Another way to look at it is that data is the ammunition used by today’s tech titans in their battle for dominance.

In either case, it is easy to see that data is a scarce and valuable resource.

The Data Deluge: Finding Signal in the Noise

We’re living in an age of data explosion. Every day, a staggering 328.77 million terabytes of data are created, amounting to an estimated 120 zettabytes of new data by year’s end.

Video is a significant driver, but so is the Internet of Things, which is growing more than 15% annually. There are now almost 20 billion connected devices, and that number will continue to grow.

This rapid growth presents a challenge. Tech giants like Alphabet, Amazon, Apple, Facebook, and Microsoft all hold unprecedented data troves, creating a race for ownership and control. Regulations struggle to keep pace with this digital stampede.

Rapid growth means little time to create adequate rules. Everyone’s jumping to own more data than the next and to protect that data from prying eyes.

As a great example of this, I often warn people to keep their intellectual property off of ChatGPT or other hosted language models.

But here’s the real concern: Are we losing sight of the signal in all this noise? Just having vast amounts of data isn’t enough. The true value comes from extracting meaningful insights – the nuggets of gold buried within the data avalanche.

To Do The Impossible, Make The Invisible Visible

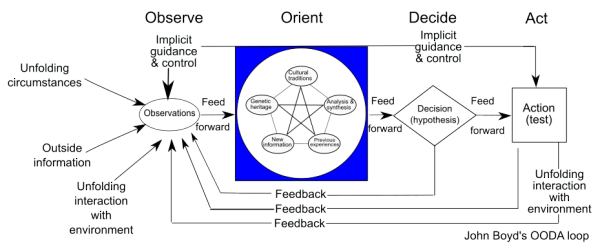

Collecting basic data and using basic analytics used to be enough, but it is not anymore. The game is changing.

I also see it trading, but it’s pervasive in every industry and our personal lives as well.

For example, traders used to focus on price data … but there has been an influx of firms using alternative data sets and extraordinary hardware and software investments to find an edge. If you’re using the same data sources as your competitors and competing on the same set of beliefs, it’s hard to find a sustainable edge.

Understanding the game others are playing (and its rules) is important. However, that’s only table stakes.

Figuring out where you can find extra insight or where you can make the invisible visible creates a moat between you and your competition and lets you play your own game.

Here is a quick high-level video about Data as fuel for your business. Check it out.

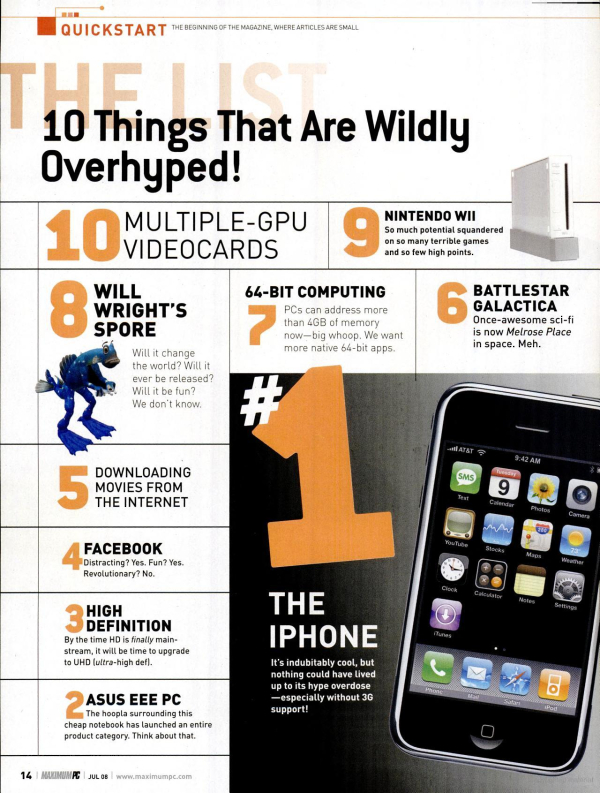

It is interesting to think about what’s driving the new world (of trading, technology, AI, etc.), which often involves identifying what drove the old world.

Decoding the New World: Data as the Catalyst

Understanding today’s driving forces – like AI – often involves examining what propelled past eras.

History has a way of repeating itself. Even when it doesn’t repeat itself, it often rhymes.

Before e-mails, fax machines were amazing. Before cars, people were happy with horses and buggies.

The key to unlocking new economic realities lies in fresh perspectives.

In this new world, new or better data is often the game-changer. It’s the alternative dataset that allows us to approach challenges and opportunities from entirely new angles.

Before data analytics, businesses relied on intuition and limited information. Now, data empowers us to see patterns and make data-driven decisions, propelling innovation at an unprecedented pace.

These comparisons help explain the importance of data in today’s new world economics.

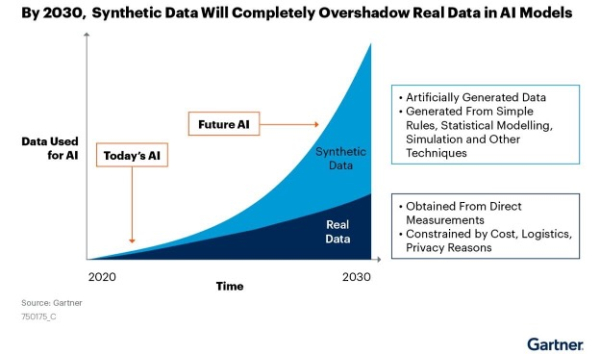

One of the more recent shifts is in the value of synthetic data.

via Gartner

Synthetic data can mimic the statistical properties of real-world data, making it useful for a variety of purposes.

For example, synthetic data can be used to train machine learning models when collecting traditional data is impractical or presents privacy concerns. It is also used in various other applications, such as data privacy, testing and development, data augmentation, simulation and modeling, risk assessment and management, and enhancing data quality.

You don’t have a competitive advantage if you use the same data and the same process as other people. That’s why understanding how to recognize and capture synthetic data is important. It can shift your perspective, add dimensionality, help you solve different problems, and create transformative results.

In the very near future, I expect these systems to be able to go out and search for different sources of information. It's almost like the algorithm becomes an omnivore. Instead of simply looking at market data or transactional data, or even metadata, it starts to look for connections or feedback loops that are profitable in sources of data that the human would never have thought of. – Howard Getson

While data is the foundation, it’s about transforming your data into actionable insights.

By identifying your real business, the KPIs of success, and what data you’re underutilizing, you can massively improve the efficiency and effectiveness of your business and create new products that transform your future.

In a word of caution, there are two common mistakes people make when making data-driven decisions. First, people often become slaves to the data, losing focus on the bigger picture. This is the same mistake people make with AI. Both are tools, not the end goal. Second, even the most insightful data can’t predict black swans. It’s essential to exercise caution and prepare for the unexpected.

The future of data is bright, but it’s also littered with potential challenges. Privacy concerns and data misuse are hot-button topics, as are fake news and the ability of systems to generate misleading data. In addition, as we gain access to more data, our ability to separate signal from noise becomes more important.

One of the biggest problems facing our youth—and really all of us—is how much information is thrust at us every waking moment of the day. No previous generation has had this much access to data. As a result, many are actually less informed than in the past. Soundbites become the entire news story, and nuance gets lost in the echo chambers.

The question becomes, how do you capitalize on data without becoming a victim of it?

Food for thought!

via

via