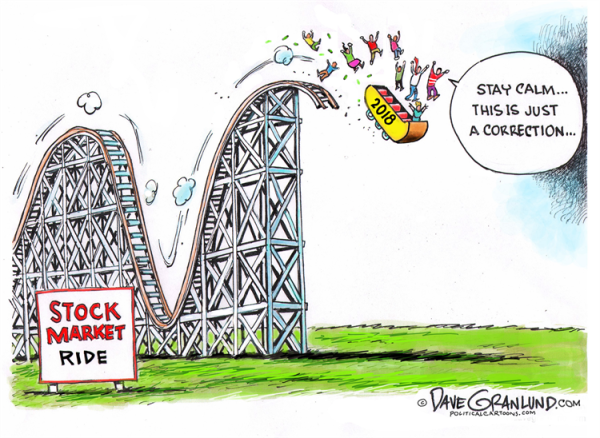

Trying to get rich quick? Want to know if the markets going to be bull or bear this year?

Look no further than the "Super Bowl Indicator".

The theory is a Super Bowl win for a team from the AFC foretells a decline in the stock market and a win for the NFC means the stock market will rise in the coming year.

There is one big caveat … it counts the Pittsburgh Steelers as NFC because that's where they got their start.

If you accept that caveat, it has been on the money 33 years out of 41 – an 80% success rate. Sounds good, right?

Come on … you know better.

Here are some other "fun" stock market fallacies:

- January Indicator

- Aspirin Count Theory

- Hemline Indicator

- Sports Illustrated Swimsuit Indicator

- Men's Underwear Index

- Big Mac Index

Back to Reality

Rationally, we understand that football and the stock market have nothing in common. And we probably intuitively understand that correlation ≠ causation. Yet, we crave order, and look for signs that make markets seem a little bit more predictable.

The problem with randomness is that it can appear meaningful.

Wall Street is, unfortunately, inundated with theories that attempt to predict the performance of the stock market and the economy. The only difference between this and other theories is that we openly recognize the ridiculousness of this indicator.

More people than you would hope, or guess, attempt to forecast the market based on gut, ancient wisdom, and prayers.

While hope and prayer are good things … they aren’t good trading strategies..

As goofy as it sounds, some of these "far-fetched" theories perform better than professional money managers with immense capital, research teams, and decades of experience.

I have a thought experiment I often ask people that come into my office.

What percentage of active managers beat the S&P 500 any given year?

… Now, what percentage beat the S&P 500 over 15 years?

The answer is about 5% (and that's in a predominantly bull market). That's significantly worse than chance. That means something they're doing is hurting, not helping.

via Gaping Void

There's simply too much information out there for us to digest, process, rank, and use appropriately.

Every second you spend looking at a market is a second wasted.

There are people beating the markets — not by using the Super Bowl Indicator … they're doing it with more algorithms and better technology.

There will never be less data or slower markets.

Onwards.