Small distinctions separate wise men from fools. Perhaps one of them has to do with what the wise man deems important.

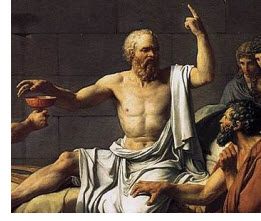

Socrates' Triple Filter.

Socrates' Triple Filter.

In ancient Greece, Socrates was reputed to hold knowledge in high esteem. One day an acquaintance met the great philosopher and said, "Do you know what I just heard about your friend?"

"Hold on a minute," Socrates replied. "Before telling me anything, I'd like you to pass a little test. It's called the Triple Filter Test."

"Triple filter?"

"That's right," Socrates continued. "Before you talk to me about my friend, it might be a good idea to take a moment and filter what you're going to say. That's why I call it the triple filter test.

The first filter is Truth. Have you made absolutely sure that what you are about to tell me is true?"

"No," the man said, "Actually I just heard about it and…"

"All right," said Socrates. "So you don't really know if it's true or not. Now let's try the second filter, the filter of Goodness. Is what you are about to tell me about my friend something good?"

"No, on the contrary…"

"So," Socrates continued, "You want to tell me something bad about him, but you're not certain it's true. You may still pass the test though, because there's one filter left. The third filter is Usefulness. Is what you want to tell me about my friend going to be useful to me?"

"No, not really."

"Well," concluded Socrates, "If what you want to tell me is neither true, nor good, nor even useful … then why tell it to me at all?"

How Does That Apply to Me or Trading?

The concept of Socrates' Triple Filter applies to trading as well.

The concept of Socrates' Triple Filter applies to trading as well.

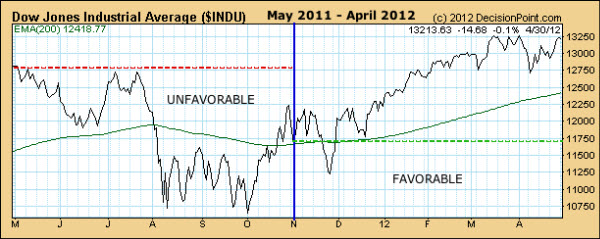

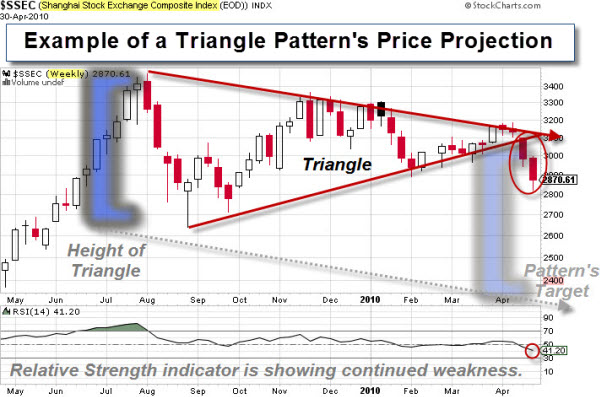

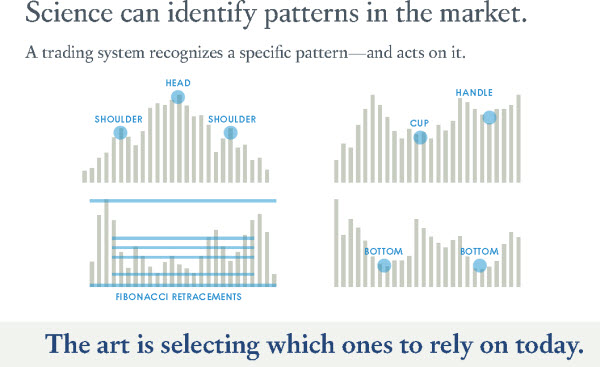

As a technical trader, rather than looking at fundamental data and scouring the news daily, I focus on developing dynamic and adaptive systems and processes to look at the universe of trading algorithms to identify which are in-phase and likely to perform well in the current market environment.

One of the arguments in favor of technical analysis is that fundamental data, news, and sentiment are already built-in to the chart.

Filter Out What Isn't Good For You.

In contrast, there are too many ways that the media (meaning the techniques, graphics, music, etc.), the people reporting it, and even the news itself, appeals to the fear and greed of human nature.

In contrast, there are too many ways that the media (meaning the techniques, graphics, music, etc.), the people reporting it, and even the news itself, appeals to the fear and greed of human nature.

This is the main reason that I don't watch CNBC during the trading day. Even though I like it on several levels … I don't think it helps me. So I filter it and get the news in other ways.

Likewise, I don't watch TV news anymore either. It seems like story after story is about terrible things. For example during a recent visit with my mother, I listened to her watch the news. There was a constant stream of "oh no," or "oh my," and "that's terrible". You don't even have to watch the news to know what it says.

Focus On What You Want.

Instead, I get the news I need a different way that is more efficient and productive for me. I subscribe to certain things via e-mail, and other things via RSS feeds. Then I supplement those with a series of search services that alert me to items that match the criteria I set. An example would be Google Alerts. Two other nice alert services are from the Financial Times and the New York Times. Recently I've also been using two great iPad apps – one is called Flipboard, the other is called Zite.

Check them out. It will save you a lot of time and effort.

Personally, I care about the source of my news. It helps me identify and account for potential bias. So using subscriptions, feed readers, and alert services help here too.

Another reason I like these tools is that I can use different filters for different purposes.

What's The Purpose Of News For You?

My purpose changes what I'm looking for and the amount of attention I pay to different types of information. Am I reading or watching the news for entertainment, to learn something new, or to find something relevant and actionable?

Getting back to Socrates' three filters and the business of trading, I ask might: is it important, does it affect our edge, or can I use it as a catalyst for innovation?

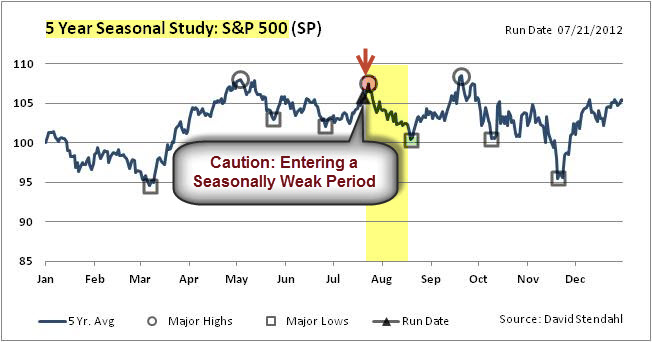

Our Portfolio Manager, David Stendahl, was recently featured in the August 2012 issue.

Our Portfolio Manager, David Stendahl, was recently featured in the August 2012 issue.